In conserving with a new document from Delphi Digital, crypto platforms are quietly morphing into distribution layers for the entirety from trading and funds to onchain apps and yield.

The “superapp” imaginative and prescient that reshaped person finance in Asia is now colliding with Western UX preferences and clearer law, and exchanges are betting that whoever controls the well-known interface will withhold an eye on the subsequent wave of users.

The aggregation generation arrives

The document concludes that crypto is entering an “aggregation generation,” where the true vitality no longer sits with inappropriate protocols but with whoever owns the person relationship. In other phrases, the situation where contributors first log in, jog money, and gawk merchandise.

In that world, exchanges and dapper platforms are racing to become the default gateway; the app that distributes liquidity, declare run alongside with the jog, stablecoins, staking, non-fungible tokens, gaming, etc.

Linked: Binance hints at stock perps in push to be half of world tokenized equities flee

Binance’s one‑app approach

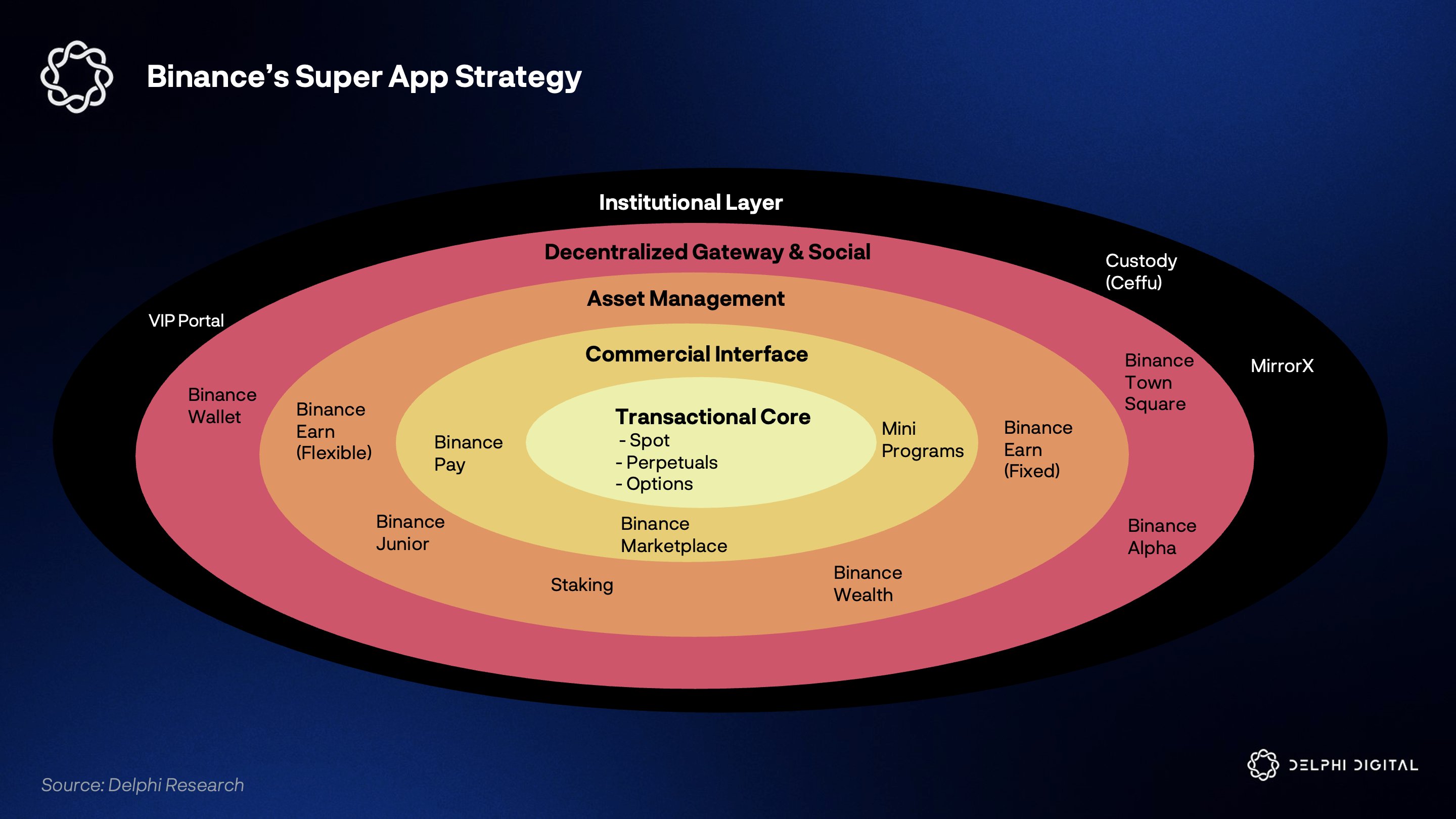

Delphi highlights Binance because the clearest example of the monolithic superapp play, arguing it mirrors the WeChat‑type “one interface, lots of utility” mannequin.

What started as a pure trading venue has gradually swallowed adjoining behaviors: region and derivatives trading, Glean merchandise, lending and staking, funds via Binance Pay, a Web3 pockets, and institutional products and services, all nested interior one dense interface.

Linked: Binance’s new ‘Junior’ app draws mixed reactions over youth entering crypto

Kraken’s constellation way

By contrast, Delphi describes Kraken as pursuing a federated “constellation” mannequin built on a shared backbone of liquidity, custody, and identification.

Rather than forcing each and every person into one crowded app, Kraken is rolling out specialist entrance ends: Inky, an leisure‑first memecoin app; Krak, remittances and funds with stablecoins and yield, and Kraken Pro for frequent, deep‑chart trading.

The premise, based totally on Delphi, is to unbundle the UI but rebundle the entirety behind the scenes, so Kraken stays the underlying distribution rail even as person experiences fragment.

Linked: Kraken provides Backed Finance to 2025 acquisition walk, brings xStocks in-dwelling

How Coinbase, OKX, and others slot in

Delphi found that other majors are edging in opposition to the an identical distribution‑layer feature, even supposing they withhold far from the “superapp” mark.

Coinbase has pushed deeper into neat wallets, onchain discovery, staking, and funds, positioning itself as a regulated, person‑pleasant hub for both trading and Web3 entry.

OKX, Bybit, and others are pairing centralized trading with in‑app Web3 wallets, NFT markets, and DeFi entry, effectively bundling onchain rails around their gift person bases.

Linked: Long-established Chartered, Coinbase deepen alliance to invent institutional crypto infrastructure

What’s at stake?

Delphi argues that below the product launches is a bigger battle over who controls discovery for third‑celebration apps and protocols, and how regulators classify these platforms.

A single, all-in-one superapp consolidates risk and oversight in a single situation, offering unmatched convenience. A federated, multi‑app mannequin spreads out person interfaces while conserving withhold an eye on of the plumbing.

Whichever type wins would perhaps well run a long manner to deciding who becomes crypto’s default distribution layer in the subsequent cycle, and on whose phrases the subsequent hundred million users be half of.