Present CryptoQuant’s Ki Young Ju announcement shows the addition of superior market indicators for over 500 altcoins. These new tools, care for a chart for quantity, frequency, direct dimension, and CVD (Cumulative Volume Delta), vastly reinforce data availability for cryptocurrency traders. This change is a important alternate in the direction of a more subtle,>altcoin home.

Dogecoin’s Volume Finds Market Sentiment

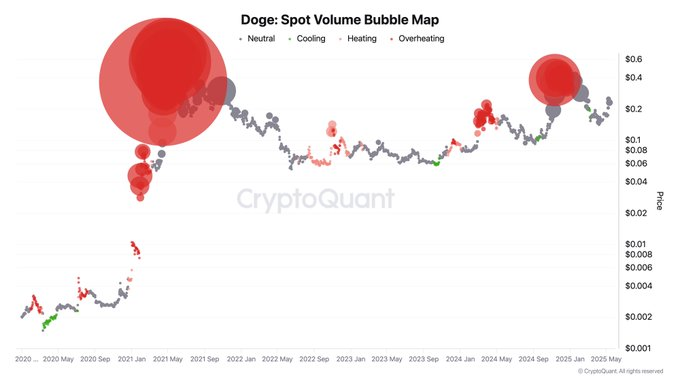

Ki Young Ju shared a chart presenting Dogecoin’s space quantity declare. This chart shows trading sessions of honest, cooling, heating, and overheating. Historical traits showed heating sessions coinciding with famend price peaks in the early months of 2021 and 2025. The info suggests that traders can video show doubtless market movements.

These indicators aid investors in measuring market sentiment in relation to whether Dogecoin is on the verge of cooling or overheating. By inspecting the ancient quantity traits, traders can forecast price volatility.

Retail Traders’ Position Examined Amid Liquidity Concerns

Ki Young Ju suggests an piquant expect relating to the feature of retail investors in the cryptocurrency market. He argues that retail traders may well presumably simply many times act as “exit liquidity” for bigger, institutional investors. In step with this theory, when the market sells off, institutional avid gamers will sell off their stocks, which is ready to cause the rate to transfer down. Later, retail investor entry can inadvertently present the liquidity for institutions to exit positions without inflicting important price disruption.

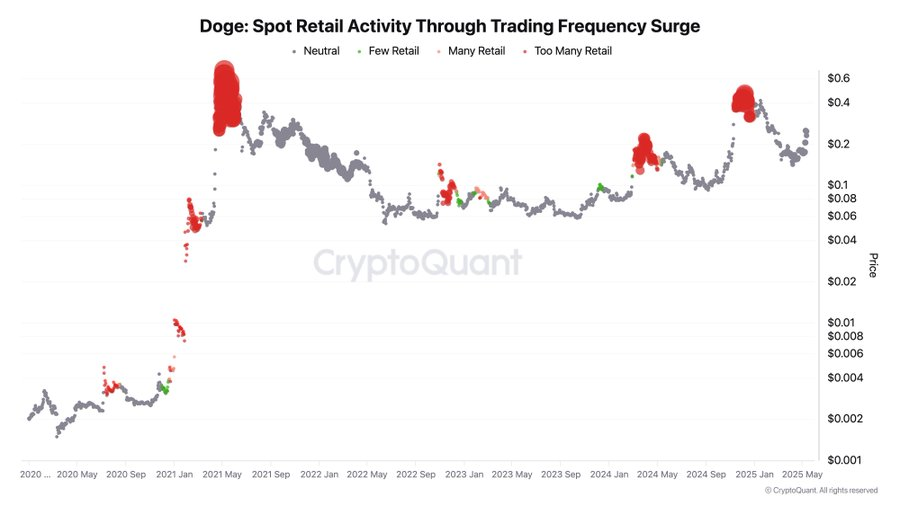

Dogecoin’s space retail declare is but one more necessary ingredient affecting its price movements. The chart visualizes retail declare utilizing trading frequency, highlighting fluctuations in investor engagement over time.

The retail declare chart shows a transparent correlation between trading frequency and Dogecoin’s price. Retail participation tends to create bigger vastly at some stage in bullish traits, suggesting that many retail investors enter the market after costs maintain already climbed.

Linked: Bitcoin Losing Dominance? Altcoins Could well well Be Interesting for a Breakout

This conduct highlights how retail traders many times put collectively market momentum, whereas institutional investors shall be positioned to act earlier, capitalizing on price movements old to retail declare surges. Idea this timing gap is major for navigating volatility and identifying smarter entry and exit capabilities.

Disclaimer: The info presented listed here is for informational and academic capabilities easiest. The article would now not direct financial advice or advice of any fashion. Coin Model is now not accountable for any losses incurred as a results of the utilization of enlighten, merchandise, or products and providers mentioned. Readers are rapid to declare caution old to taking any action related to the firm.