Whereas the growing anticipation for a doable crypto bull drag, CryptoQuant has analyzed the leverage phases on various centralized crypto exchanges. CryptoQuant’s diagnosis coping with the CEX leverage phases highlights default possibility, liquidity, and the extent of strengthen that the crypto reserves strengthen for the shopping and selling of perpetual futures amidst the intention in which bull drag. In its most modern social media put up, the on-chain analytics supplier examined this market scenario.

Centralized Change Leverage Threat on the Midst of the Upcoming Bull Recede

We assess the leverage phases of assorted crypto exchanges to mediate their liquidity, default possibility, and the extent to which their perpetual futures shopping and selling bid is backed by their crypto reserves.

Our… pic.twitter.com/NAadJSAlVT

— CryptoQuant.com (@cryptoquant_com) December 21, 2024

Binance Takes Famed Assign amongst CEXs for Declaring Resilient Reserves

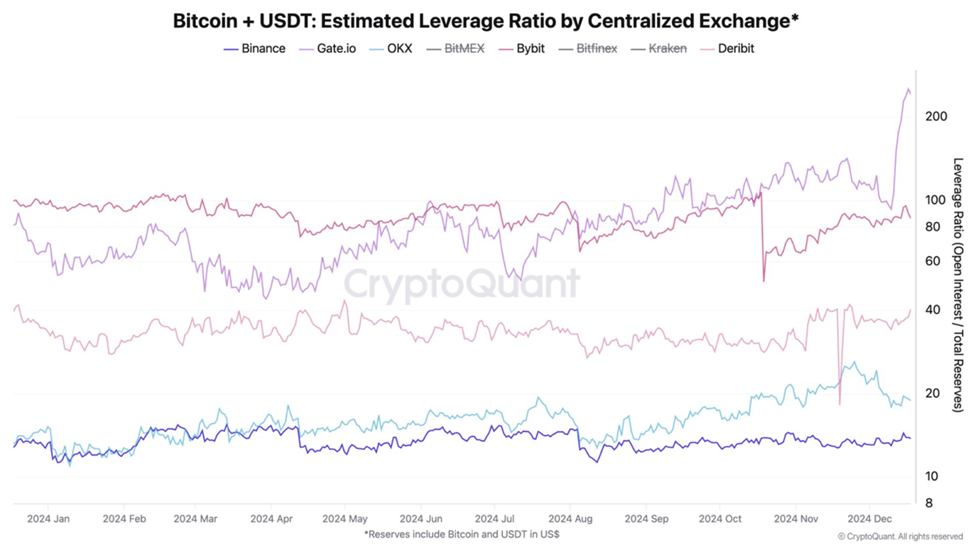

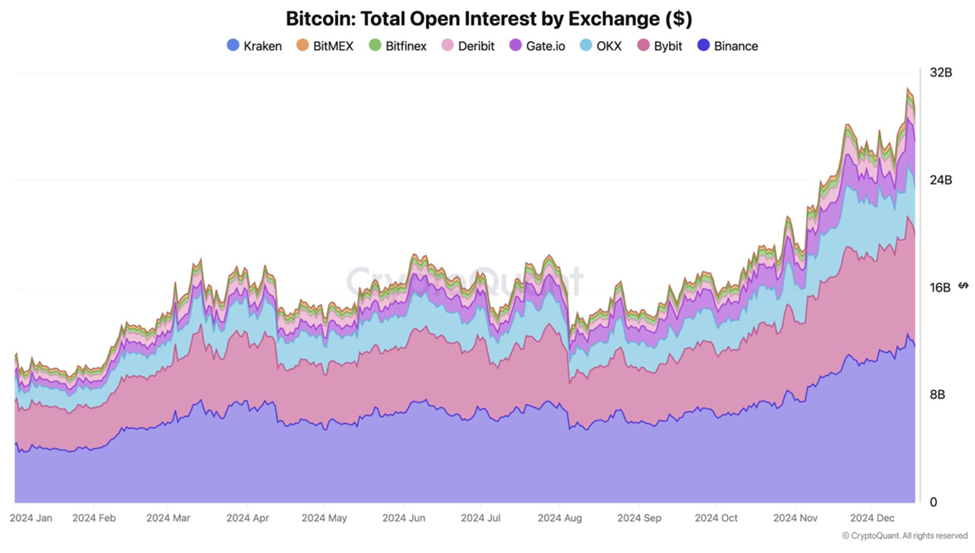

CryptoQuant mentioned that its diagnosis takes into myth the leverage ratio to measure the leverage that the merchants bid. Apart from to this, it additionally gauges the every crypto change’s financial health. In this appreciate, an elevated leverage ratio doubtlessly denotes likely liquidity risks. Binance dominates the dear exchanges for sustaining resilient reserves regardless of the broad growth in launch ardour all over 2024.

Additionally, Binance’s reserves in $BTC, $ETH, and $USDT very with out problems surpassed the launch ardour thereof. The crypto change additionally reported the least as well to most proper leverage ratio in comparability with the stay exchanges. In December final 365 days, it saw a ratio of as much as 12.8 which reportedly elevated to 13.5 this December. This balance combines with a basic 2.6x enhancement in Bitcoin’s launch ardour that rose to $11.64B from good $4.45B. Therefore, this overall combination underscores the crypto change’s doable to address market liquidity along with the following liquidations.

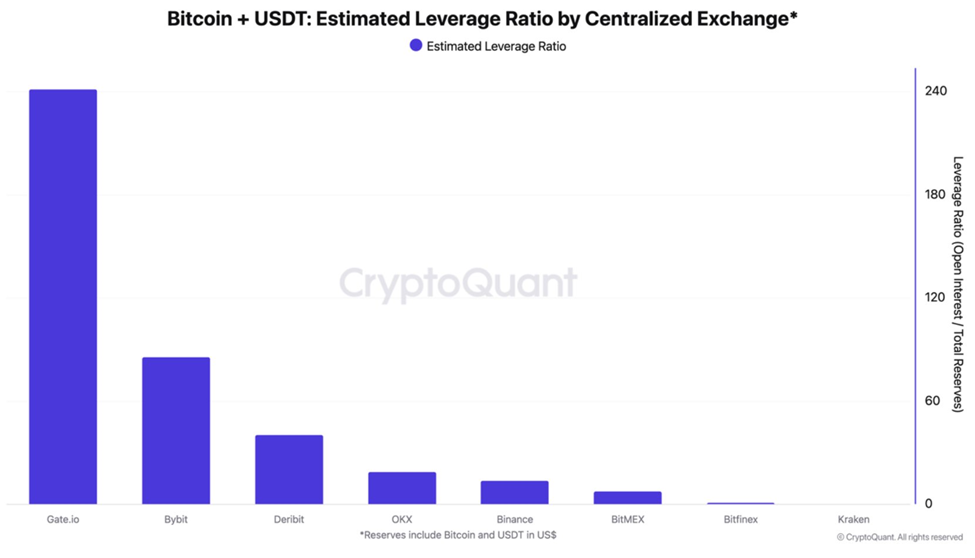

Deribit, Bybit, and Gate.io’s Delivery Interest Surpasses or Approaches the Reserves

On the assorted hand, Deribit, Bybit, Gate.io, and various such exchanges earn the stay leverage ratios at 32, 86, and 106, respectively. The respective figures repeat the launch ardour surpasses or nears the reserves with analogous patterns recorded for Ethereum. Keeping this in glance, CryptoQuant deems observing change leverage compulsory in step with the dear role of excessive leverage in the FTX atomize in 2022’s November.