Finbold encountered three cryptocurrencies to lead sure of trading within the first week of Would possibly perhaps presumably presumably attributable to fundamental token unlocks.

Unlocking cryptocurrency property in total creates sell-off pressures that can enormously affect its ticket and funding results. Savvy merchants and merchants actively get in suggestions provide and query dynamics to get a hit choices and spot up dangers.

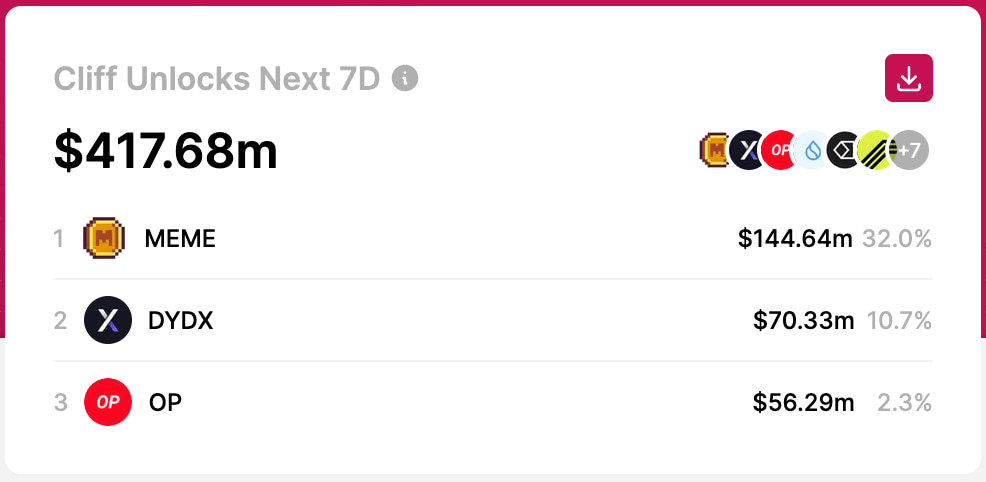

Particularly, recordsdata from TokenUnlocksApp exhibits $417.68 million in doubtless sell-offs for the subsequent seven days from April 27. The end 3 absolute top unlocks will happen from April 29 to Would possibly perhaps presumably presumably 3, releasing $271.26 million price of tokens.

Defend some distance from trading Memecoin (MEME)

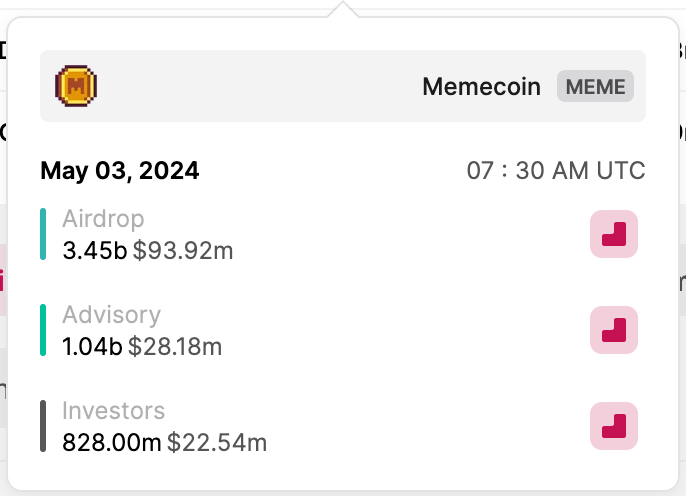

First, Memecoin (MEME) stands out with a staggering $144.64 million price of 5.318 billion MEME. The team will unencumber these tokens on Would possibly perhaps presumably presumably 3, inflating the circulating provide by 32%, that can presumably presumably well reason a smash.

From the total, 3.forty five billion MEME will be launched by plan of airdrop for an forthcoming sell-off of $93.92 million. Basically essentially based fully on the CoinMarketCap index, this amount is over twice Memecoin’s 24-hour volume of $40 million.

dYdX Protocol (DYDX)

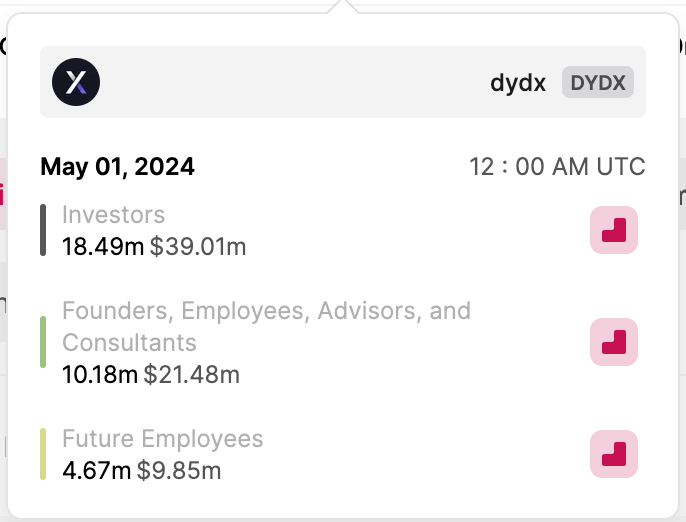

The decentralized exchange protocol DYDX is again featured amongst cryptocurrencies to lead sure of trading attributable to its unlocks. Finbold reported a identical warning for March 31 and, previously, for February 29, with 33.34 million tokens unlocked – price $117.33 million and $130 million, respectively.

Now, the protocol will assign the a similar amount of DYDX in circulation on Would possibly perhaps presumably presumably 1, currently price $70.33 million. Evidencing the losses gathered from old unlocks, price near to 50% lower than from February’s unencumber.

As for the distribution, early merchants will receive many of the unlocks, price $39.01 million by press time. The team will non-public $21.48 million price of DYDX to sell within the next weeks, and a reserve for future workers will take the remainder, price $9.85 million.

Optimism (OP)

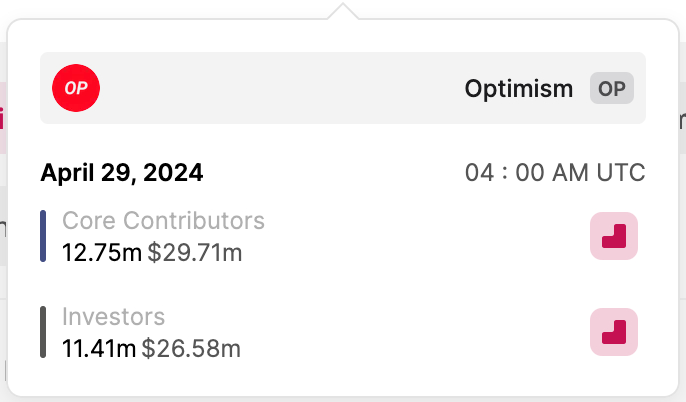

At closing, Optimism (OP) has the third-largest token unencumber for the first week of Would possibly perhaps presumably presumably. Traders have to aloof moreover steer sure of trading OP within the next days despite a proportionally lower inflation than the old two.

The layer-2 blockchain for the Ethereum (ETH) ecosystem will unencumber 24.16 million OP, price $56.29 million. On April 29, core contributors will receive 12.75 million tokens, whereas merchants will receive 11.41 million tokens.

Rising a token’s provide does not guarantee that its ticket will drop, as query acts as a balancing power when there is any.

On the other hand, crypto merchants will try to speculate on the industrial effects these unlocks could presumably presumably well simply non-public on ticket, which could carry elevated volatility and worsen the aptitude menace-reward ratio. The market is unsure and influenced by extra than one factors, requiring proper menace administration and learning when to lead sure of trading disclose cryptocurrencies.

Disclaimer: The yell on this stutter have to aloof not be regarded as funding advice. Investing is speculative. When investing, your capital is at menace.