No topic crypto whales offloading substantial amounts of Ethereum (ETH), the asset’s staunch supporters stay optimistic. Present recordsdata highlights a vogue of stakeholders though-provoking substantial volumes of ETH, seemingly on the market, amidst a not unique downturn in crypto asset costs.

Moreover, the possibility Ethereum ETFs were recording outflows for the past eight buying and selling days.

Crypto Whales and Institutions Circulate ETH to Centralized Exchanges

At some stage in this week, distinguished movements beget captured the distinction of market analysts. To find On Chain reported that a whale’s wallet, identified as 0x46c, moved 5,088 ETH—valued at about $13.66 million—from Elixir to a deposit take care of at Binance.

“Particularly, the whale withdrew those ETH tokens from Binance at $3,393 on sensible (estimated value: $17.3 million), mostly between March 28 and April 3, 2024. If truly selling now at $2,682, the whale would model an estimated loss of $3.62 million (-21%) after 5 months,” To find On Chain acknowledged.

Learn extra: How To Hold stop into consideration Cryptocurrencies with On-chain & Basic Evaluation

In a single other transaction, an investor linked to wallet 0x75b transferred 8,825 ETH to Binance, value approximately $24.07 million, marking a with regards to 23% loss.

At the identical time as, one other entity believed to be linked with Amber Neighborhood moved 6,443 ETH to Binance and Kraken. Moreover, one other take care of that supposedly belongs to Cumberland moved 6,439 ETH value $17.66 million to Binance.

In most cases, crypto entities stride funds to centralized exchanges for the motive of selling them.

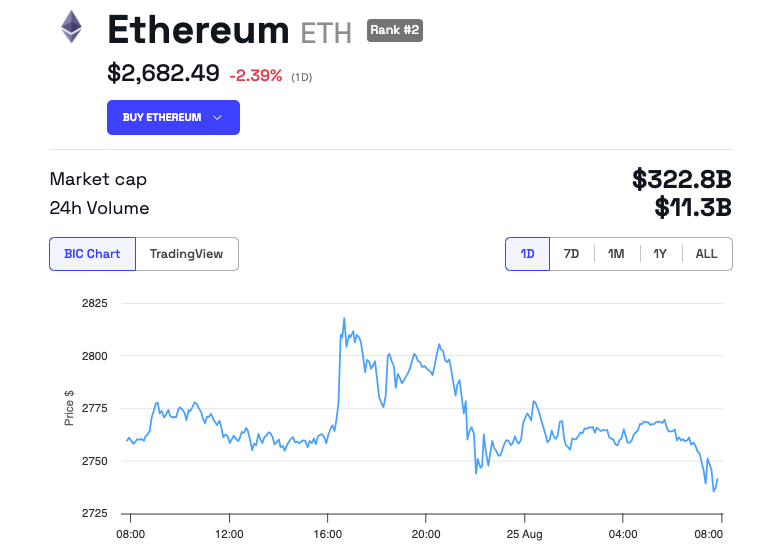

These movements of crypto whales and establishments beget collectively introduced with regards to $73 million value of selling stress into the market. Amid these sell-offs, Ethereum’s model has reduced a little by 2.39% in the closing 24 hours. It is on the 2d buying and selling at $2,682.49.

Ethereum commerce-traded funds (ETFs) beget also seen main outflows, with a uncover outflow of $13.23 million on Monday alone. This extends the outflow toddle to eight days, totaling round $112 million.

Alternatively, the community sentiment remains overwhelmingly certain. Influential figures like Ryan Adams continue to champion the blockchain’s possible and future vigorously. Adams has identified the strengths of Ethereum and its decentralized finance (DeFi) ecosystems, suggesting a shining future ahead.

“DeFi is awesome. ETH is a sexy asset. Ethereum is one of a truly grand methods on the planet. Vitalik’s leadership and imaginative and prescient are admirable. L2 teams are entirely crushing. DeFi is building fetch. The correct is yet to come,” Adams talked about.

Moreover, Vitalik Buterin, Ethereum’s co-founder, lately addressed concerns regarding the platform’s viability in a annoying market. He also emphasized Ethereum’s solid fundamentals and famed improvements in transaction effectivity on Layer-2 alternatives.

Learn extra: Who Is Vitalik Buterin? An In-Depth Search recordsdata from at Ethereum’s Co-Founder

The enthusiasm is also fueled by the anticipation of Ethereum’s upcoming Pectra Enhance. Scheduled for early 2025, this distinguished update is expected to red meat up both the execution and consensus layers of the network. Deliberate