Opposite to the anticipated “Uptober” rally, the cryptocurrency market has skilled a huge downturn, largely driven by geopolitical tensions in the Middle East. Major sources grasp seen their values decline, with some retesting multi-week lows.

No matter the market volatility, crypto whales grasp continued to win definite tokens. Toncoin (TON), Ethereum (ETH), and Axie Infinity (AXS) grasp emerged as high decisions for these good holders.

Toncoin (TON)

Telegram-linked Toncoin (TON) currently trades at $5.35, noting a 9% tag decline all the strategy in which via the last seven days. If truth be told, it plunged to a weekly low of $5.16 sometime of the intraday trading session on Thursday.

However, this has not deterred the whales from shopping for the altcoin, demonstrating their lengthy-time frame self belief in its tag growth. Previously seven days, TON’s good holders’ netflow — the adaptation between the cash whale addresses aquire and sell over a particular period — has skyrocketed by 1698%.

Mountainous holders consult with whale addresses that support over 0.1% of an asset’s circulating provide. When their netflow surges, it indicates an uptick in whale accumulation.

Ethereum (ETH)

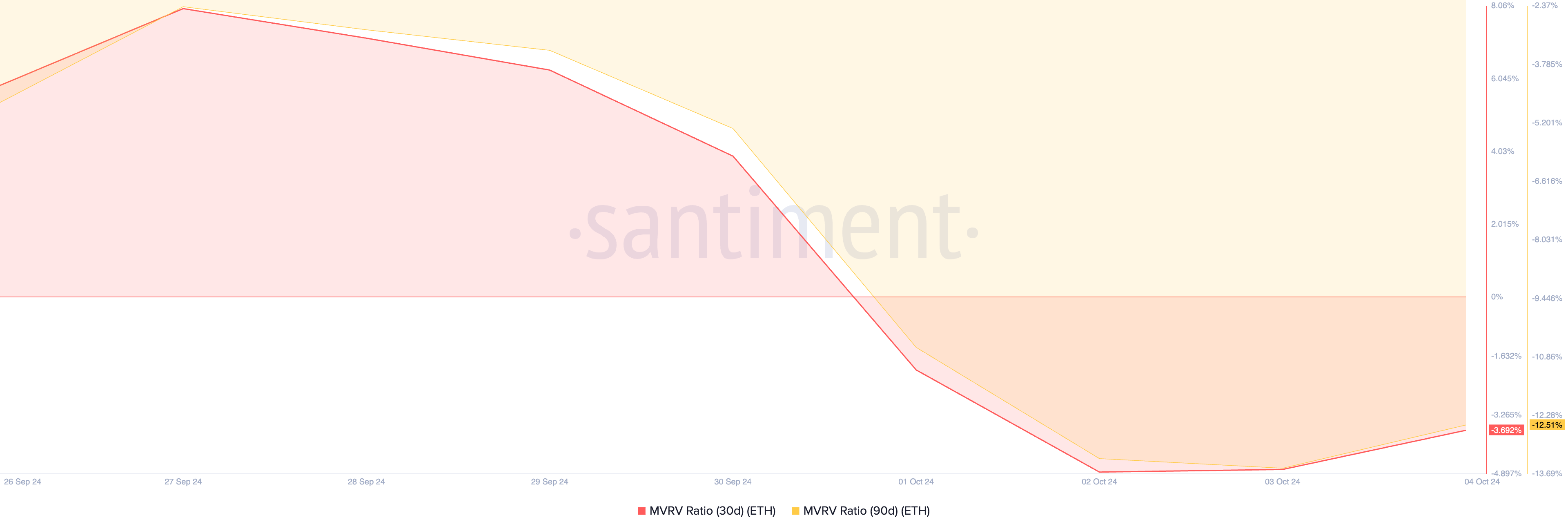

Main altcoin, Ethereum (ETH), has seen its cost dip by 10% in the past seven days. However, this decline has provided a shopping for different as evidenced by its destructive market cost to realized cost (MVRV) ratio, which measures the overall profitability of all its holders.

As of this writing, the coin’s 30-day and 90-day MVRV ratios are -3.69% and -12.51%, respectively. Traditionally, destructive MVRV ratios are a aquire impress. They display that the asset trades below its historical acquisition cost, giving a huge gamble for merchants taking a look to aquire the dip.

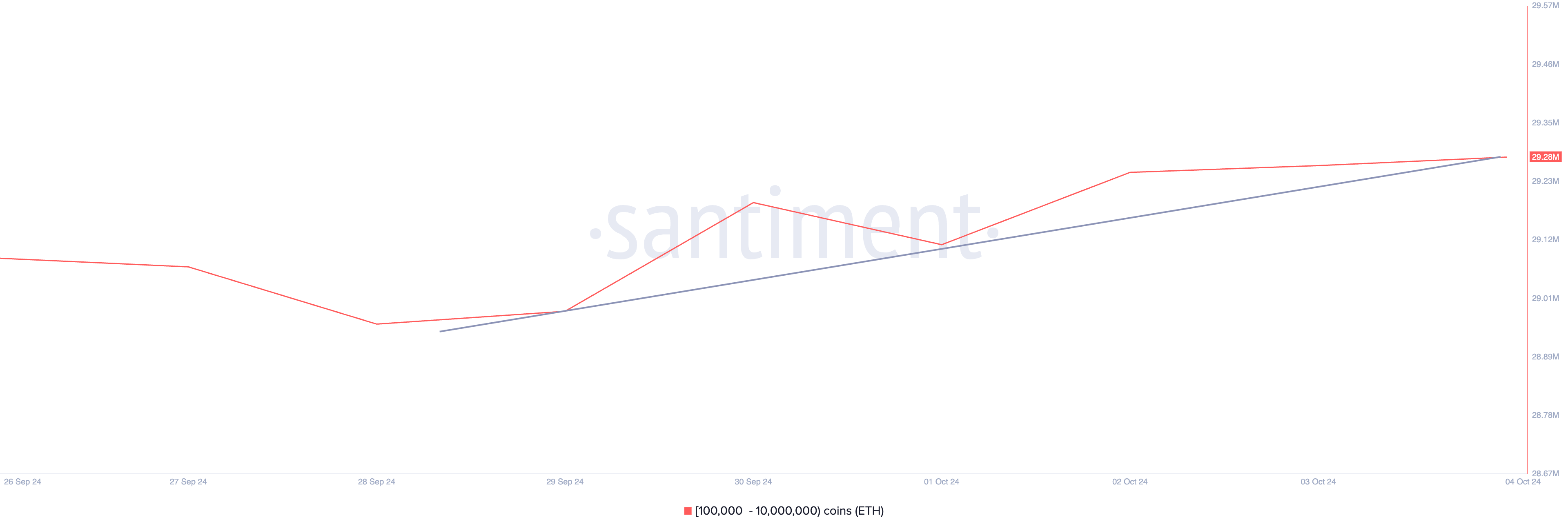

Ethereum whales preserving between 10,000 and 10,000,000 ETH cash grasp done correct this. Over the last week, this cohort of good patrons grasp added 200,000 ETH valued at $476 million to their portfolio.

Axie Infinity (AXS)

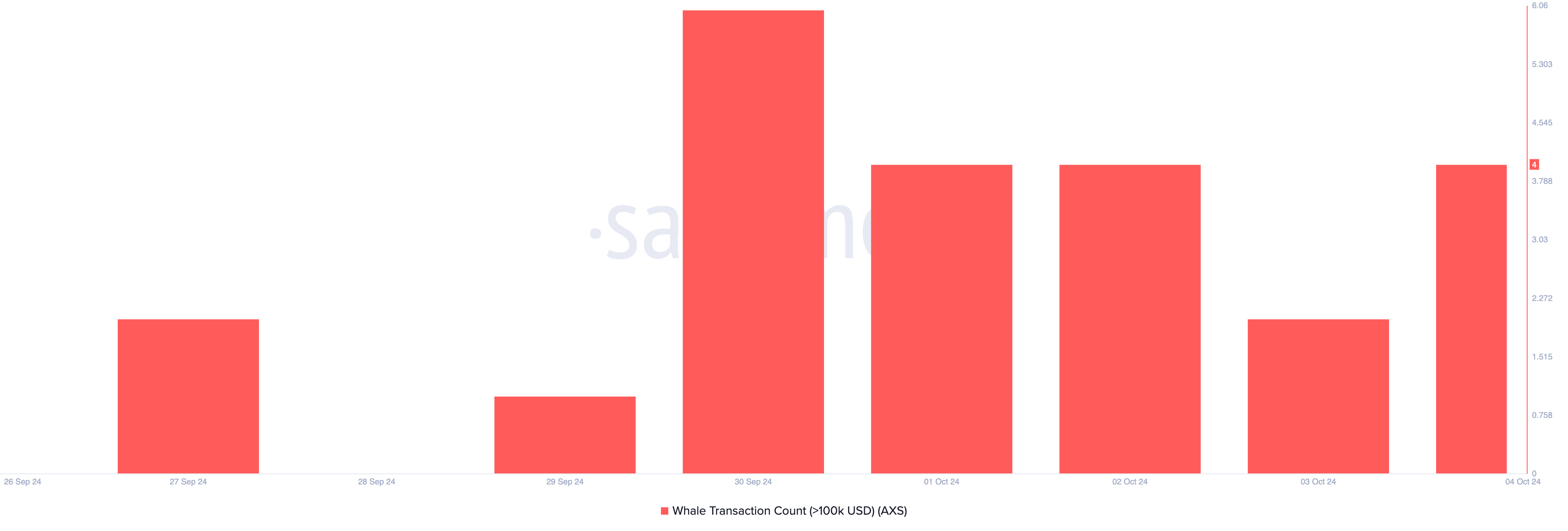

AXS, the native token of the main play-to-construct platform Axie Infinity, has moreover attracted crypto whale attention this week. No matter a 14% drop in its tag over the period, the different of whale transactions spirited AXS has step by step increased.

On-chain recordsdata unearths a consistent upward push in the day-to-day depend of AXS transactions exceeding $100,000 since September 30. A spike in good transactions can also merely impress a shift in market sentiment. If good avid gamers are shopping for, it’ll also imply they inquire future tag appreciation.