A large crypto whale recently offloaded $46 million value of Ethereum (ETH) amid a severe duration for the crypto market.

This transaction has stirred great consideration as the market anticipates the US Securities and Substitute Charge’s (SEC) dedication on the space Ethereum substitute-traded funds (ETFs).

Crypto Whales Money Out on Ethereum

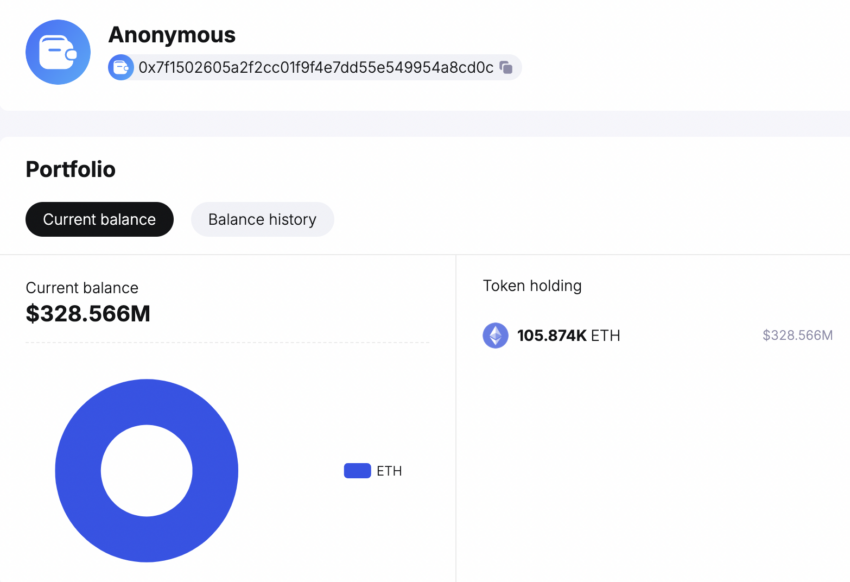

Consistent with the on-chain diagnosis platform Spot On Chain, the crypto whale, known by the pockets address 0x7f1, deposited 15,000 ETH (~ $ $46 million) to Kraken at $3,065 every on May perchance also 20. This transaction marks the first time this whale has moved such a valuable quantity to Kraken.

“Critically, the whale is currently gaining a large estimated total profit of $172.4 million (+86.7%) from ETH,” Spot On Chain mentioned.

This profit stems from strategic movements, including withdrawing 120,874 ETH from Kraken at an sensible impress of $1,645 per ETH in September 2022. With the latest deposit, the whale’s closing Ethereum holdings stand at 105,874 ETH, valued at roughly $327 million.

Read more: Ethereum (ETH) Ticket Prediction 2024/2025/2030

This pattern occurs as long-term Ethereum holders present indicators of promoting. Ethereum has surged by over 9% from final week’s lows, and crypto whales’ must occupy capitalized on the price surge.

BeInCrypto recently reported that one other significant Ethereum investor, known by the pockets address 0x2ce, transferred 4,153 ETH, value about $12.17 million, to Coinbase.

Moreover, records from Glassnode, an on-chain diagnosis platform, presentations a 15% decline in the total provide of ETH that had remained unmoved for five to seven years. Particularly, this metric dropped from 11.6 million ETH in late February to the recent 9.8 million ETH.

The timing of those transactions coincides with the impending SEC dedication on space Ethereum ETFs. On May perchance also 23, the SEC is anticipated to yell its ruling on VanEck’s space Ethereum ETF.

The regulatory company’s cautious stance displays the broader challenges all the procedure in which by procedure of the crypto market. Jan van Eck, CEO of VanEck, expressed skepticism relating to the SEC’s approval of space Ethereum ETFs. At some point soon of an interview at the Paris Blockchain Week, he mentioned that VanEck and Ark Invest’s applications could presumably perhaps face rejection.

“The system the elegant route of goes is the regulators gives you comments for your utility, and that came about for weeks and weeks before the Bitcoin ETFs — and upright now, pins are dropping up to now as Ethereum is anxious,” van Eck outlined.

Moreover, Bloomberg’s senior ETF analyst Eric Balchunas estimates lower than a 35% likelihood of SEC approval for Ethereum ETFs. Similarly, bets on Polymarket role the likelihood at elegant 10%.

Read more: Ethereum ETF Explained: What It Is and How It Works

The SEC’s latest extend of BlackRock’s Ethereum ETF utility, seeking out public enter on fraud and manipulation concerns, additional highlights the regulatory complexities. The transition to a Proof-of-Stake (PoS) consensus mechanism has added layers of scrutiny. The SEC questions whether Ethereum now meets the Howey Test requirements for security.

Because the market eagerly awaits the SEC’s dedication, the actions of great Ethereum holders and the broader regulatory atmosphere will undoubtedly shape the crypto industry in the impending months.