- Bitcoin recovers a little from strengthen tested at $102,513 as world markets react to tensions between Israel and Iran.

- BTC derivatives market liquidations surge, hitting $446 million in the leisure 24 hours as Birth Hobby drops under $70 billion.

- Ethereum extends losses however holds above the 200-day EMA because the enviornment ETF rep inflow jog holds regular.

- XRP downside risks escalate, accelerating the decline towards the $2.09 strengthen level.

The cryptocurrency market has been hit by a unexpected wave of vulgar volatility, triggering in vogue declines as world markets react to tensions between Israel and Iran. Bitcoin (BTC) is hovering at spherical $104,668 at the time of writing on Friday, following a reflex restoration from strengthen tested at $102,513.

Altcoins grasp been no longer spared, with Ethereum (ETH) amplifying losses and testing a lower vary limit strengthen spherical $2,500. Meanwhile, Ripple (XRP) holds a little above the excessive $2.09 strengthen as bulls navigate the highly volatile market.

Market overview: Israel-Iran tensions construct instability

Israel launched a wide-scale strike towards Iran on Friday, citing focused nuclear providers and products, ballistic missile factories and armed forces commanders. Per Israeli Top Minister Benjamin Netanyahu, as reported by Reuters, the assault is to forestall Iran from constructing an atomic weapon, which locations the lives of his folk at effort.

Iran responded to that assault with spherical 100 retaliatory drones focused on Israeli territory. Israel has been working to intercept Iranian drones, declaring a convey of emergency in preparation for extra escalation.

The arena is on alert with world markets, alongside with crypto, hit by intense volatility. Popular declines grasp been witnessed across the board, with the total crypto market portion falling by almost 3% to $3.4 trillion from $3.5 trillion on Thursday, basically based mostly on CoinGecko.

Crypto market capitalization | Provide: CoinGecko

Records highlight: Bitcoin, Ethereum enviornment ETF inflows shrink

Hobby in Bitcoin-associated financial merchandise, such as enviornment Alternate Traded Funds (ETFs), has declined over the leisure few weeks when put next with the times main up to the all-time excessive of $111,980, reached on Could maybe maybe also merely 22.

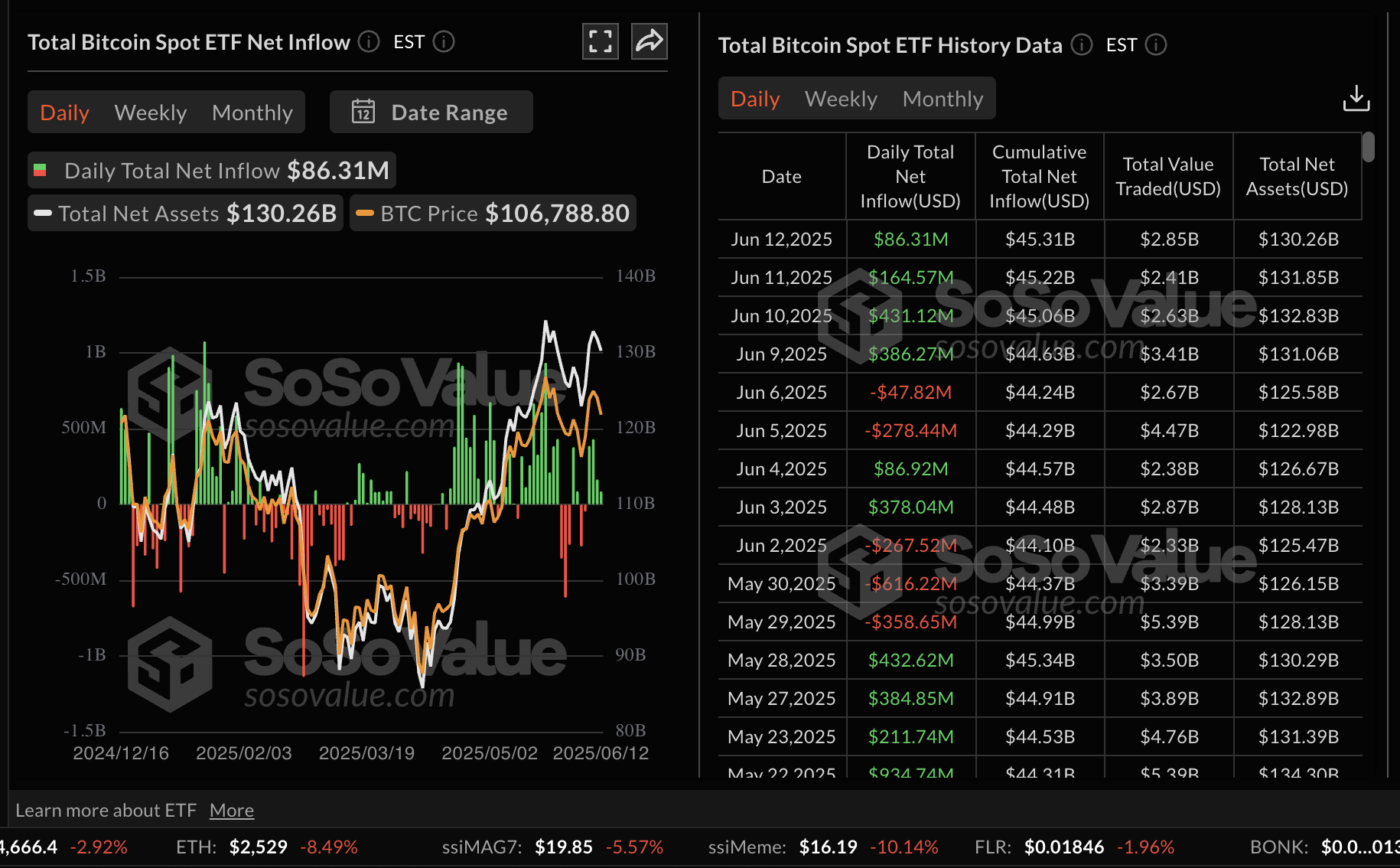

SoSoValue files presentations that enviornment BTC ETFs recorded roughly $86 million in day-to-day total rep inflows on Thursday, down from $165 million posted on Wednesday and $431 million that streamed in on Tuesday.

Bitcoin enviornment ETF stats | Provide: SoSoValue

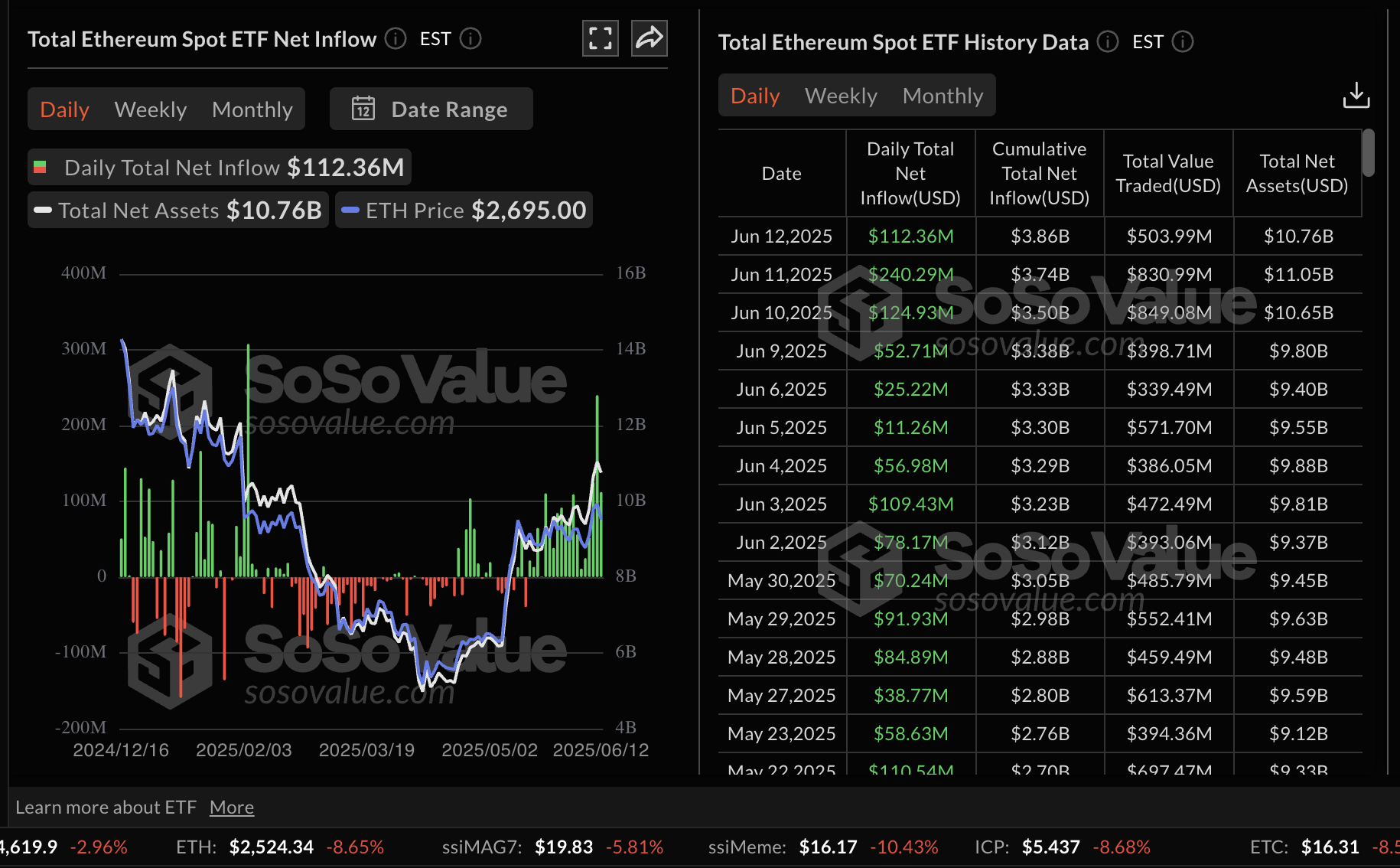

On the rather a couple of hand, inflows into Ethereum enviornment ETF merchandise declined by more than half, reaching $112 million on Thursday when put next with $240 million in rep inflow volume on Wednesday. In difference to Bitcoin, pastime in Ethereum enviornment ETF merchandise stays moderately excessive, with the rep inflow extending for 19 consecutive days.

Ethereum enviornment ETF stats | Provide: SoSoValue

The unexpected tumble in costs has left merchants rattled whereas merchants navigate a adverse climate, especially in the derivatives market. Bitcoin skilled a vital spike in liquidations, with lengthy-put merchants bearing the brunt of the losses.

The CoinGlass chart under highlights that over $446 million used to be worn out in the leisure 24 hours as volatility intensified. Lengthy put liquidations accounted for the lion’s portion at $423 million, with easiest $23 million in shorts liquidated.

Bitcoin derivatives files analysis indicates a 4.6% decline in Birth Hobby (OI) to $69.8 million. Nonetheless, the buying and selling volume surge to $135 million, representing a 54% construct bigger, signals brief positions defending and compelled liquidations.

Bitcoin derivatives market stats | Provide: CoinGlass

Chart of the day: Bitcoin eyes a transient squeeze rebound

Bitcoin’s imprint hovers a little above $105,000 at the time of writing, marking a 2.5% restoration from strengthen tested at $102,513, as highlighted by the 50-day Exponential Transferring Common (EMA).

The restoration could well maybe continue into the weekend as merchants aquire BTC to cover their positions. Therefore, a day-to-day discontinuance above the rapid $105,000 strengthen could well maybe decrease possible downside risks, paving the vogue for gains towards the resistance at $110,000, which is roughly 5% above the present level.

BTC/USDT day-to-day chart

Serene, Bitcoin’s vulnerability to geopolitical tensions between Israel and Iran can’t be no longer critical, especially with the Relative Strength Index (RSI) slipping under the 50 midline, indicating increasing bearish momentum. Key ranges of pastime on the downside consist of the 50-day EMA strengthen at $102,513, the 100-day EMA at $98,161 and the 200-day EMA at $92,546.

Altcoins update: Ethereum and XRP demonstrate downside vulnerability

Ethereum’s imprint is testing strengthen at the lower level of the consolidation vary, spherical $2,500. The 200-day EMA reinforces the strengthen preserving at $2,473, whereas the 100-day EMA sits at $2,351.

The RSI downtrend merely under the midline reinforces the bearish grip on the ETH imprint. If merchants decrease publicity, citing intense volatility, the rate could well maybe tumble extra, pulling the RSI towards the oversold enviornment.

Nonetheless, since the vary strengthen at $2,500 is tranquil intact, a restoration could well maybe ensue, allowing Ethereum’s imprint to discontinuance the gap to the present high of $2,881, reached on Wednesday.

ETH/USDT & XRP/USDT day-to-day charts

On the rather a couple of hand, XRP hovers at spherical $2.13 at the time of writing, with losses drawing design 5% on the day. The route of least resistance could well maybe cease downward, underpinned by a sell signal from the Transferring Common Convergence Divergence (MACD) indicator on the day-to-day chart. This signal, confirmed on Friday when the blue MACD line crossed under the red signal line, could well maybe construct XRP shorts though-provoking. Thereby accelerating sell-side strain.

Beef up at $2.09, highlighted by the 200-day EMA, stays excessive to XRP. If damaged, the downtrend could well maybe lengthen under $2.00 and doubtlessly elevate April lows of $1.61 into glimpse.