August 2023: proposed guidelines

On Aug. 25, 2023, the US Treasury and the IRS released proposed guidelines that can possibly well possibly require corporations engaged in digital asset-related products and services to file records returns and furnish payee statements for digital asset dispositions.

The proposed guidelines present clarification on quite a lot of valuable suggestions, in conjunction with which digital resources are subject to reporting, who qualifies as a broker, pointers on how to calculate foundation in a digital asset and the treatment of digital resources as a separate class trudge from securities and commodities.

“A key allotment of this effort fits in with the larger IRS compliance focal point on neatly off taxpayers. We savor to make sure that digital resources are no longer weak to veil taxable profits, and the proposed guidelines are designed to earn a clearer line of peek into actions by excessive-profits contributors as neatly as others utilizing them,” said IRS Commissioner Danny Werfel.

The guidelines outline “digital asset middleman” broadly, encompassing entities admire shopping and selling platforms, pockets suppliers and payment processors. Below these proposed guidelines, brokers would possibly well well possibly be mandated to report on digital asset sales, with an expanded definition of “digital asset.”

These guidelines are slated to rob originate for transactions occurring on or after Jan. 1, 2025, with some reporting suggestions having later efficient dates. It is valuable to display masks that these guidelines are serene in the proposal stage and would possibly well well possibly additionally undergo further revisions.

Definition of digital resources and brokers

The proposed US Treasury and IRS guidelines lengthen the definition of reportable digital resources to encompass stablecoins, NFTs and tokenized shares, moreover for virtual resources restricted to closed programs admire video sport tokens.

A digital asset is a illustration of payment recorded on a real, distributed ledger. Popular kinds encompass:

- Convertible virtual forex and cryptocurrency (e.g., Bitcoin, Ethereum).

- Stablecoins, that are cryptocurrencies pegged to a real asset admire a fiat forex (e.g., USD Coin, Tether).

- Non-fungible tokens (NFTs), uncommon tokens representing ownership of digital resources admire art work or collectibles.

- These digital resources serve varied capabilities within blockchain and digital finance programs.

The definition of a “broker” is broadened to quilt entities offering “facilitative products and services” for digital asset sales, requiring detailed transaction reporting in conjunction with customer records and sale specifics.

Additionally, the Infrastructure Funding & Jobs Act broadened the definition of “broker” to encompass these facilitating digital asset transfers for others. This applies to any digital illustration of payment recorded on a distributed ledger.

US tax experts savor been vocal on the lack of readability in latest tax law. For instance, the proposed law § 1.6045–1(a)(21)(iii)(A) defines a facilitative service as any service that without lengthen or in a roundabout intention enables a sale of digital resources. It excludes contributors fully engaged in offering distributed ledger validation products and services, admire proof of labor or proof of stake, with out offering other capabilities or products and services.

In accordance to a Bloomberg Regulation report, as a result of a lack of readability, many proof-of-stake stakers and staking companies are taking a conservative technique. They report the payment of reward tokens as profits for the time being they’re created, in desire to when they surely acquire profits by selling their reward tokens.

Monitoring crypto profits by technique of software program forms

The IRS is now monitoring cryptocurrency profits by asking taxpayers on Maintain 1040 about their crypto actions. The earn particularly inquires whether contributors engaged in receiving, selling, sending, exchanging, or acquiring virtual forex. Providing false records can consequence in penalties, as tax returns are legally binding statements.

On Jan. 22, 2024, the IRS reminded taxpayers that they’ve to answer a digital asset query and report any related profits when submitting their 2023 federal profits tax returns, equivalent to what used to be required for the 2022 tax returns.

The query appears on the discontinue of forms:

- 1040, Particular person Revenue Tax Return;

- 1040-SR, U.S. Tax Return for Seniors;

- 1040-NR, U.S. Nonresident Alien Revenue Tax Return.

- 1041, U.S. Revenue Tax Return for Estates and Trusts;

- 1065, U.S. Return of Partnership Revenue;

- 1120, U.S. Company Revenue Tax Return;

- 1120-S, U.S. Revenue Tax Return for an S Company.

The digital resources query asks taxpayers whether, at any time all over 2023, they purchased digital resources as a reward, award, or payment for property or products and services, or in the occasion that they sold, exchanged, or otherwise disposed of a digital asset or a monetary ardour in a digital asset.

The query would possibly well well possibly additionally fluctuate barely looking out on the trend of taxpayer (person, company, partnership, or estate/belief). Besides checking the box, taxpayers must report all profits related to digital asset transactions.

April 2024: 1099-DA draft earn

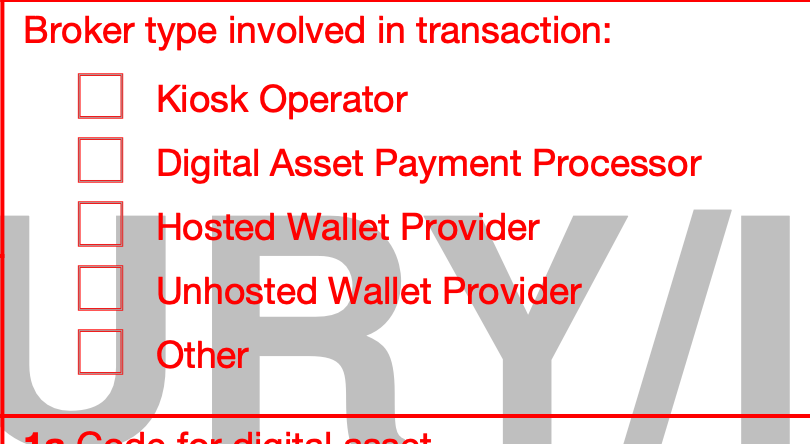

On April 18, 2024, the IRS unveiled a draft of Maintain 1099-DA geared toward calculating taxable features or losses from brokered digital asset transactions. This earn involves token codes and fields for pockets addresses, valuable for reporting to both taxpayers and the IRS.

Maintain 1099-DA involves person token codes, areas for pockets addresses and facts on pointers on how to detect transactions on the blockchain. Brokers are required to report digital asset dispositions on this earn to both taxpayers and the IRS, doubtlessly leading to identified features for taxpayers.

Nonetheless, the cryptocurrency alternate remains unsure about how the IRS will title brokers subject to those guidelines, in particular touching on varied kinds of actions admire kiosks, payment processors and pockets suppliers. The absence of a proper digital asset registry complicates compliance for brokers, in conjunction with centralized exchanges and decentralized platforms.

Topic of digital asset middleman

The good definition of “digital asset middleman” in the proposed guidelines would possibly well well possibly savor a few brokers in a single transaction. For instance, if a person uses a self-hosted pockets with a DeFi platform for a token swap, both the pockets provider and DeFi platform would possibly well well possibly additionally be opinion to be middlemen.

No longer like securities principles, there would possibly be no longer any exemption for a few middlemen, so every must file their savor Maintain 1099-DA with the IRS and taxpayer. This would possibly occasionally confuse taxpayers, leading to over-reporting or discrepancies with IRS records, adding to taxpayer burden.

Additionally, proposed guidelines’ pockets-by-pockets identification technique would possibly well well possibly pose challenges for taxpayers preserving resources with low bases in narrate wallets. They are going to savor to transfer excessive-foundation resources to those wallets to title them.

Crypto brokers: Who’re they?

The Infrastructure Funding and Jobs Act, efficient from Jan. 1, 2024, requires crypto brokers to report transactions over $10,000 to the IRS. This has sparked controversy as a result of perceived burdens and implementation challenges.

Brokers must post detailed reports to the IRS within 15 days of qualifying transactions, in conjunction with sender records. Lack of IRS steering leaves customers doubtful about compliance, in particular referring to miners, validators, decentralized exchanges and anonymous transactions.

Starting Jan. 1, 2025, proposed guidelines would mandate brokers admire digital asset shopping and selling platforms, payment processors and narrate hosted pockets suppliers to report execrable proceeds utilizing Maintain 1099-DA and furnish payee statements to potentialities.

Additionally, under certain prerequisites, brokers would savor to encompass waste/loss and foundation facts for sales occurring after Jan. 1, 2026, on these returns and statements to reduction potentialities in tax preparation.

In accordance to the PwC report, IRS anticipates receiving a rare volume of “eight billion” 1099-DA reports every year, with related costs projected in the billions. Companies will face challenges imposing the proposed guidelines if the efficient dates remain unchanged.

Crypto alternate response to IRS

Variant’s Jake Chervinsky called out IRS proposed guidelines as principles that “don’t originate sense.”

He believes the IRS’s technique is pushed by a perception of tax evasion, leading them to rely on monetary surveillance. Chervinsky argues that the IRS overlooks technology enabling look-to-look transactions with out intermediaries in a position to conducting KYC exams and reporting transactions.

Awful news: despite years of alternate engagement with IRS explaining why “unhosted wallets” can’t be brokers, the message one intention or the opposite hasn’t landed.

True news: principles that originate actually no sense the least bit infrequently ever continue to exist scrutiny in the courts.

Colossal news: we surely admire submitting lawsuits.

— Jake Chervinsky (@jchervinsky) April 21, 2024

Jason Schwartz, tax partner and digital resources co-head at Fried Frank, licensed how the unconventional definition of digital resources middleman does no longer aid to give an clarification for apart brokers.

18/ INITIAL REACTIONS. The proposed regs’ definition of digital resources middleman would turn internet pages builders into brokers if the earn sites “facilitate” digital asset sales.

That’s deplorable legislation and deplorable policy.

— CryptoTaxGuy.ETH 🦇🔊🛡️ (@CryptoTaxGuyETH) August 27, 2023

On Nov. 7, 2023, the DeFi Education Fund (DEF) filed a snappy supporting James Harper’s allure against the IRS, aiming to restrict the government’s access to person transaction historical past on cryptocurrency platforms.

Harper used to be one among thousands of Coinbase customers whose records used to be disclosed to the IRS in 2017, prompting a honest narrate for stronger digital privateness rights. DEF argues that guidelines proposed on Aug. 27 would lengthen the definition of “broker” too broadly, impose burdens on contributors and entities unable to conform, while jeopardizing privateness.

The IRS’s “broker rule” hasn’t been finalized, but it appears admire Treasury is admittedly going to rob the station that “unhosted pockets suppliers” are “brokers” 🤦♂️🤦♂️

IRS released draft 1099 earn for digital asset “brokers”: https://t.co/wH2IVWZ2gX pic.twitter.com/6oVNNmwPXO

— Miller (@millercwl) April 19, 2024

IRS steering sources

The treatment of cryptocurrency is subject to restricted steering, in conjunction with:

- See 2023-34, offering steering on certain convertible virtual currencies.

- The Infrastructure Funding and Jobs Act of 2021, which addresses digital asset records reporting for brokers.

- Proposed Regulations on digital asset reporting released Aug. 25, 2023.

- Revenue Ruling 2023-14, which discusses the inclusion of staking rewards in profits for money-technique taxpayers.

- See 2023-27, clarifying that NFTs must be treated as collectibles.

- Revenue Ruling 2019-24, offering steering on arduous forks and air drops.

- FAQ, as updated on the IRS internet pages.