Disclosure: The views and opinions expressed here belong fully to the author and make no longer signify the views and opinions of crypto.news’ editorial.

The US govt’s most up-to-date actions against crypto giants handle KuCoin and Binance own place it on look and solid an ominous shadow over the alternate. With regulators ramping up crypto enforcement in the North American market, startups and founders are having a assume in a single other country to assemble friendlier climates that can beef up the growth of their initiatives.

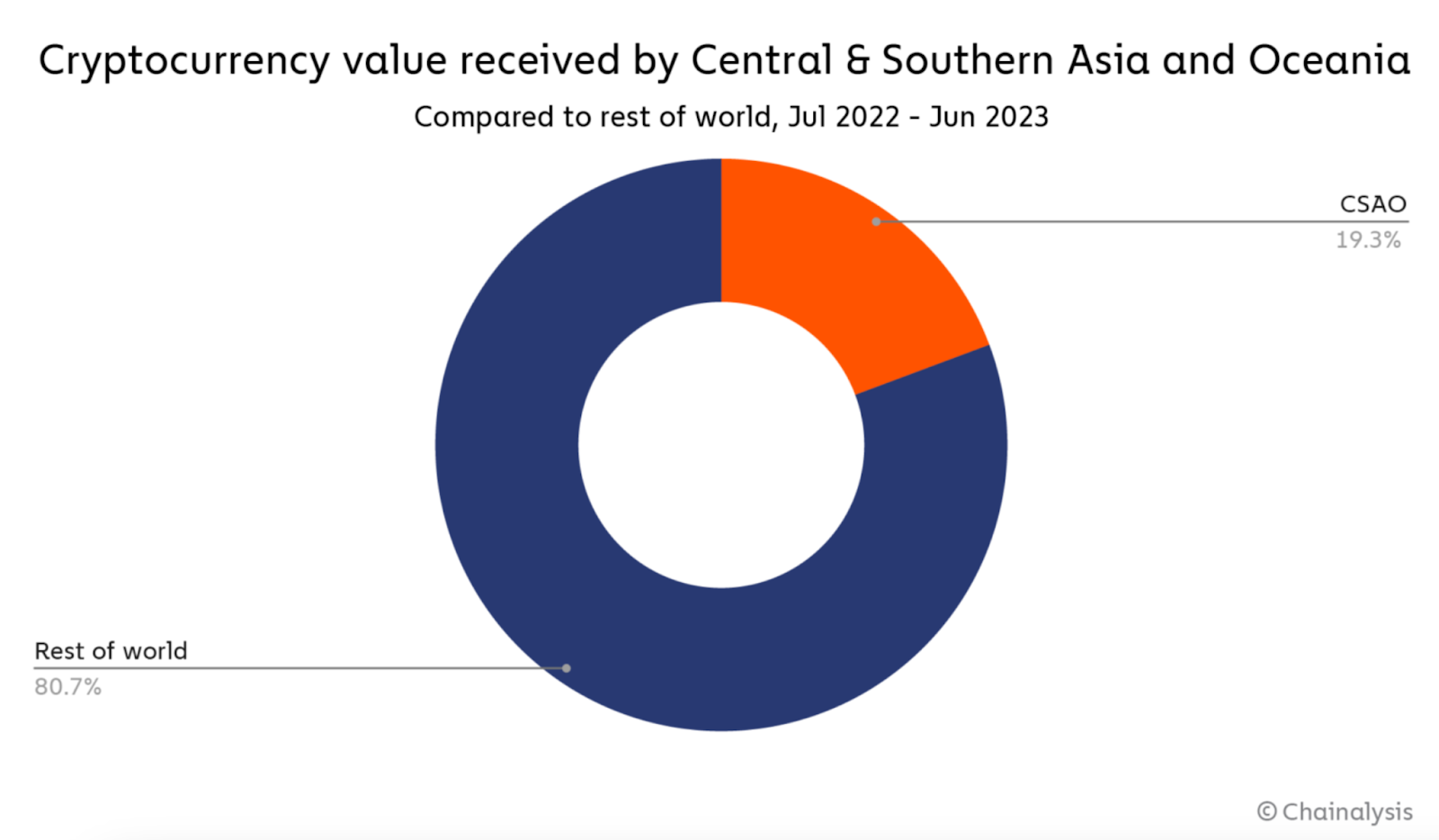

When evaluating investments, user engagement, product enlargement, and govt acceptance, Asia is a spot advancing institutional adoption while setting up itself as a hub for crypto innovation. Provided that six out of the cease 10 countries in crypto adoption are in Asia, it’s no surprise that the continent continues to push the blockchain frontier.

Asia’s proactive come to guidelines sets a gather precedent and provides a sturdy framework for legislators worldwide. Even monetary establishments working in Asia own taken legit-crypto actions to lift aged finance (TradFi) and decentralized finance (DeFi) nearer together. This proactive stance instills self belief in the alternate’s steadiness and future growth.

Hong Kong is one spot having a assume to reassert its region as a number one monetary hub, hoping its recent regulations entice a flood of entrepreneurs and investors. Following in the footsteps of the U.S., Asia’s first region Bitcoin ETFs debuted in Hong Kong, allowing investors to originate publicity to underlying sources’ designate stream with out straight proudly owning said sources. Though Hong Kong would possibly well well well presumably own a population of ideal seven million, the spot stands out for its alignment among regulators and govt officers with a frequent goal in the crypto sphere.

In other locations, in 2023, Japan made strides with its web3 whitepaper, sharing its strategies namely pertaining to NFTs and DAOs. The doc serves as a roadmap for navigating the complexities of the blockchain place while affirming regulatory compliance.

Japan has moreover implemented foundational regulations to help catalyze crypto growth. Most lately, lawmakers own developed web3 policies advocating for corporate tax reductions and recent opportunities for VC corporations to make investments in crypto. This recent guidelines, if enacted, will likely consequence in the creation of extra web3 corporations funded by Eastern investors.

From Japan’s proactive legislative changes to Hong Kong’s embrace of digital asset administration, the foundation has been laid for a regulated web3 ecosystem in Asian international locations.

Previous funding entrepreneurs’ targets, Asia-based enterprise capital corporations own develop into pivotal figures in propelling innovation. Along with to offering funding, these investors develop into companions who provide guidance, mentorship, and rep entry to to networks for blockchain initiatives.

DFG, for occasion, demonstrates how a number one blockchain and cryptocurrency funding firm with a necessary portfolio navigates by arrangement of a host of sectors inside of the blockchain sphere. With sources underneath administration exceeding $1 billion, DFG actively seeks out impactful initiatives in web3, defi, NFTs, and initiatives across ecosystems handle Polkadot and Ethereum, aiming to make price by arrangement of strategic investments.

As demonstrated by their participation in most up-to-date events handle the TEAMz Web3/AI Summit in Tokyo, DFG has shown its commitment to supporting web3’s growth, critically in Japan. With plans to deploy extra capital and have interaction in more initiatives, the firm exemplifies enterprise capital’s necessary role in advancing the blockchain place.

By demonstrating how efficient guidelines can coexist with blockchain innovation, Asia sets a clear example for the the leisure of the sphere to notice. The vogue of entire frameworks in the Asian market fosters an ambiance where blockchain can flourish, guaranteeing particular person protection and market integrity.