On June 30, 2024, the regulation “Markets in Crypto Sources” (MiCA) will formally advance into pause within the European territory, and demanding measures will seemingly be presented to curb the expansion of stablecoins managed from in one other country in uncover to prefer those native ones correlated to the EURO.

The main exchanges of the continent equivalent to Binance, OKX, and Kraken bag already ready for the regulatory replace and bag revised doubtless the most products offered to their prospects in Europe.

All this may per chance per chance possibly even, then again, restrict the technological expansion of the Union in the crypto sector, main to an on a regular basis regression relatively than development.

Let’s delve deeper into the topic in this text.

Summary

MiCA and stablecoin: the crypto regulation that limits electronic cash issuers will advance into pause on June 30

On October 10, 2023, the regulation “Markets In Crypto Sources” (MiCA) was once popular by the European Parliament with a favorable vote of 28 members, and now it is about to advance support into pressure, formally marking the introduction of the principle EU regulation that governs the crypto sector.

The matters display in the recent Textual train are aimed toward a big resolution of matters operating in the industry, equivalent to issuers of crypto-resources, suppliers of companies associated to crypto-resources (CASP), and cryptographic alternate platforms, addressing key points equivalent to person protection, recent tasks for anti-cash laundering, environmental impact, and corporate social accountability.

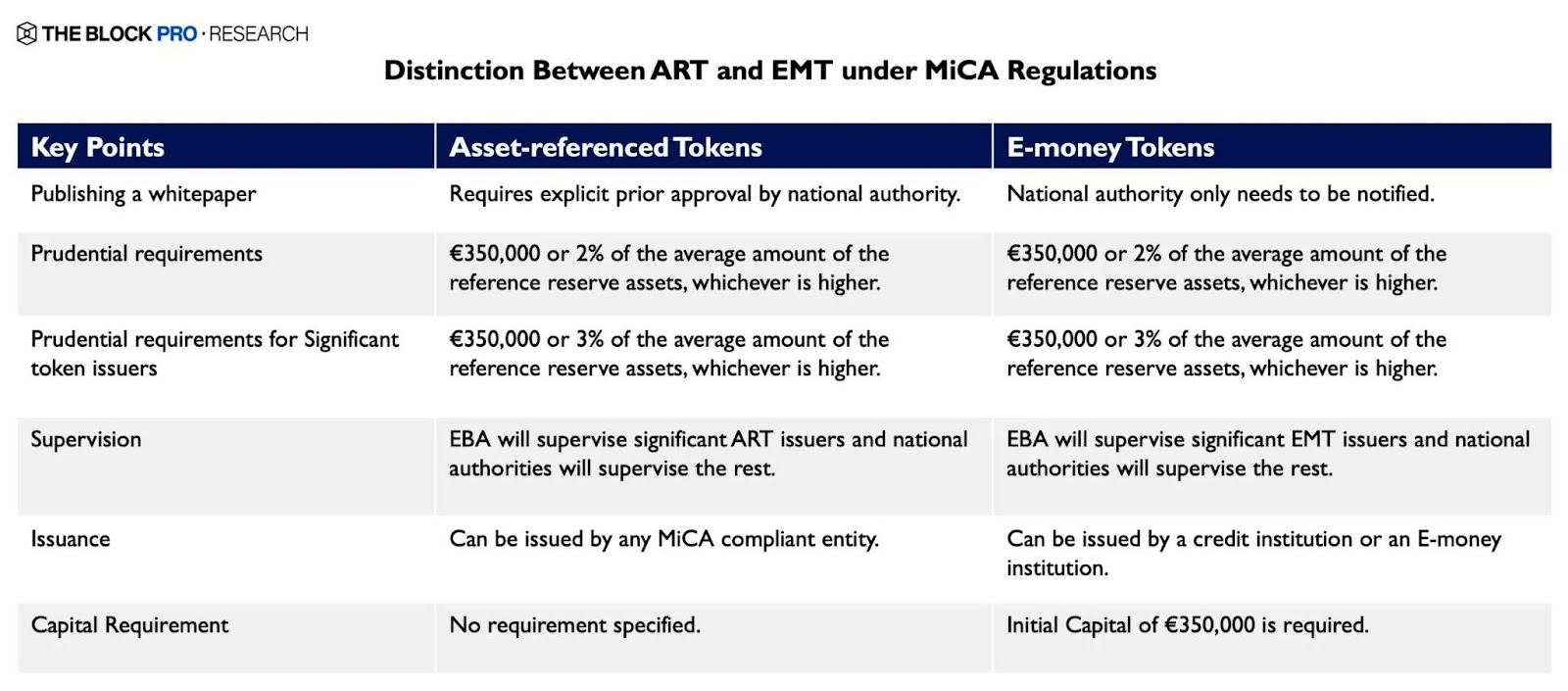

A total allotment of the regulation is, then again, dedicated completely to the arena of stablecoins, more precisely relating to the issuers of e-cash token (EMT), that’s, a particular form of crypto-asset that goals to take care of a stable price by relating to the price of an legitimate currency.

This definition distances itself from that of asset-referenced token (ARTs) which identifies crypto-resources aimed toward inserting forward a price relative to the mix of multiple resources or legitimate currencies.

The MiCA establishes the tax relevance of exchanges (swaps) between cryptocurrencies and e-cash tokens, whereas exchanges from cryptocurrencies to asset-referenced tokens may per chance per chance possibly soundless not be conception to be in this sense.

The recent MiCa regulation additionally stipulates that the particular stablecoins allowed to be freely traded in Europe are those who meet obvious requirements, equivalent to their supervision by the European Banking Authority (EBA) and the presence of a particular “electronic cash license”.

These requirements strongly restrict some established stablecoins both in Europe and in assorted continents equivalent to USDT, which turns into successfully illegal which ability that of the dearth of the explicit license, in the market in case of deposit of collateral resources at a credit institution basically basically based in the EU.

Moreover, the recent regulation that will soon advance into pause devices a maximum restrict of 200 million euros of on day by day basis trading volume (quarterly moderate): this quantity is a ways lower compared to the volumes recorded on day by day basis by the principle stablecoins in the crypto market.

In accordance to some experts on the topic, equivalent to Mathieu Hardy from the OSOM wealth management app, this limitation of MiCa on the stablecoin entrance may per chance per chance possibly be conception to be a solid discrimination against electronic cash tokens with a peg in USD.

Staring on the smartly-liked volume of the final 30 days of the principle USD stablecoins, we can peep how the highest 10 diversified coins by blockchain of belonging would abundantly exceed the restrict of 200 million euros on day by day basis.

Monthly stablecoin transfer volume breakdown: https://t.co/wWd6qcES3n pic.twitter.com/MGnRSxX028

— Token Terminal (@tokenterminal) June 19, 2024

Kaiko Learn: a springboard for EURO-pegged stablecoin crypto

In accordance to Kaiko Learn, the forthcoming MiCA regulation in Europe may per chance per chance possibly reassess the scope of EURO-pegged stablecoins, issued and managed by companies basically basically based within the Union.

The recent regulation is indeed considered as a springboard for native emoney tokens, which in the meanwhile file volumes soundless specifically low compared to those of assorted international e-cash tokens.

Already in most up-to-date months, several credit institutions bag moved to provide their bear stablecoin, equivalent to Société Générale with the originate of EURCV.

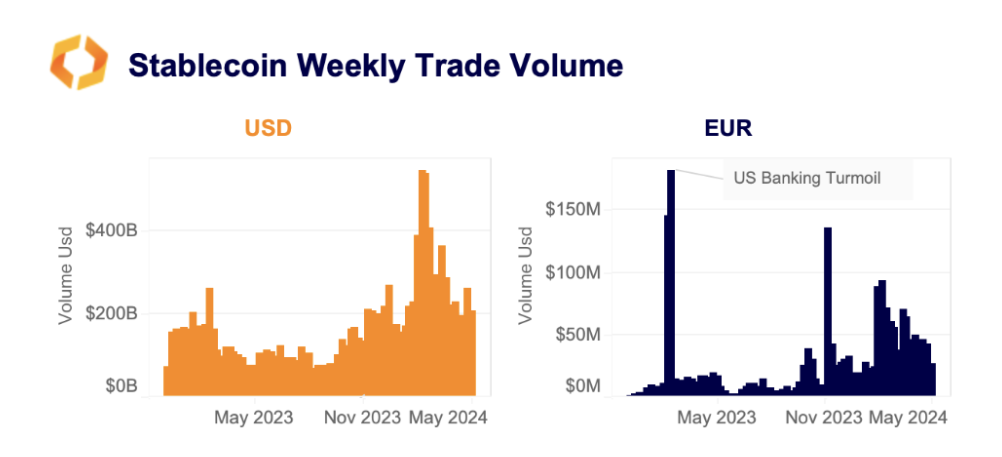

From October 2023 onwards, ever for the rationale that European Parliament popular the MiCA regulation, the weekly trading volumes of stablecoins pegged to the EURO bag considered a solid develop, even fleet surpassing 100 million, suggesting that interrogate is sooner or later increasing in European markets.

We remind you, then again, that the aspect motorway to competing with products pegged to the US buck is soundless very long.

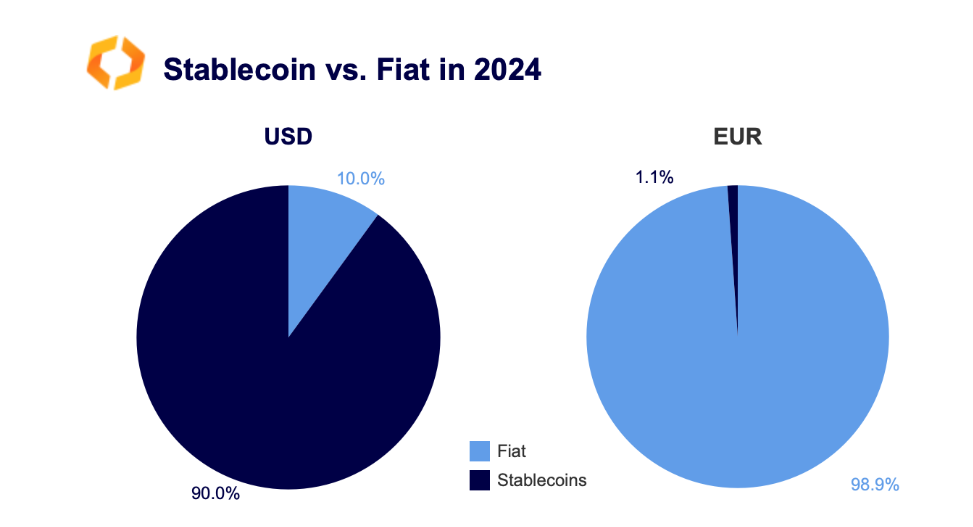

As of as of late in step with the data from The Block, Ninety nine.3% of the market portion of Ethereum stablecoins is dominated by those in USD, whereas the respective currencies in EUR bag appropriate 0.63%.

The euro is soundless the “second splendid resolution” compared to assorted FIAT currencies outdoors of the buck in this context, being the second most outdated currency in the stablecoin arena.

Total, the USD-backed stablecoin continues to dominate the bull and undergo cryptocurrency market.

Nearly 90% of all crypto transactions are carried out the usage of USD-backed stablecoins relative to the USD.

Their moderate weekly volume in 2024 was once 270 billion greenbacks, which is 70 times greater compared to their EU counterparts. On the synthetic, splendid 1.1% of all transactions are implemented the usage of Euro-backed stablecoins.

Nonetheless, it is payment noting that this portion has increased from almost zero in 2020 and is in the meanwhile at historical highs.

While splendid time will narrate if the introduction of Mica will push EUR-pegged stablecoins to compete with those in one other country, for the time being experts already agree that the regulation is having a clear impact on the crypto sector even sooner than it basically comes into pause.

To illustrate, Dante Disparte, the Head of World Coverage at Circle, observed in a publish on X that which ability that of regulatory improvement in Europe, the portion of VC investments in cryptographic projects on the continent has increased by almost 10 times from 2022 to 2023, rising from the initial 5.9% to 47.6%.

In the same length, the portion of VC investments in the US and Dubai has considerably diminished.

The MiCA pause 🇪🇺🚀

The portion of VC funding into European crypto projects is up almost 10x in one yr – from a portion of 5.9% in Q1 2022 to 47.6% in Q2 2023.

Regulatory readability attracts capital & entrepreneurs from world wide. Colossal improvement for crypto in Europe! pic.twitter.com/kUVp3rwlg3

— Patrick Hansen (@paddi_hansen) Might per chance possibly well per chance 9, 2023

Change, Tether e USDT: la regolamentazione MiCA advance passo indietro per l’Europa

The predominant crypto exchanges operating in Europe bag already ready for the regulatory earthquake that will soon be unleashed with MiCa, and bag proceeded to delist from their trading-pairs those stablecoins that are chanced on to be non-compliant with the regulation.

Binance has announced in this regard that it has differentiated its offering between stablecoin “regulated” and “unauthorized”, without then again explicitly relating to which coins will seemingly be excluded for European prospects.

What all americans knows for the second is that the launchpads in FDUSD will seemingly be suspended, and that the rewards in USDT for the “Exercise-to-Maintain” allotment will no longer be credited after June 29, aside from for the rewards gathered sooner than that length: Nonetheless, it is miles rarely clear if USDT, which turns out to be the stablecoin most tormented by the recent regulation, can soundless be traded on Binance’s plot and futures markets.

The alternate OKX, on the assorted hand, delisted USDT already in March, without relating to the MiCa regulation nonetheless with evident underlying connections, whereas Kraken lately denied intentions of a identical delisting.

For the time being, from the most up-to-date data from the crypto market, the decision of UpHold to delist on July 1, 6 stablecoins in conjunction with USDT, DAI, FRAX, GUSD, USDP, and TUSD, aside from USDC from the checklist, emerges.

Cryptocurrency alternate Uphold announced that which ability that of the MiCA in Europe on June 30, it’ll end supporting multiple stablecoins, in conjunction with Tether (USDT), Dai (DAI), Frax Protocol (FRAX), Gemini Buck (GUSD), Pax Buck (USDP) and TrueUSD (TUSD) from July 1. They’ll be…

— Wu Blockchain (@WuBlockchain) June 18, 2024

The bullism of MiCA against USD-pegged stablecoins, though motivated to scuttle away set for EURO counterparts, may per chance per chance possibly generate onboarding complications for European prospects of exchanges, who soundless exhaust USDT because the principle draw to transition from FIAT to CRYPTO.

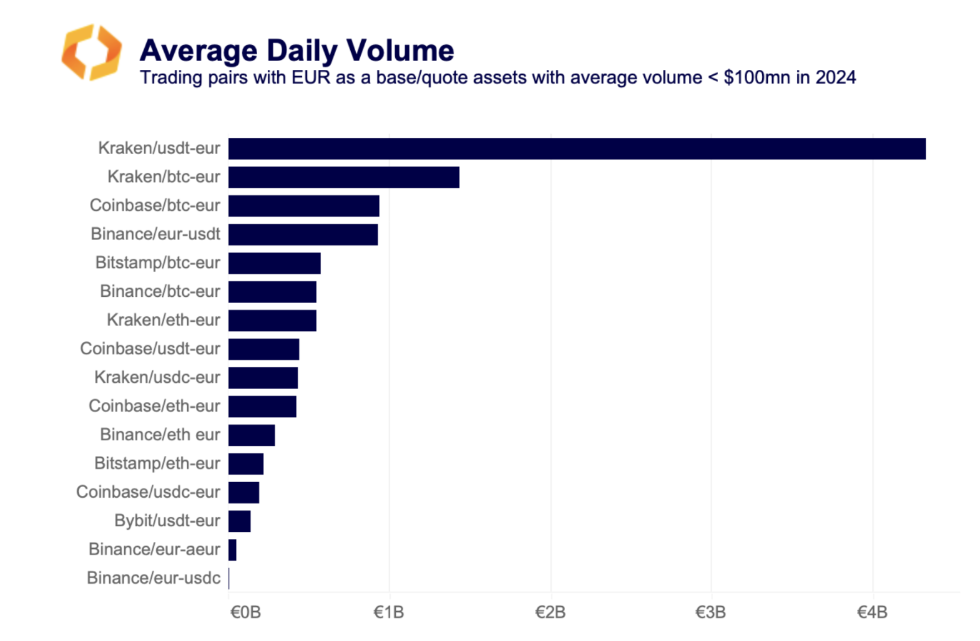

In point of fact, as highlighted by the info from Kaiko Learn, both on Binance and Kraken, the USDT-EUR pair turns out to be a more traded instrument by draw of volumes compared to BTC-EURO, demonstrating that Tether’s currency represents an wanted resource for European markets.

In the kind of context, whereas OTC trading will proceed to provide USDT-EUR liquidity, many traders may per chance per chance possibly resolve to rotate against regulated picks treasure USDC.

Paolo Ardoino, novel CEO of Tether, has strongly criticized the upcoming Mica regulation, emphasizing how the requirement for issuers to take care of not less than 60% of reserves in financial institution deposits acts as a counter-ambiance pleasant measure by draw of safety for the tip customer.

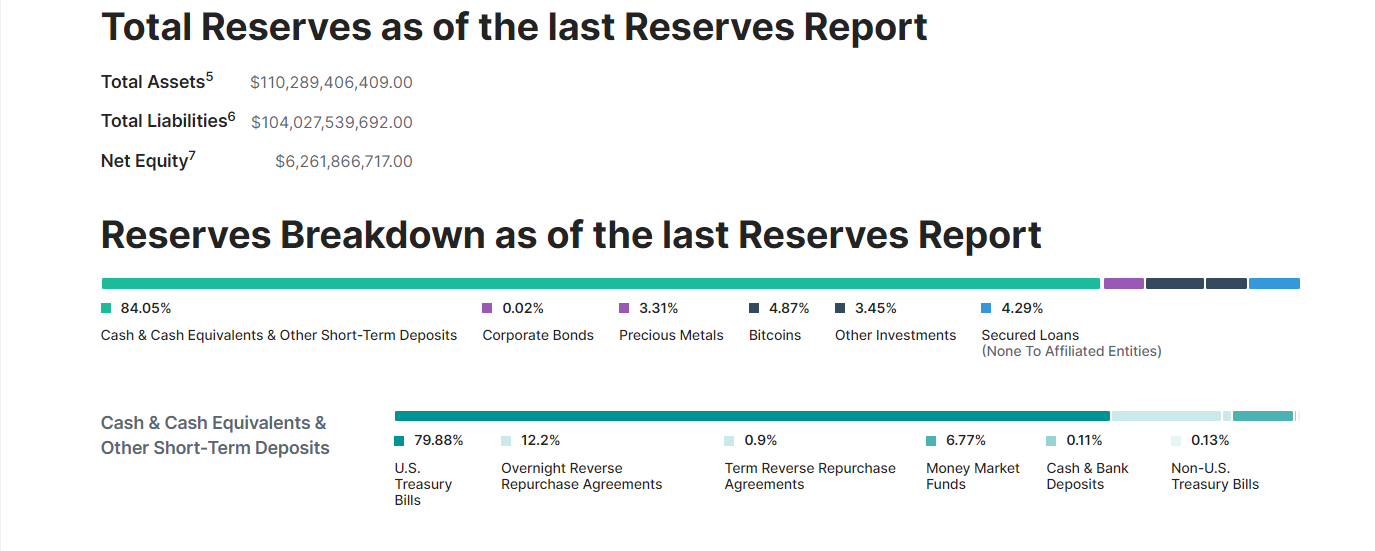

In point of fact, the European Central Bank insures splendid financial institution deposits up to 100,000 euros, a figure considerably lower than the market capitalization of USDT, which quantities to 112 billion greenbacks.

Imposing on issuers treasure Tether to set aside their reserves with straightforward financial institution deposits to change into compliant with the rules gives a that that you would be in a position to possibly imagine premise for no doubt one of many greatest financial failures in the arena of cryptographic finance in case of a give design of the custodian financial institution.

We remind that Tether in the meanwhile holds reserves in cash and equivalents, US treasury securities, useful metals, Bitcoin and assorted investments, offering a wonderfully differentiated asset allocation weighted in step with the financial predicament of the tech big, which in the principle quarter of 2024 recorded earnings of 4.5 billion greenbacks.