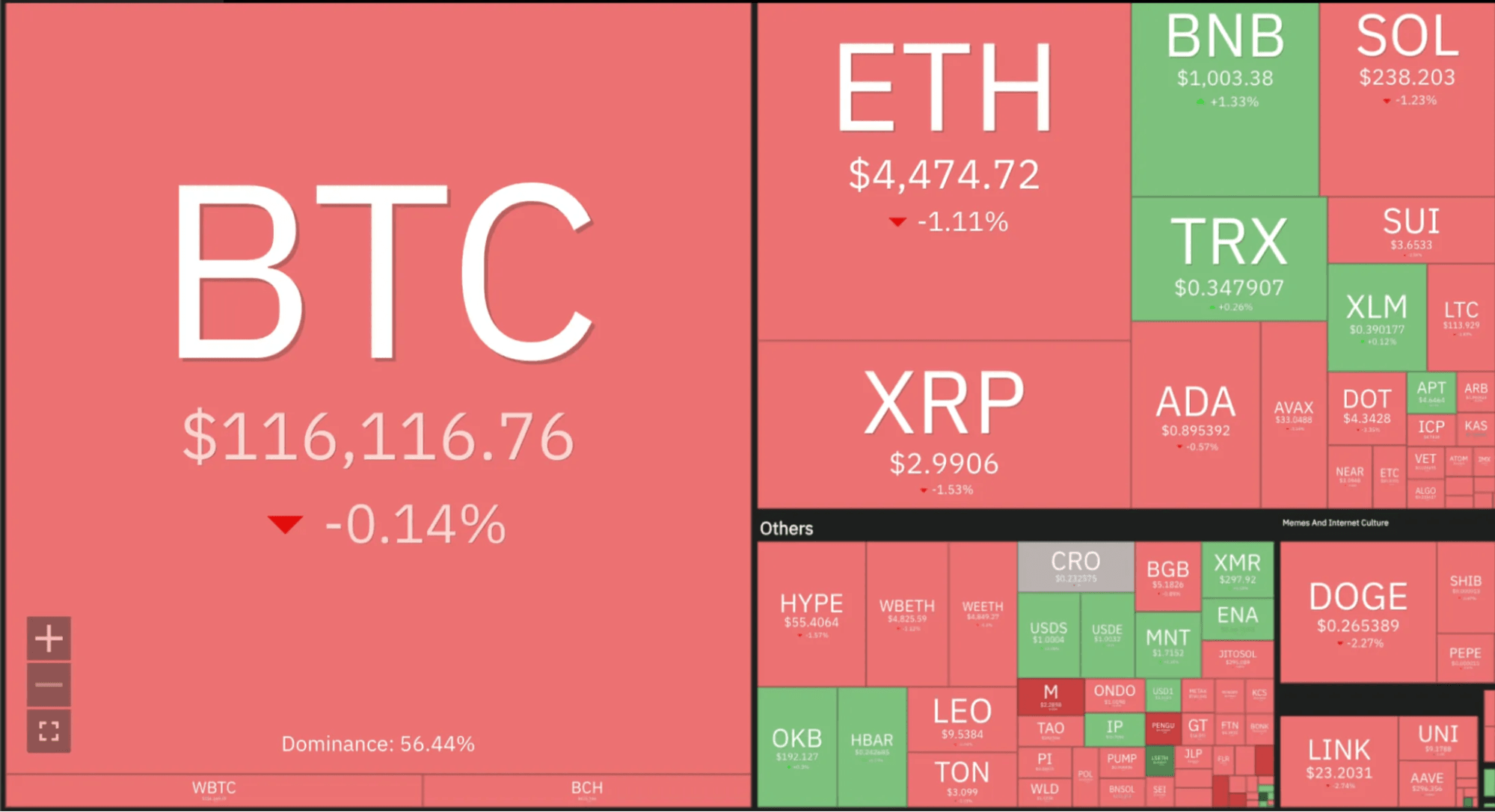

The cryptocurrency market has entered a decisive segment as Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) point out blended signals following their slack-August pullbacks. Bitcoin continues to face resistance around $117,500; on the opposite hand, bulls catch performed properly to again the stress as they push towards every other all-time high retest. As of writing, Bitcoin trades at $116,860, with a 24-hour trading volume of roughly $22.4 billion, per Coingecko data.

Ethereum, on the opposite hand, has outperformed the broader crypto market in recent months, having won about 5.4% within the past 14 days. Whereas the broader vogue stays positive, every chart gifts uncommon technical setups that can dictate the route of the next leg.

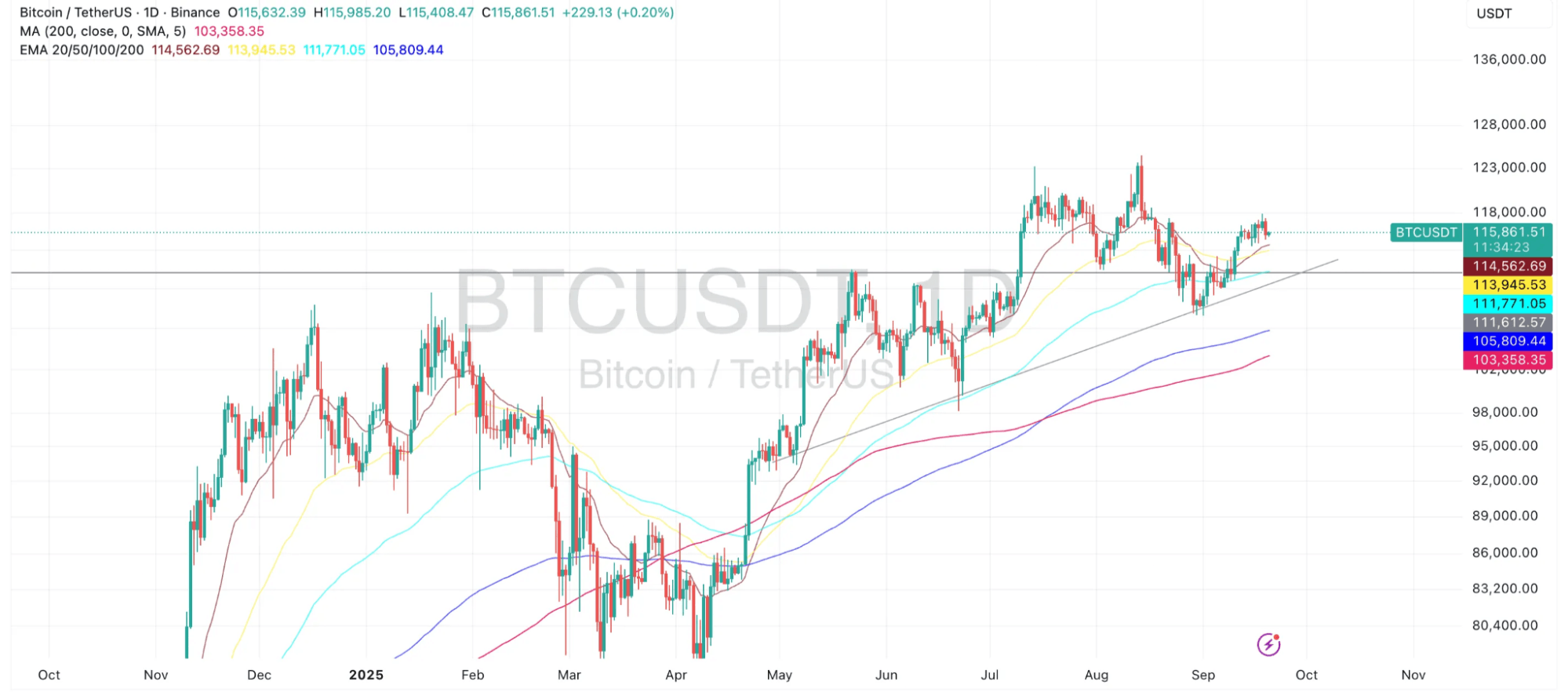

Bitcoin (BTC) Tag Prognosis

Bitcoin (BTC) has been trading around the $115,000–116,000 fluctuate after getting better from its early-September dip below $108,000. The trace came across make stronger attain $111,000, aligning with the 100-day EMA, and has since rebounded towards the $116,000 zone. The hot structure reveals BTC urgent in opposition to rapid-length of time resistance, whereas the longer-length of time engaging averages (20, 50, 100, and 200-day) continue to slope upward—a signal of sustained bullish momentum.

- Bullish Teach: If BTC can preserve above $114,500 and prolong past $118,000, the door opens for a retest of the $123,000 space, closing viewed in July. Sustained power above this level would possibly well ascertain a continuation of the broader uptrend, with the next purpose zone around $128,000–130,000.

- Bearish Teach: On the draw back, failure to preserve above the $113,500–114,000 make stronger cluster (coinciding with the 50-day EMA) would possibly well stumble on BTC breeze help towards $111,000 or even the 200-day MA attain $103,000. A ruin of this longer-length of time make stronger would flip the structure bearish, elevating concerns of a deeper retracement towards $98,000.

At this stage, Bitcoin’s structure leans cautiously bullish, however the market stays sensitive to macro catalysts and liquidity situations.

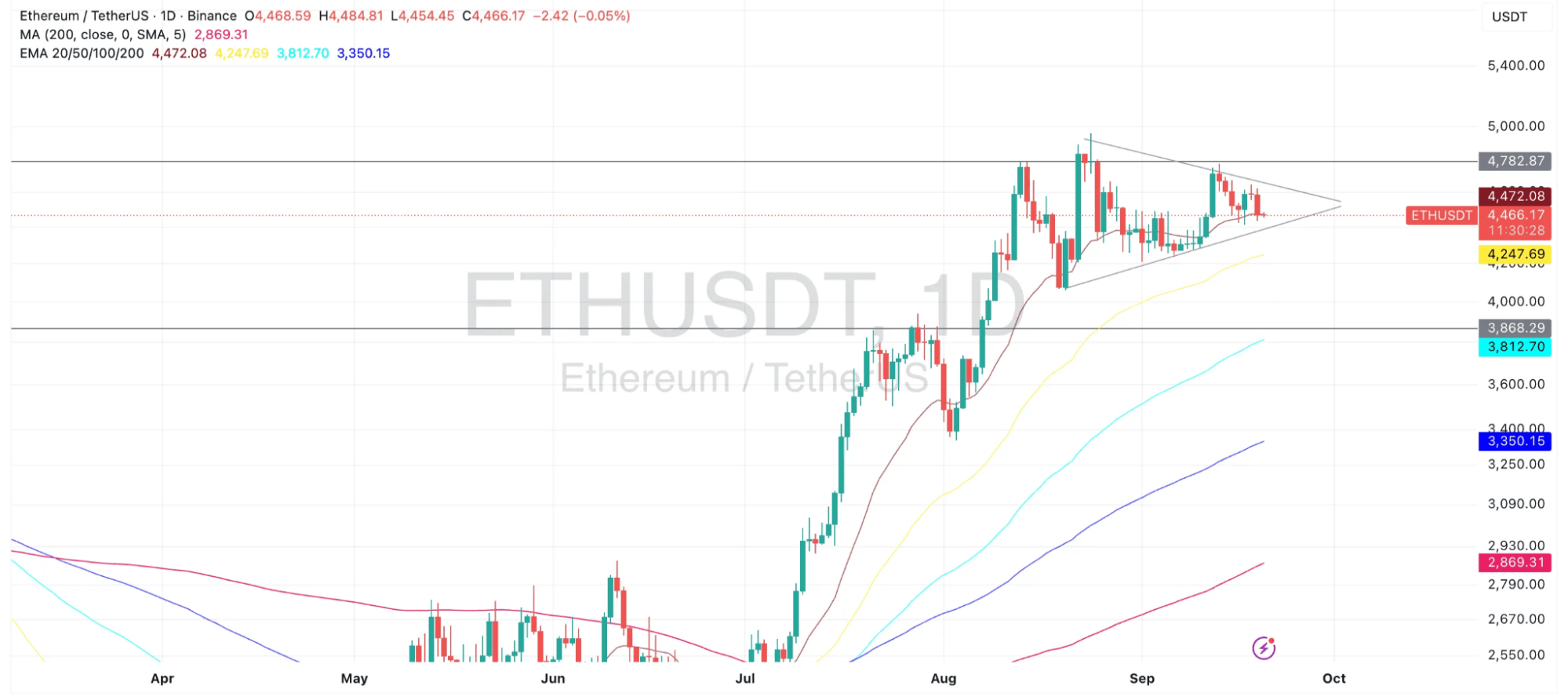

Ethereum (ETH) Tag Prognosis

Ethereum’s trace action is shaping into a symmetrical triangle formation, consolidating between $4,250 make stronger and $4,780 resistance since slack August. This tightening structure signals indecision, with bulls and bears preparing for a breakout. ETH has held firmly above its 50-day EMA attain $4,247, which continues to behave as a springboard.

- Bullish Teach: A fine ruin above $4,780 would ascertain the triangle breakout, paving the means for ETH to take a look at $5,000 and potentially stretch towards $5,200–5,400. Volume expansion will doubtless be key to validating such a transfer.

- Bearish Teach: Conversely, a rejection from the upper boundary followed by a breakdown below $4,250 would possibly well trek ETH help to the $4,000–3,900 zone, where the 100-day EMA sits as backup make stronger. A decisive lack of this level would possibly well impart ETH to deeper retracement towards $3,500.

Within the attain length of time, Ethereum’s consolidation suggests a breakout is forthcoming. Traders will doubtless be carefully ready for confirmation in either route.

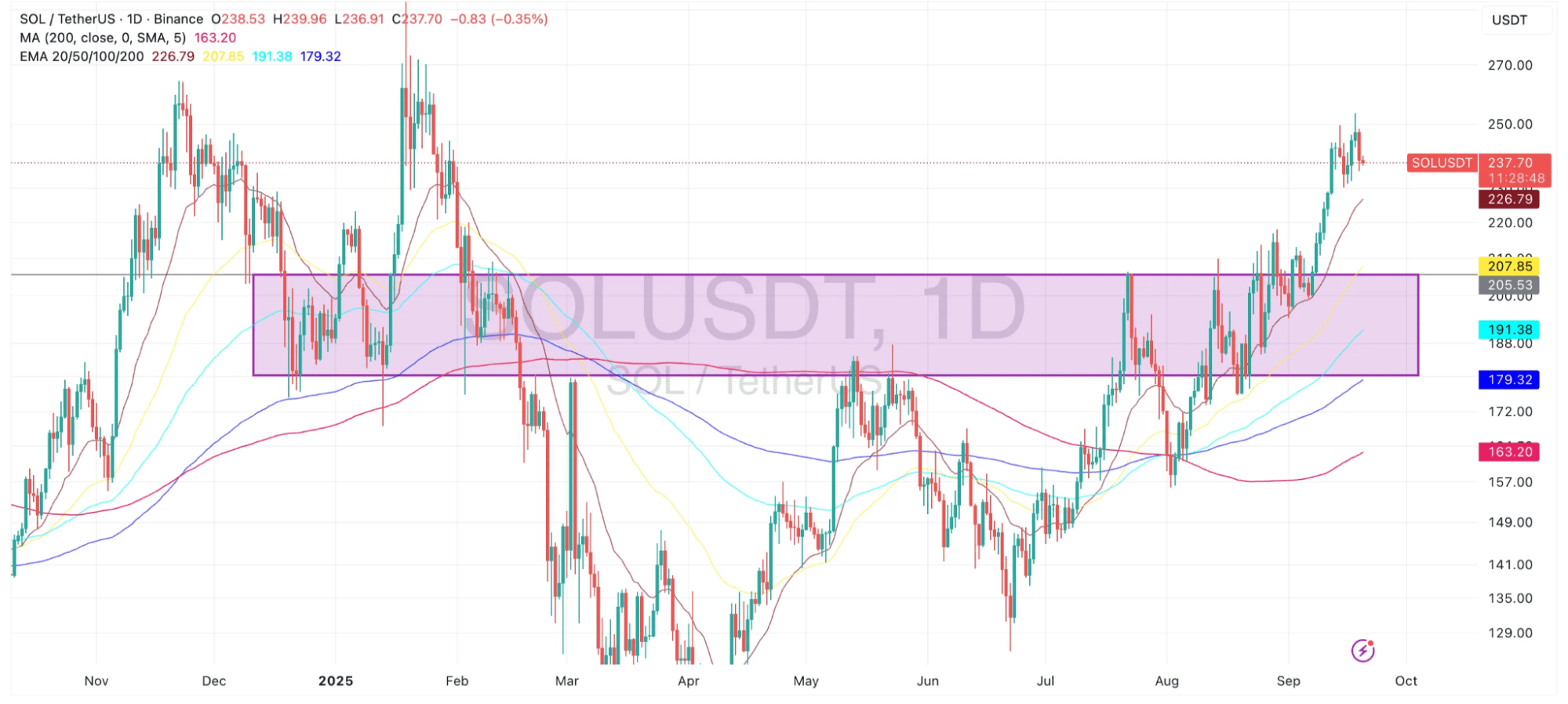

Solana (SOL) Tag Prognosis

Solana has been one in every of the stronger performers, breaking out of a prolonged consolidation zone between $170 and $205 in slack August. The breakout carried SOL as high as $239, where the token is now consolidating after a interesting move. Importantly, the breakout above the $205 ceiling marked a shift in market structure, turning earlier resistance into a brand sleek make stronger crude.

- Bullish Teach: If SOL holds above $225–227 and builds momentum, the next upside targets take a seat attain $250 and $265. A a hit retest of the breakout zone would possibly well ascertain the flexibility of this bullish leg, keeping SOL amongst the stronger altcoins in September.

- Bearish Teach: A failure to again above $227 would possibly well stumble on SOL retreat towards the breakout zone at $205. Shedding this serious level would suggest a counterfeit breakout, elevating risks of a breeze help towards the 200-day MA around $163.

For now, Solana’s chart reveals resilience, however after a solid rally, income-taking stress would possibly well amplify unless patrons step in aggressively.

Market Outlook

As September unfolds, Bitcoin, Ethereum, and Solana remain in technically positive positions however face key resistance levels. BTC is grinding precise below $118,000, ETH is at the apex of a triangle waiting for breakout, and SOL is testing submit-breakout momentum.

The bull case hinges on Bitcoin affirming its make stronger crude and dragging the broader market increased, with ETH confirming an upside breakout and SOL extending past $250. Conversely, the endure case would possibly well be ended in if BTC falters below $114,000, ETH breaks its triangle to the draw back, or SOL loses the $205 breakout level.

For now, the charts suggest cautious optimism, with bulls retaining an edge however requiring confirmation within the upcoming lessons. Traders have to remain alert to volatility spikes as these main cryptocurrencies take a look at serious technical levels.