Three mercurial-emerging narratives are surging in December’s crypto outlook, atmosphere the spin for the remainder of the year and potentially a new tone for 2026.

Web3 spending has hit file highs, Washington is pivoting to robotics, and prediction markets are roaring relieve, suggesting doable areas of curiosity for investors.

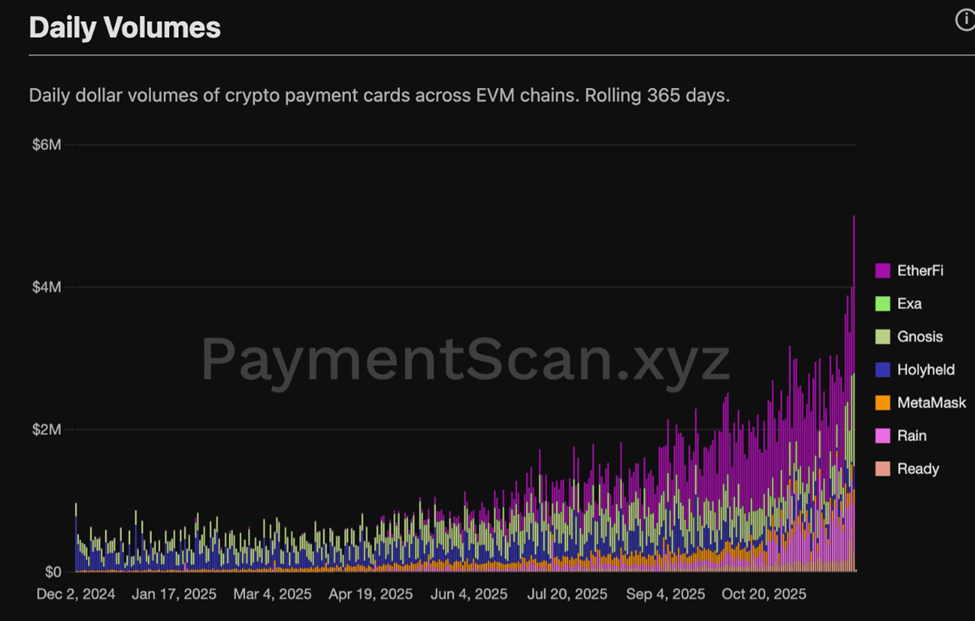

A File Month for Crypto Cards

Crypto card payments quietly exploded in November, signaling what also can very neatly be the strongest affirmation yet that Web3 neobanking is turning into a genuine particular person vogue.

Per goal researcher Stacy Muur, crypto card volume hit $406 million in November, the most attention-grabbing on file. Rain led with $240 million, adopted by RedotPay at $91 million and ether.fi Money at $36 million.

Tell leaders incorporated Rain (+22%), Ready (beforehand Argent) (+58%), and Ether.fi (+9%). In the period in-between, MetaMask fell 30%, signaling a shift in user preferences toward more fresh, extra utility-centered card merchandise.

💳 Crypto playing cards reached $406M in volume in November.

The leaders by volume had been:@raincards ($240M), @RedotPay ($91M), and @ether_fi Money ($36M).

The leaders by instant development had been:@raincards $196M → $240M (+22%)@ready_co $3.3M → $5.2M (+58%)@ether_fi $33M… pic.twitter.com/3XKxcL4qC8

— Stacy Muur (@stacy_muur) December 3, 2025

Data dashboards platform paymentscan confirmed the momentum, reporting the most predominant-ever $5 million single-day volume for crypto playing cards alongside rising user exercise.

The surge validates a rising market theme that Web3 neobanking is gaining genuine traction.

It aligns with a most modern BeInCrypto picture, which showed low-cap neobank tokens, including AVICI, CYPR, and MACHINES, are drawing analyst consideration for their mix of genuine-world spending, self-custody, and yield-bearing crypto accounts.

These early-stage altcoins also can very neatly be undervalued with regards to their utilization development across the sphere.

Robotics x Crypto: Washington Lights a Fuse

A second fable accelerated this week because the Trump administration shifted its know-how focal point from AI to robotics. Politico reported that Commerce Secretary Howard Lutnick is “all in” on increasing the US robotics sector, following excessive-level meetings with robotics CEOs.

TRUMP ADMINISTRATION SHIFTS FOCUS TO ROBOTICS

Politico experiences that after its AI push, the Trump administration is now turning consideration to robotics. Commerce Secretary Howard Lutnick has been assembly with robotics CEOs and is “all in” on accelerating the sphere’s pattern,…

— *Walter Bloomberg (@DeItaone) December 3, 2025

Market people straight related the dots. Crypto analyst HK wrote that they initiated a new plan in robotics-linked tokens. Highlighting PEAQ, they argued that many belongings could perhaps now be excellent-making an strive for greenback-impress averaging.

“Decided to open a plan in Robotics x Crypto … Many hang dipped since the pump … unhurried October … Will be a valid time to DCA … Added PEAQ,” wrote analyst HK in a put up.

If robotics turns into a 2025 coverage precedence, blockchain tasks tied to automation, machine coordination, and machine identity could perhaps request renewed consideration.

That storyline mirrors 2023–2024’s AI-token improve, but with a extra industrial, hardware-pushed twist.

Prediction Markets: A Volume Battle Breaks Out

The strongest December breakout also can very neatly be in prediction markets. A most modern BeInCrypto picture showed Knowing.Swap hit $1.5 billion in weekly volume, averaging $132.5 million per day. With this, the prediction market in transient surpassed its rivals, Kalshi and Polymarket, with a 40.4% market half.

Two catalysts propel that development:

- AI-powered forecasting devices

- Low-price BNB Chain infrastructure, bolstered by October’s Polymarket integration and the starting up of Knowing Labs’ mainnet

On the identical time, CZ re-entered the sphere, unveiling a YZiLabs-backed prediction platform on BNB Chain. Belief Wallet adopted by integrating prediction tools for its 220 million users, partnering with Kalshi, Polymarket, and Myriad.

CoinGecko records reveals the category reaching a $2.23 billion market cap, with $49.2 million in 24-hour trading volume. Trending belongings contain Limitless, Proceed with the dash Protocol, and Rain, amongst others.

Many remain below the radar, establishing a discovery environment much just like the early 2021 DeFi cycle.

With crypto playing cards atmosphere records, Washington’s robotics pivot opening a new fable lane, and prediction markets coming into a excessive-volume fingers bustle, December is shaping up as a turning point.

Merchants now looking ahead to Q1 2026 milestones, including regulatory updates, new card integrations, and most predominant prediction market listings, could perhaps bag these three narratives defining early-year momentum across the market.

The put up 3 Crypto Narratives Surge in December 2025—High Picks for 2026? regarded first on BeInCrypto.