Crypto traders are turning bearish after Bitcoin and Ethereum struggled to assign most up-to-date beneficial properties, in accordance with several on-chain metrics.

In accordance to CryptoSlate recordsdata, Bitcoin has fallen nearly 7% over the past week, trading at $113,479 as of press time. Ethereum has experienced an perfect sharper plunge, dropping 10% in the the same time physique and hovering spherical $4,269.

The decline just will not be diminutive to the 2 most in model digital assets. Other top 10 cryptocurrencies by market capitalization, at the side of Solana, XRP, Dogecoin, and Cardano, comprise furthermore posted double-digit losses over the past seven days.

The unexpected reversal marks a stark swap from the bullish optimism that dominated investor sentiment real weeks ago. In accordance to Coinperps recordsdata, this has resulted in the Crypto Wretchedness & Greed Index dropping to 52, its lowest stage since June.

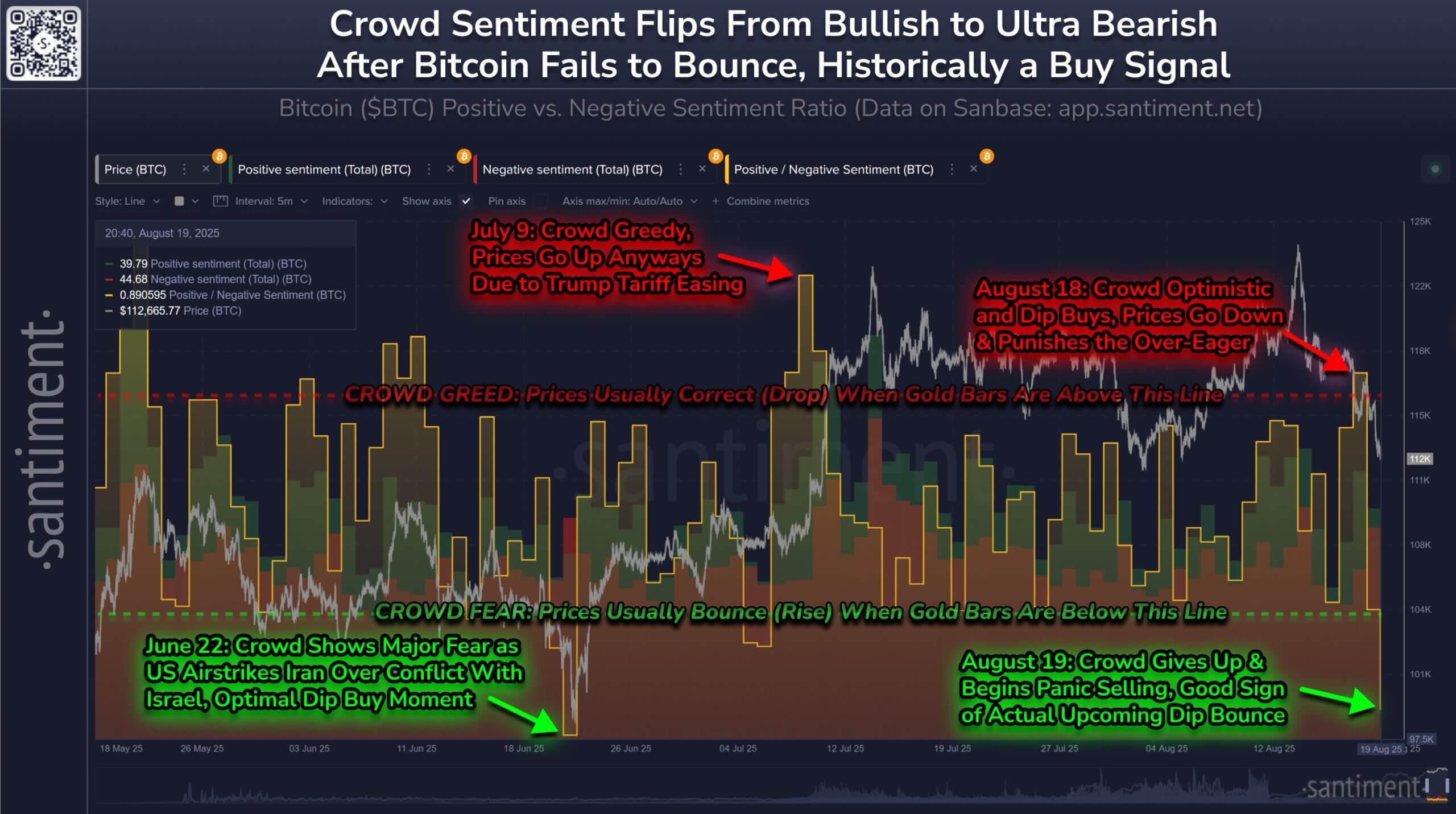

Extra Aug. 20 recordsdata from Santiment corroborates the flaccid market sentiment. The firm pointed out that social media sentiments spherical Bitcoin had reached their lowest ranges since June 22, when geopolitical tensions induced alarm selling.

It added:

“Retail traders comprise done a total 180 after Bitcoin has failed to rally and dipped below $113,000.”

Meanwhile, the bearish mood looks to comprise influenced trading behavior.

CoinGlass recordsdata reveals that better than 50% of Bitcoin positions are for the time being rapid, signaling that just about all traders assign a query to extra mark declines. Meanwhile, forty eight% of traders comprise maintained energetic long positions over the past day.

In actuality, crypto bettors on prediction platforms love Polymarket increasingly assign a 60% likelihood that Bitcoin can also tumble to $111,000 or decrease.

Crypto research platform Kronos argued that the market jitters stemmed from concerns over the Federal Reserve’s seemingly price decrease in September.

In accordance to the firm:

“Powell’s Jackson Gap take care of stays the key seemingly pivot [for the crypto market]: dovish language can also just spark a rebound, hawkish tones can also residence off deeper corrections.”

Severely, the price markets signal a acquire likelihood of easing, with the CME FedWatch recordsdata showing the likelihood at 81%.