- Analysts utter Bitcoin may also fair be drawing near a local bottom, citing key give a rob to on the 61.8% Fibonacci retracement at $94,253, and reversal may lead to an total crypto market rally.

- Altcoins utter early indicators of stabilizing, with ETH and XRP attempting to aid key give a rob to levels after fascinating weekly declines.

Even as US equities and Gold proceed to carry genuine beneficial properties, Bitcoin (BTC) and the broader crypto market receive delivered a subpar performance. With BTc extending its weekly losses to 10%, market analysts inquire of the put apart the underside lies.

On the diverse hand, altcoins luxuriate in Ethereum (ETH), XRP, and Solana (SOL) receive also extended double-digit losses over the previous week, triggering huge crypto market liquidations.

Will Crypto Market Glean greater As Bitcoin Assessments Local Backside?

Crypto market liquidations receive hit yet any other $500 million on the present time because the BTC trace took a dive below $93,000 earlier on the present time. The long liquidations dominate at $378 million, as high altcoins luxuriate in ETF, XRP, and SOL face volatility.

Nonetheless, market consultants receive started believing that the Bitcoin bottom may soon be in, whereas projecting a reversal to the upside. BTC pulled help nearly 10% final week after being rejected on the 38.20% Fibonacci retracement stage at $106,453, measured from the April 7 low of $74,508 to the October 6 all-time high of $126,299. As of Monday, the asset is trading come $95,300.

If BTC trace holds give a rob to at some stage in the 61.8% Fibonacci retracement stage at $94,253, it will in all probability resume its rebound and retest the $106,453 stage.

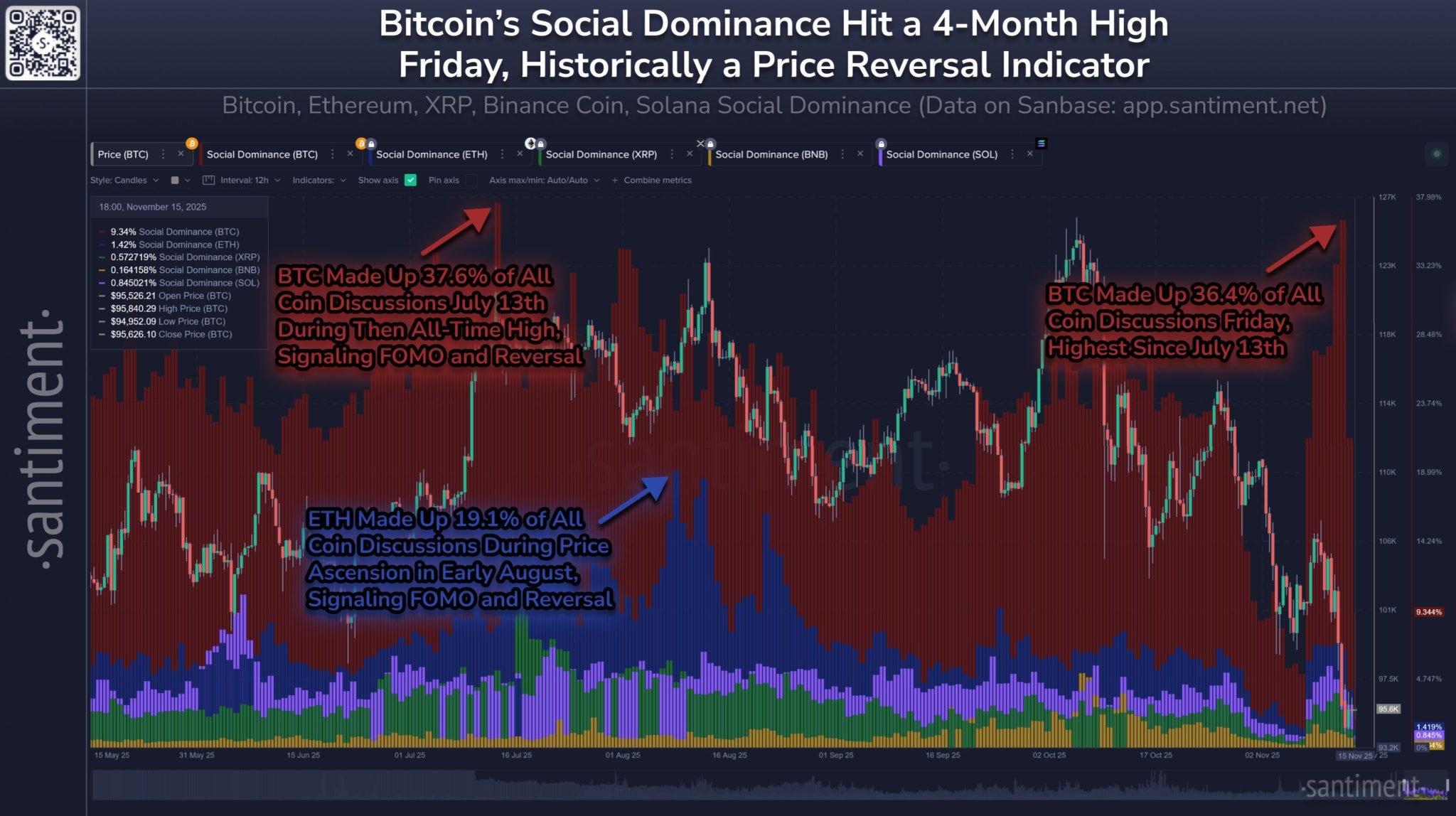

Additionally, blockchain analytics company Santiment reported that whereas it’s no longer a definitive market-bottom indicator, the chance of a reversal will increase when Bitcoin’s social dominance spikes.

All the draw by means of Friday’s drop below $95,000, dialogue levels reached a four-month high. They highlighted that BTC may soon score its footing as retail horror and grief develop.

On the same time, analyst Ted Pillows acknowledged the continued trace action suggests Bitcoin stays in a Wyckoff distribution allotment. He eminent that the $88,000–$90,000 range may also fair present a key give a rob to zone and doubtlessly reduction as a local bottom. He also puzzled the put apart the crypto market may effect its next definitive bottom.

A Gaze At ETH, XRP Restoration Possibilities

Amid the broader crypto market sell-off, high altcoins luxuriate in ETH, XRP, and others receive also extended losses. Ethereum fell nearly 14% after being rejected on the previously broken trendline come $3,592 final week, with the token trading around $3,100 on Monday.

A help above give a rob to at $3,017 may draw the stage for a transfer help toward the $3,592 resistance zone. Resembling Bitcoin, Ethereum’s RSI has bounced from oversold territory, indicating weakening bearish momentum.

In the same draw, XRP encountered resistance on the 50-day EMA come $2.49 final week, main to a decline of fair about 7%. As of Monday, the token is trading around $2.25.

A endured restoration may open the course for a transfer help toward the 50-day EMA at $2.49. The on each day basis RSI sits at 42, shut to the honest 50 trace, indicating weakening bearish momentum.