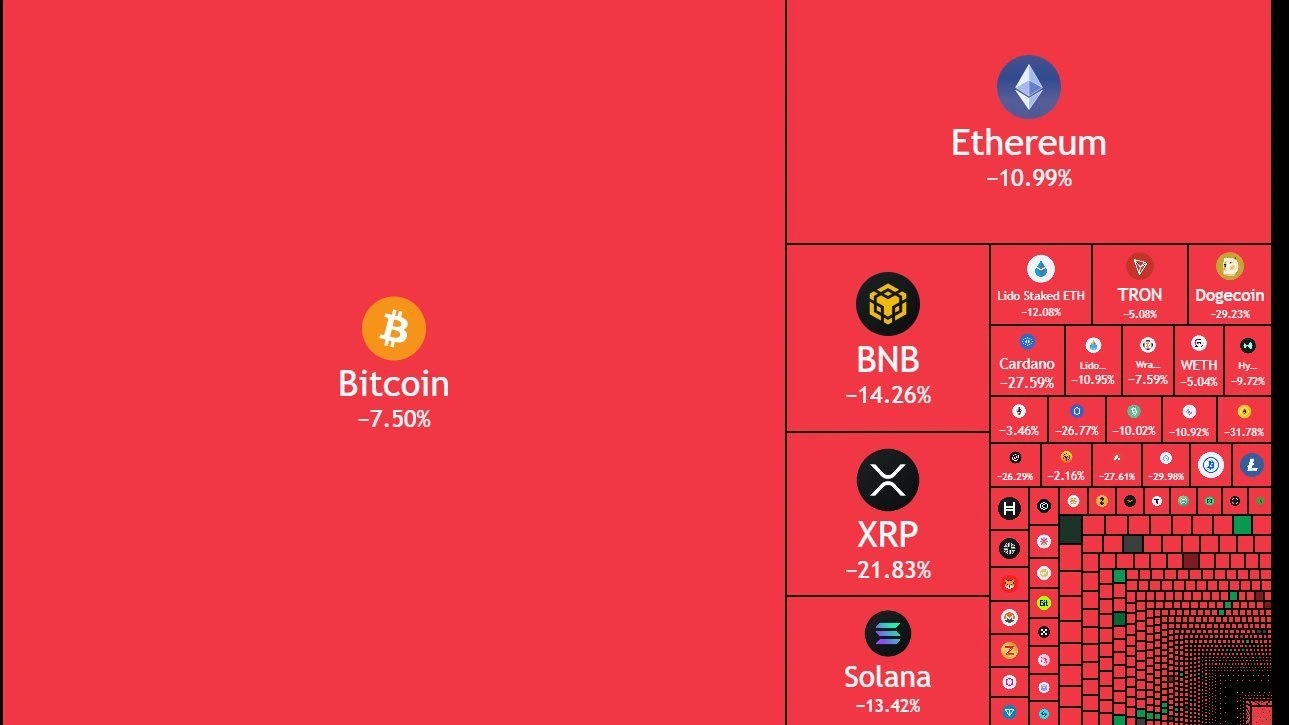

On October 10, 2025, the cryptocurrency market experienced what is now being called the greatest liquidation occasion in the history of procuring and selling. Since the dump, crypto natives maintain been shopping for solutions, and a fundamental theme has been suspicion of centralized exchanges.

Stakeholders and commentators maintain linked essentially the latest volatility to broader monetary market jitters, now not not like the sell-off that rocked US inventory markets. On the other hand, the rate and scale of the impact on the crypto market maintain amplified suspicion.

Speculations on what triggered the rupture

“Notice on the avenue is that huge CEX’s auto liquidation of collateral tied to wrong margined positions is why a total bunch alts obtained smoked on the pass down,” Arthur Hayes wrote on X. “Congrats to all you stink bidders. We won’t be seeing those ranges any time soon on many top quality alts.”

Any other influencer referred to an occasion that Cryptopolitan reported on Friday, when a whale opened short positions on BTC and ETH two days ahead of the market massacre.

The wheels had been in the kill situation in motion after Trump’s declaration on October 10, nonetheless the market supreme dipped slightly; nothing too major. Then, just a few hours later, a podium announcement apparently declared commerce battle on China, causing awe.

“Initiating November 1, the US will impose a 100% tariff on all Chinese language imports,” the declaration stated and within minutes, the S&P 500 dropped over 2%, Bitcoin plunged to $104K, Ethereum crashed to $3,574 and altcoins bled 60–90%, all culminating in nearly $1T in crypto market cap wiped in beneath 3 hours.

The influencer infamous how suspicious the timing modified into once; Thirty minutes sooner than Trump made the respectable announcement, the an analogous whale doubled its short publicity, and when the rupture hit, those positions had been closed for an estimated $200M revenue.

“Too most attention-grabbing to be a accident,” wrote the influencer, who stays blissful that this tag extraction would now not originate a undergo market. In accordance with him, it modified into once a purge, and that is characteristic of bull markets — supreme sooner than they pass up one more extensive leg.

While Trump’s tariffs may well per chance well additionally merely maintain triggered the cascade, what comes now may well per chance well per chance gas the next expansion or abolish it.

Other theories circulating on the on-line are linked to insider procuring and selling and “engineered liquidations” fueled by on-chain knowledge, and political timing.

For now, these claims are extra speculative than confirmed, nonetheless they echo the lengthy-standing components admire thin liquidity and whale dominance that made some maintain remote from crypto in the early days.

Are we in a undergo market?

First off, it may well possibly possibly per chance well per chance additionally merely serene be infamous that the serene circumstances produce now not match the criteria of previous undergo markets. On the other hand, immature reactions may well per chance well per chance trigger bearish continuity, threatening previous positive aspects.

The volatility modified into once triggered in neat phase by essentially the latest round of tariffs from US President Donald Trump, supreme days after BTC made a new all-time high.

Trump announced on Friday that he would impose an additional 100% tariff on China and export controls on machine, causing prices to tumble at a time the market modified into once already showing weakness.

Bitcoin, which had touched above $125,000 earlier this week, dipped as low as $104,000 on Saturday sooner than hovering around $112,000 as of newsletter time.

The autumn may well per chance well additionally merely now not look for admire significant, nonetheless all the way thru the last 24 hours, over $19 billion price of bets had been worn out, and bigger than 1.6 million merchants obtained liquidated, per Coinglass knowledge. Extra than $7 billion of those positions had been reportedly closed in much less than an hour of procuring and selling on Friday.

Coinglass suspects the total will possible be significant elevated since exchanges don’t necessarily memoir such orders in valid time. Binance, as an illustration, supreme experiences one liquidation disclose per second, the post claims.

“The purpose of ardour now turns to counterparty publicity and whether this triggers broader market contagion,” stated Brian Strugats, head vendor at Multicoin Capital, sooner than alongside side that some estimates draw total liquidations above $30 billion.