With the Bitcoin fee hovering above $50,000, the purpose of hobby of the crypto neighborhood has shifted against the DeFi sector, which has been witnessing a predominant surge, marking an pause to the crypto wintry weather. This pivot is basically attributed to the mainstream consideration DeFi has garnered amidst the ongoing AI craze.

Platforms enabling customers to lend, borrow, or alternate crypto with out the intermediation of a government, corresponding to Uniswap and others, like considered a spike in cost following various innovative proposals.

Therefore, it looks that the DeFi tokens might maybe maybe just develop a big noise in the upcoming bull journey and imprint unique highs.

Maven11 Capital’s Strategic DeFi Gains

Amidst this DeFi sing, Maven11 Capital has exemplified the chance of astute beneficial properties in the crypto enterprise establish. With a strategic investment in DeFi tokens, Maven11 Capital has reported a outstanding return of 54%, amounting to $1.43 million.

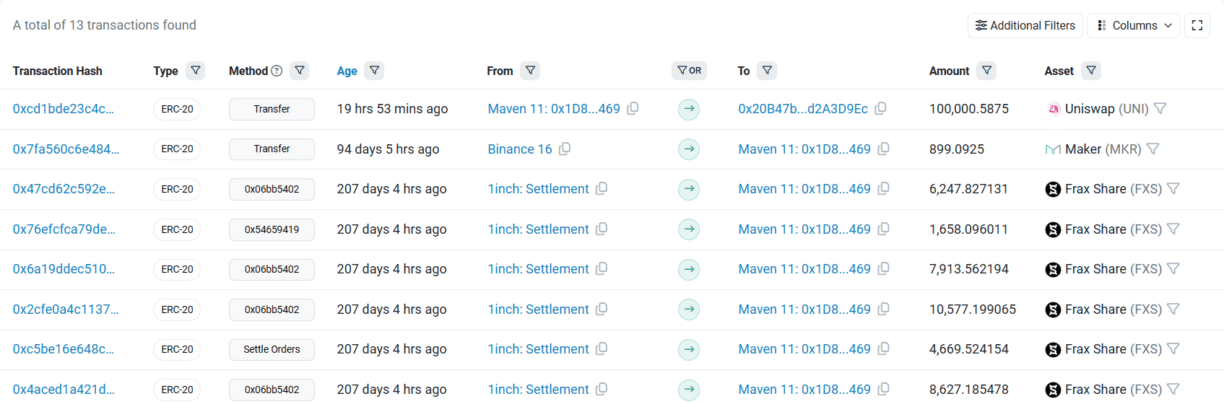

Offer: Etherscan

This success story began with the possess of 100,000 UNI tokens at $5.74 each from Binance, later equipped at $11.2, ensuing in a 95% develop of $546K.

Equally, investments in other tokens love MKR, AAVE, and FXS like yielded predominant returns of 38%, 58%, and 43%, respectively, highlighting the profitable alternatives interior the DeFi sector.

Uniswap’s Governance Proposal Fuels DeFi Rally

pattern fueling this surge is the contemporary proposal by Uniswap to reward its token holders. The proposal suggests distributing protocol expenses among UNI holders who stake and delegate their tokens, thereby making improvements to the protocol’s governance.

This initiative, spearheaded by Eric Koen, the governance lead of the Uniswap Foundation, ended in a 70% hike in UNI tokens and guarantees to revitalize the community’s decision-making direction of.

Other than Uniswap, COTI (COTI) has marked a considerable soar of over 38%, while SushiSwap (SUSHI) soared above 36%.

Liquidity Tendencies Signal Rising DeFi Optimism

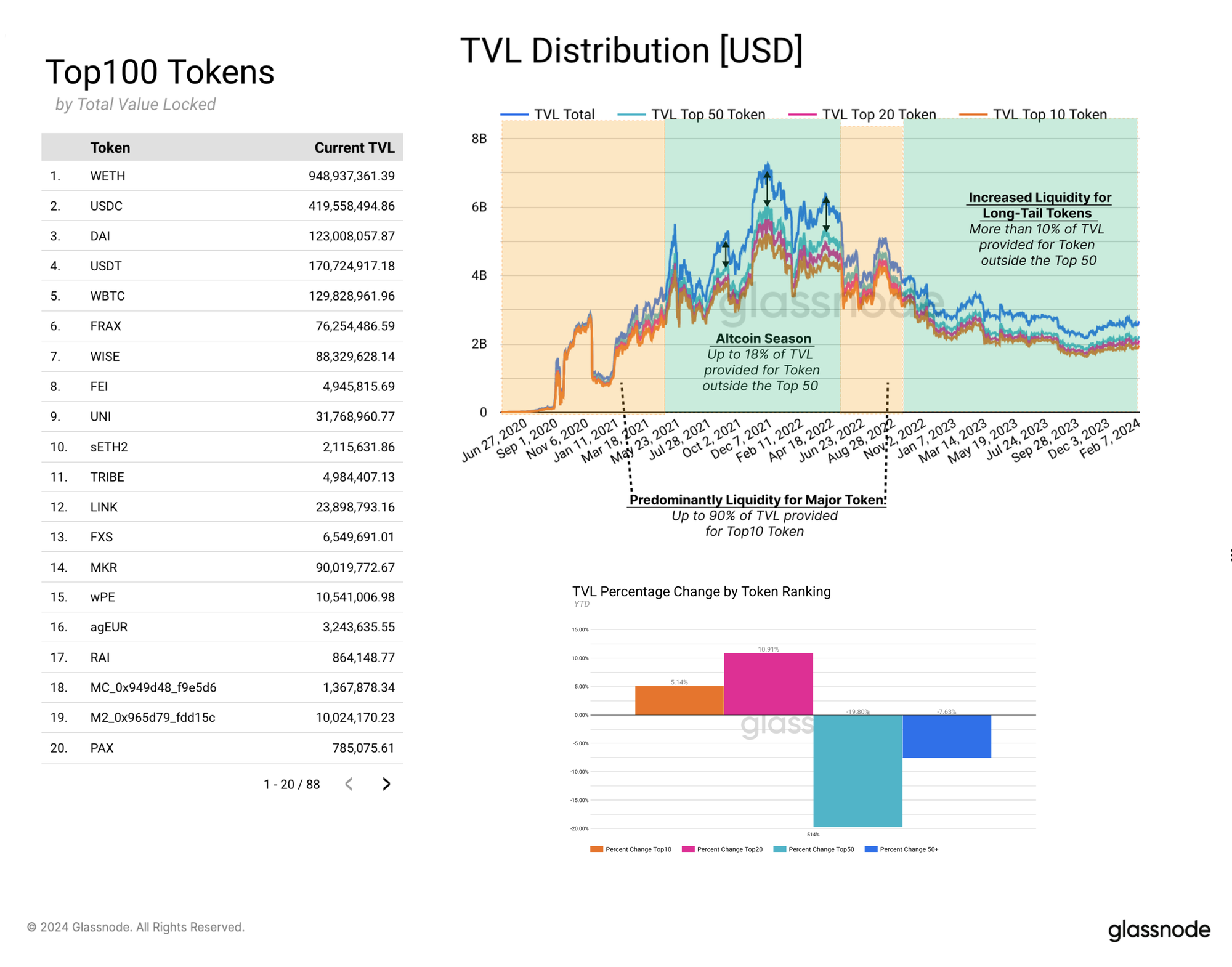

In a recent Glassnode file, a compelling pattern used to be noticed in the Total Rate Locked (TVL) on Uniswap, signaling burgeoning optimism in the DeFi establish. For the length of the altcoin season, there’s a considerable uptick in the liquidity profile for tokens outdoor the Top 50, reflecting a burgeoning investor hobby in prolonged-tail tokens.

Offer: Glassnode

Even supposing endure markets in general see liquidity concentrating in the pause 50 tokens, the establish the bulk of exchange occurs, the most up-to-date landscape is altering. The Top 10 tokens, which consist mainly of WETH, WBTC, and stablecoins, like witnessed an develop in liquidity by 5.14%, and the Top 20 by 10.9%.

Meanwhile, the shift a ways off from tokens ranked 20 to 50 indicates a strategic transfer by investors to potentially better-yielding sources.

This liquidity redistribution hints at a increasing self assurance available in the market, as investors appear to be warming up to the postulate of diversifying their portfolios with a broader vary of sources. It’s a seemingly trace that the investors might maybe maybe look out for prolonged-tail sources.

In conclusion, the DeFi establish guarantees predominant sing in the upcoming bull journey.