Welcome to our institutional newsletter, Crypto Prolonged & Immediate. This week:

- Josh Olszewicz of Canary Capital on equities, liquidity and crypto’s early — but silent tentative — indicators of a bullish flip.

- Joshua de Vos analyzes ten basic blockchain ecosystems and traits to see in 2026.

- Top headlines institutions ought to silent hear to, curated by Francisco Rodrigues

- “Solana’s Risk Appetite Returns” in Chart of the Week

Thanks for becoming a member of us!

-Alexandra Levis

Expert Insights

Markets at Highs, Crypto Quiet Ready

– By Josh Olszewicz, head of buying and selling, Canary Capital

Macro & equity backdrop

Broader equity markets proceed to print all-time highs (ATHs). Equal-weight indices (i.e., RSP) are exhibiting basic energy alongside new ATHs within the S&P 500, whereas QQQ also appears to be like poised to anguish highs. Sector management remains astronomical, with vitality, commodities, protection, aerospace, biotech/pharma and little caps leading. The basic go inner equities continues to be the Dazzling 7, with relative weakness birth air of Google, Amazon and Tesla.

Rates, liquidity, and the fed

Following this day’s unemployment account, which came in rather of stronger than expected, market-implied fee odds for the January FOMC assembly personal shifted decisively into the “no carve” camp. This aligns with the Fed’s newest emphasis on labor files over inflation. That said, the broader inflation account remains increasingly extra dovish. Staunch-time inflation metrics from Truflation personal fallen below 2.0%, whereas inflation nowcasts from the Fed expose month-over-month declines within the PCE Stamp Index, the Fed’s most popular inflation gauge, dating aid to October.

Taking a see ahead, President Trump’s yet-to-be-named substitute for Fed Chair Jerome Powell is widely expected to galvanize a fee-reducing cycle origin within the 2d quarter . Importantly, total Fed assets personal began to rise as soon as more after the formal pause of quantitative tightening slack closing twelve months, signaling renewed liquidity coming into the machine.

Crypto relative performance & rotation threat

Many trades personal been working, most notably gold and silver, which sarcastically remains one of the crucial supreme headwinds for bitcoin BTC$97,654.92 and ether ETH$3,370.58. Capital could perhaps doubtless also within the destroy rotate aid into crypto, but timing remains risky. For now, the crypto market risks feeling esteem Looking ahead to Godot, caught in anticipation of a breakup that beneath no instances arrives.

Two of the extra actionable trades on the 2d look like Metaplanet and Monero. Metaplanet, in general viewed as the Eastern MicroStrategy (MSTR) analog, has accomplished a bearish-to-bullish reversal after an 82% drawdown from its June highs. In incompatibility, MSTR itself continues to flounder advance lows, and not utilizing a determined technical evidence of a sturdy bottom. Monero XMR$712.55, which in general trades inversely to bitcoin, has shaped a decade-long ascending triangle and appears to be like poised for higher prices, particularly as the privateness-coin account has recently won traction. Zcash’s developer exodus could perhaps doubtless also further push capital into diversified privateness money, providing a bullish tailwind for XMR.

Bitcoin technicals & constructing

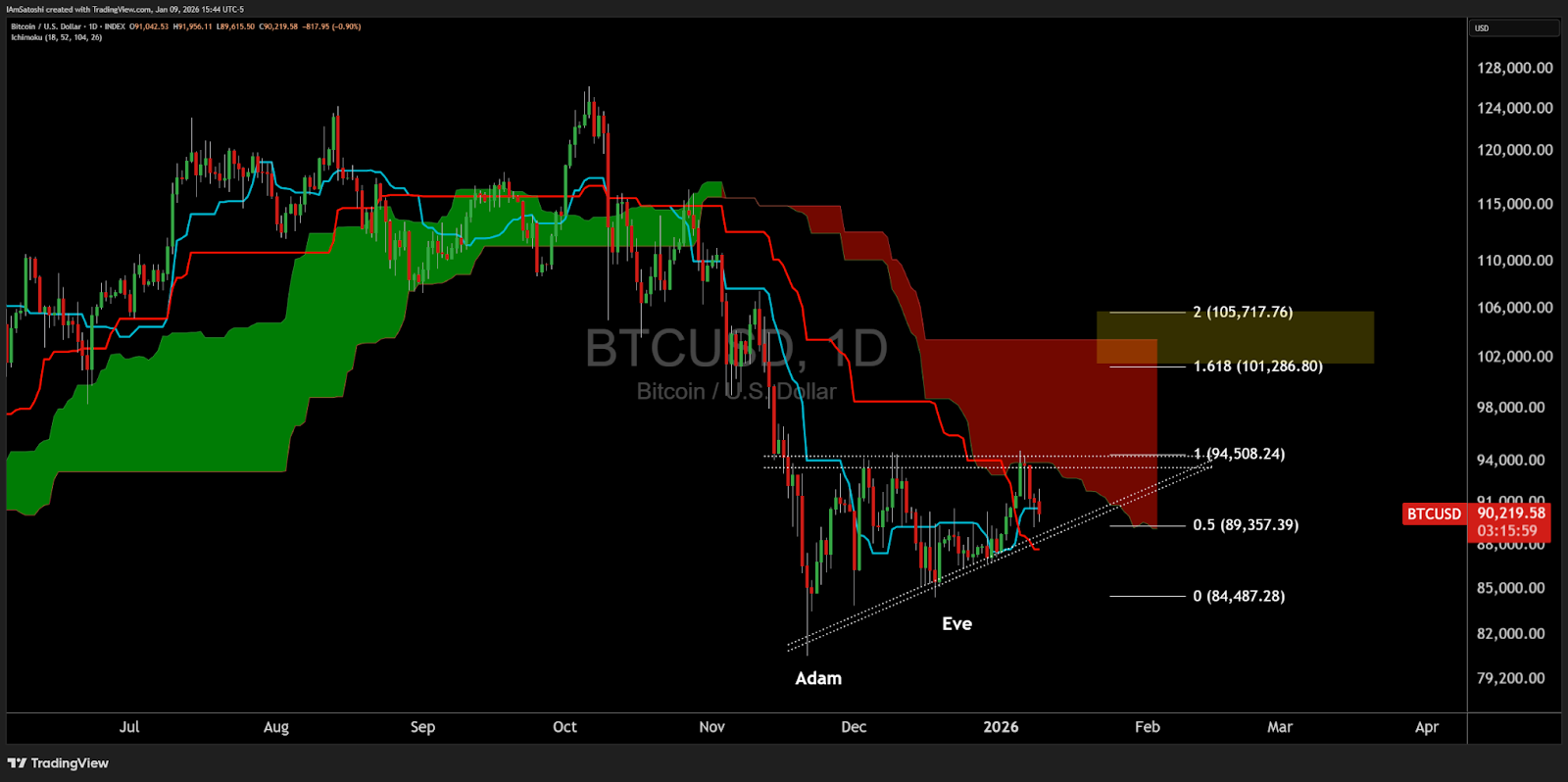

A doable catalyst for broader crypto restoration is a increasing bearish-to-bullish reversal in BTC. Stamp has been forming an Adam (V) & Eve (U) vogue double bottom, which could perhaps perhaps also additionally evolve into an inverted head-and-shoulders or an ascending triangle. Every of these patterns carries a measured-switch goal toward the $100k+ region. Beforehand, scheme back threat used to be centered on a doable high-timeframe undergo flag breakdown, but that threat appears to be like to personal frail following aggressive tax-loss harvesting into twelve months-pause 2025. That said, BTC ETF flows live firmly adverse, with one other ~$700 million in outflows this past week.

https://www.tradingview.com/x/3C0H83GB/

Positioning, derivatives & on-chain indicators

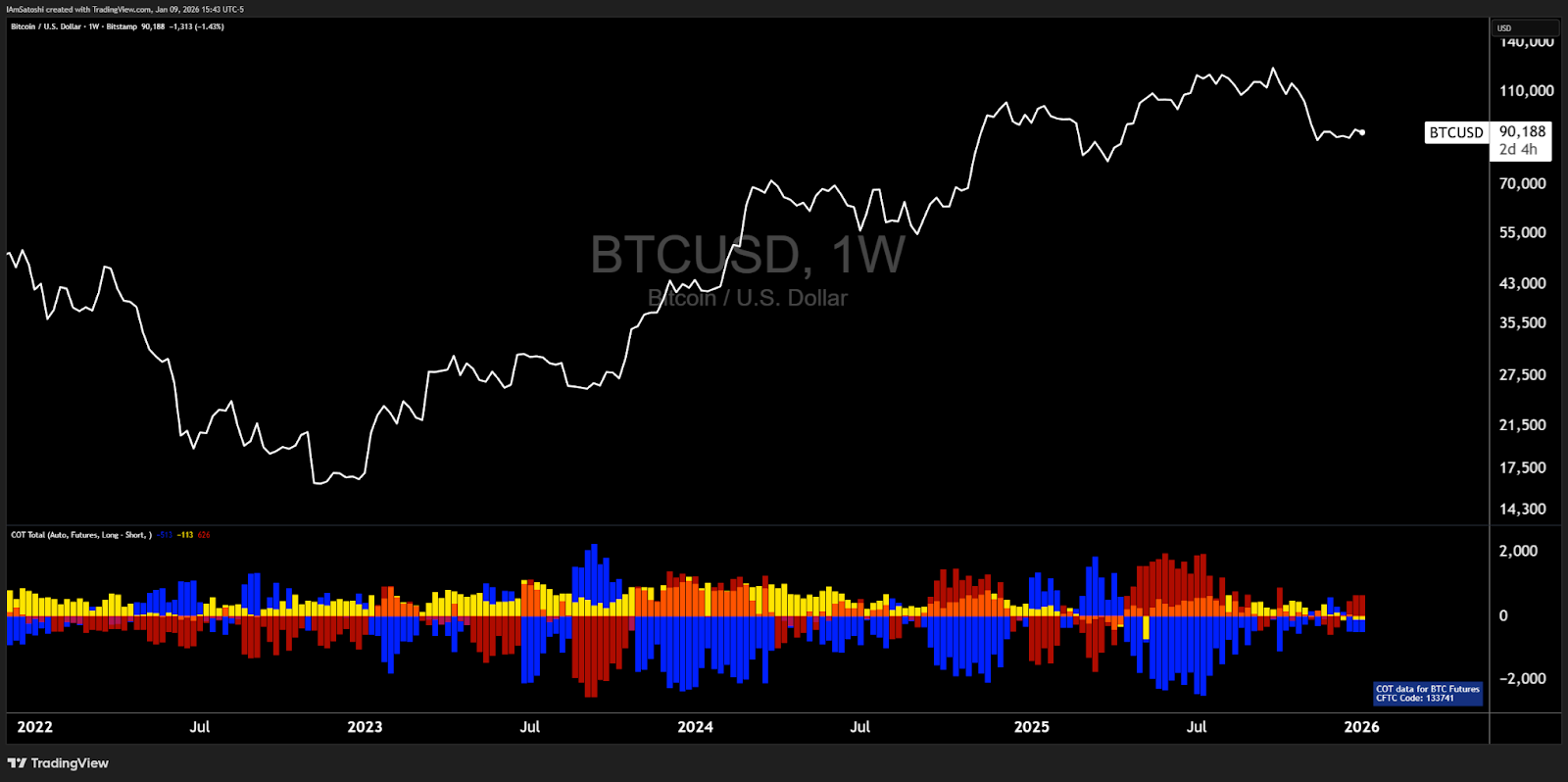

Extra, albeit modest, bullish confluence is emerging from positioning files. Derivatives funding rates across crypto exchanges and CME Commitment of Traders (CoT) files each recommend early indicators of a bullish shift. Traders live safe bearish, whereas industrial participants shield a bullish bias, an imbalance that could also gasoline challenging upside if shorts are forced to quilt.

Industrial miners, which had been just to bearish in newest weeks, personal now flipped bullish. Meanwhile, hashrate has declined sharply since mid-October. Hash ribbons (30- and 60-day though-provoking averages of hash fee) printed a bearish defective in slack November, a signal historically related to BTC weakness. On the other hand, each hashrate and hash ribbons strive to stabilize just correct as fee appears to be like to be consolidating, environment the stage for a doable inflection point over the next few weeks.

https://www.tradingview.com/x/mzLzQpeJ/

Headlines of the Week

– Francisco Rodrigues

The cryptocurrency market’s “infrastructure phase” of institutional adoption appears to be like to be well underway, with basic financial institutions now environment the constructing blocks wanted for his or her continued involvement. As finance steps in, crypto lobbies Washington to offer protection to its model.

- Morgan Stanley files for bitcoin, ehter and solana ETFs: Morgan Stanley has filed with the U.S. Securities and Substitute Rate (SEC) to birth situation bitcoin, solana, and ether alternate-traded funds.

- Lloyds Monetary institution completes UK’s first gilt aquire the employ of tokenized deposits: The transaction veteran blockchain-primarily based totally mostly bank deposits to straight identify the bond aquire and used to be done with the help of Archax and Canton Network.

- Barclays invests in stablecoin settlement firm as tokenized infrastructure advances: Ubyx is constructing a clearing machine designed to let tokenized bank deposits and regulated stablecoins switch between institutions at par.

- Coinbase pushes aid in opposition to banks to shield rewarding customers for preserving stablecoins: Coinbase is signaling doable opposition to the CLARITY Act to retain its stablecoin rewards program, arguing it will stifle competition and hurt patrons.

- Stand With Crypto advocacy group sees almost 700,000 new participants ahead of 2026 election: The Coinbase-established group Stand With Crypto reported an elevate in its signups of 675,000 closing twelve months. It now has about 2.6 million U.S. participants.

Evaluation Characterize

Content of the Blockchain 2025

– By Joshua de Vos, Evaluation Lead, CoinDesk

The 2025 crypto market used to be defined by a widening gap between bid and fee performance. Across most basic ecosystems, utilization expanded whereas tokens struggled to copy that growth. This sample used to be constant across Bitcoin, Ethereum and the immense quite plenty of Layer 1s, and it capabilities to a shift within the attach fee is being captured.

Records from our Content of the Blockchain 2025 account makes this determined. Whole fee locked (TVL) increased in native terms in seven of the eight ecosystems lined. Day-to-day bid rose in four. Over the identical period, snide layer charges declined across all eight. App-stage earnings moved within the reverse direction. Mixture quarterly app earnings increased from roughly $3.9 billion within the basic quarter to extra than $6 billion by quarter four. Layer 1s proceed to dominate market capitalisation, but they now capture a worthy smaller half of business fee.

Ethereum’s ether ETH$3,370.58 sits on the centre of this shift. ETH underperformed on fee in 2025, yet ecosystem fundamentals reinforced. TVL increased, stablecoin provide expanded and decentralized alternate (DEX) volumes grew. In spite of this, Layer 1 earnings fell sharply as execution and bid migrated to rollups, whereas application earnings remained broadly stable. Cost did not leave the ecosystem. It modified the attach it gathered to. Institutional flows, particularly by capability of digital asset treasuries, grew to turn out to be a extra major driver of ETH fee dynamics as fee-primarily based totally mostly valuation weakened.

Solana adopted a critically identical trajectory. On-chain utilization remained elevated across memecoins, payments, DePIN and AI-related bid. Stablecoin market capitalisation expanded sharply and proprietary AMMs accounted for roughly half of of DEX quantity by twelve months-pause. Market constructing improved, even as fee volatility continued. Regardless, throughput and bid by myself weren’t enough to force token performance.

BNB Chain stood out closing twelve months by converting infrastructure upgrades straight into execution quality. Sooner finality and lower charges translated into solid application-stage earnings boost. Perpetual DEXs dominated volumes, and fee performance reflected monetisation on the application layer as a substitute of snide layer fee capture.

Bitcoin moved alongside a diversified direction. Institutional possession continued to rise by ETFs and public treasury corporations, with combined holdings impending 13% of provide. Miner earnings remained closely dependent on block subsidies, with transaction charges contributing a minimal half. This increased the relevance of BTCFi and Bitcoin Layer 2s that generate sustained on-chain bid and fee quiz.

Across ecosystems, incentive-driven boost confronted increased scrutiny. In ether lending, monolithic protocols retained dominance whereas modular markets slowed following threat events. In diversified areas, quantity focus raised questions spherical durability. Capital allocation grew to turn out to be worthy extra selective over the twelve months.

The direction of dash is popping into clearer. Utility-stage monetisation, capital effectivity and institutional utility now play a better position in figuring out relative performance across crypto markets.

For the total insights, read the plump account:

https://www.coindesk.com/learn/dispute-of-the-blockchain-2025

Chart of the Week

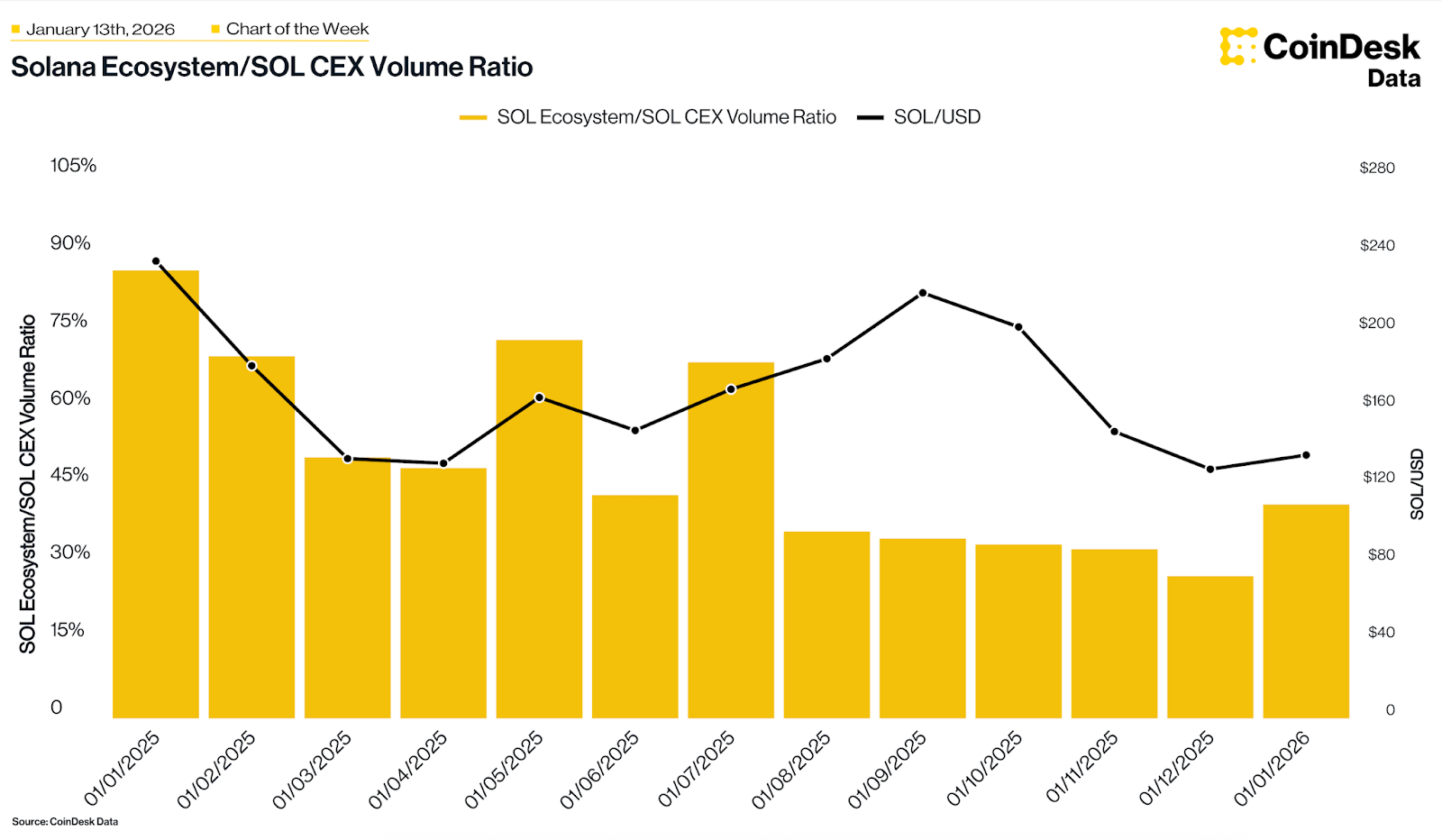

Solana’s Risk Appetite Returns

The ratio of solana ecosystem token volumes over SOL volumes on centralized exchanges has jumped over 40% this month — a six month high. This capability early indicators of ardour inner the upper beta assets on Solana. This shift is validated by the month-to-date outperformance of ecosystem leaders esteem PENGU (27%) and RAY (21%) in opposition to SOL (10%), signaling that investor appetite has began to switch down the threat curve toward the community’s inner economy and “multiplier” performs whereas the snide asset provides a stable floor.

Listen. Read. Behold. Have interaction.

- Listen: Katie Stockton of Fairlead Systems breaks down why bitcoin is behaving extra esteem a threat asset than a safe haven.

- Read: International digital assets: December ETF and ETP evaluation and 2025 recap in partnership with ETF Explicit and Trackinsight.

- Behold: Polygon Labs acquires Coinme and Sequence for $250M.

- Have interaction: Decide CoinDesk indices and rates are if fact be told available on TradingView. Explore the crypto markets with CoinDesk Indices.