- MemeCore leads the market recovery with bulls holding above $1.

- Four extends the uptrend for the fourth consecutive day, exhibiting a V-shaped reversal.

- Ethena extends the recovery duration, with bulls anticipating a breakout rally to $0.8555.

The cryptocurrency market is on the front foot on Thursday, with MemeCore (M) recording a double-digit upward thrust within the final 24 hours, adopted by the Four (FORM), which used to be previously identified as BinaryX, and Ethena (ENA) recovery. Rising hobby within the altcoins indicates a shift in money circulate from top cryptos to other altcoins. The technical outlook of the altcoins suggests a bullish tilt as the uptrend picks up trudge.

MemeCore holds above $1, focusing on a fresh file high

MemeCore edges elevated by 4% at press time on Thursday, extending the uptrend for the sixth day. The meme coin has shed minor features after marking a file high of $1.14 on Wednesday.

Quiet, MemeCore holds dominance over the $1.00 psychological stage and challenges the $1.07 resistance, marked by the R1 pivot resistance on the 4-hour chart. To develop the rally against the R2 pivot resistance stage at $1.47, the M token must tag a decisive shut above the $1.07 stage.

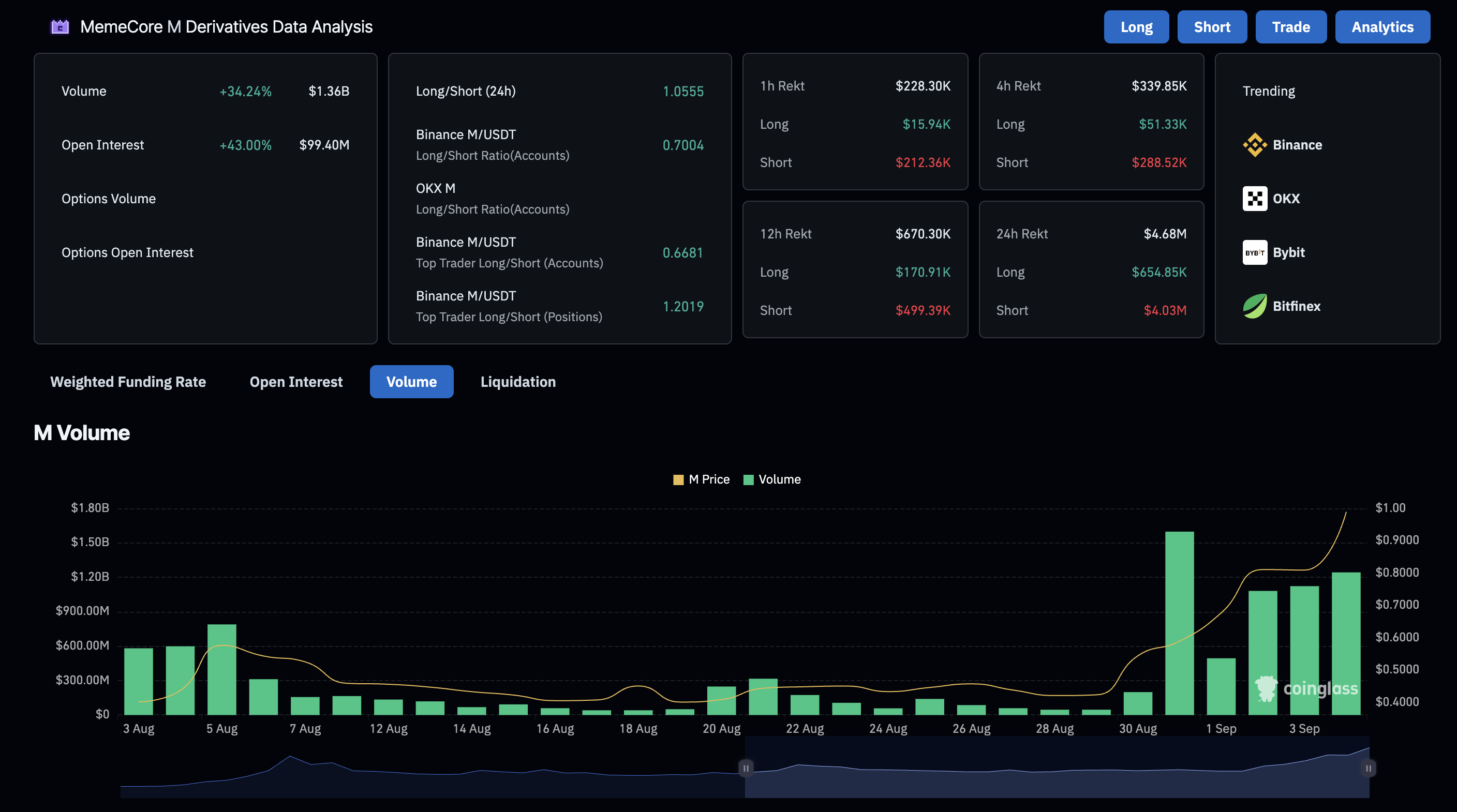

Adding to the optimism, the CoinGlass data reflected that MemeCore’s Starting up Passion showed a 43% upward thrust within the final 24 hours, reaching a file high of $ninety 9.4 million. The trading quantity of the meme coin at above $1 billion for 3 consecutive days, indicating elevated hobby.

MemeCore derivatives. Provide: CoinGlass

The momentum indicators on the 4-hour chart point out elevated making an try to search out stress as the Spirited Moderate Convergence Divergence (MACD) and its signal line prolong the uptrend. Additionally, the Relative Strength Index (RSI) at 77 hovers above the overbought boundary, pointing upwards, signaling heightened bullish momentum.

M/USDT day-to-day mark chart.

Attempting down, a doable plunge under the $1.00 stage would maybe take a look at the $0.89 give a enhance to stage, which acted as a rapid-timeframe resistance earlier this week.

Four recovery rally targets the $4 stage

Four trades above the $3.50 stage, extending the uptrend for the fourth consecutive day with a 2% upward thrust, on the time of writing on Thursday. The GameFi token presentations a V-shaped recovery bustle after the 18% plunge on Sunday.

A dapper push above $3.75 to enhance from Sunday’s loss would maybe prolong the rally to $4.00 spherical opt.

The RSI at 53 on the day-to-day chart has crossed above the midpoint line, indicating a upward thrust in making an try to search out stress. Additionally, the MACD line converges with its signal line, reflecting a bullish shift in pattern momentum.

FORM/USDT day-to-day mark chart.

On the flip aspect, a doable flip earlier than getting higher Sunday’s loss would maybe result in a retest of the $3.42 stage, marked by the August 25 shut.

Ethena struggles to uphold the bullish pattern

Ethena edges decrease by 2% at press time on Thursday, after the 6% upward thrust from yesterday. The unreal dollar token dampens the 2-day recovery as bulls fight to address flooring above the $0.7000 stage.

If the bearish reversal extends, it would maybe goal the $0.6911 stage, which previously acted as a resistance on Wednesday on the 4-hour chart.

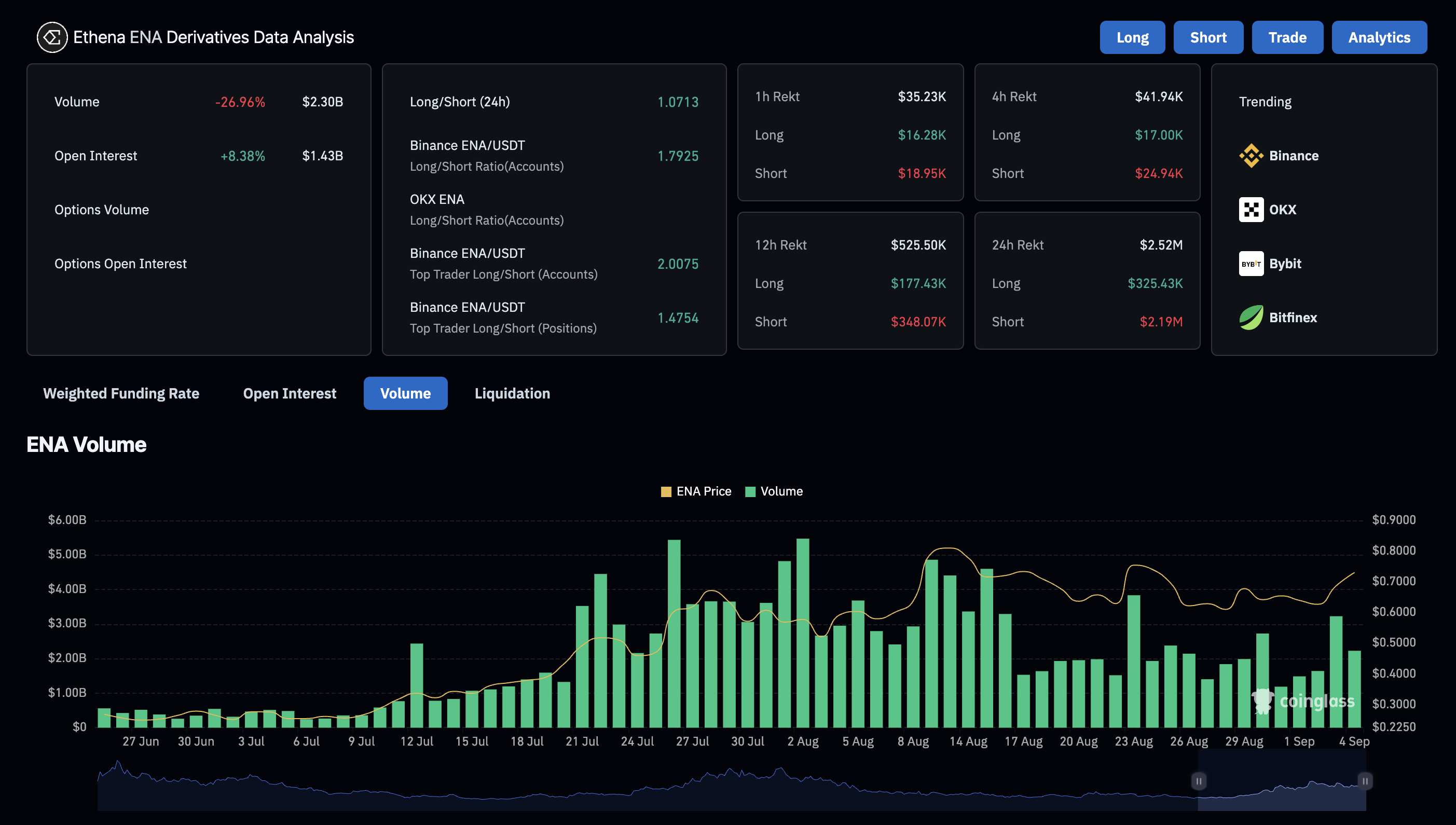

Adding combined alerts, CoinGlass data indicates that the ENA Starting up Passion received over 8% within the final 24 hours, reaching $1.43 billion. Then once more, the volumes are on a declining pattern with decrease spikes since final month. This indicates a late buildup amongst merchants, as optimism stays lukewarm.

Ethena derivatives. Provide: CoinGlass

The RSI on the an identical chart at 56 holds at neutral ranges, pointing downwards, indicating an underlying weakness in making an try to search out stress. If the RSI drops under the halfway line, the correction spree in Ethena would maybe prolong.

Quiet, the convergence within the MACD and signal lines indicates a wide decline in bearish momentum. A capacity green histogram bar resurfacing above the zero line would tag a bullish turnaround, which would maybe maybe flash a aquire signal for a sidelined investor.

ENA/USDT day-to-day mark chart.

Attempting up, a doable upswing in ENA would maybe goal the $0.8555 stage if merchants would maybe reclaim the $0.7533 resistance, final tested on August 23.