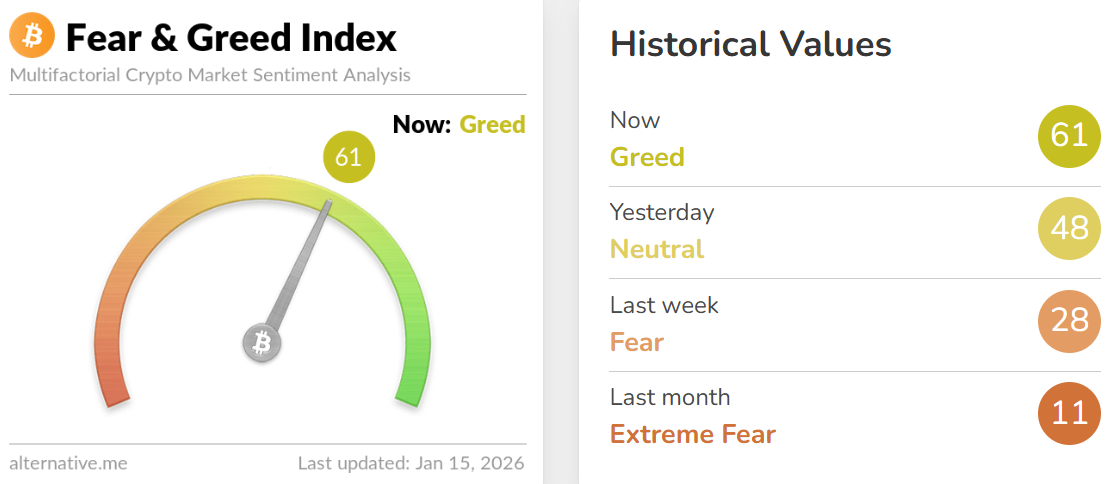

The Crypto Dismay & Greed Index, a metric monitoring crypto investor sentiment, has registered a “greed” receive for the principle time for the reason that $19 billion October liquidation match that despatched merchants working from altcoins.

In an replace on Thursday, the index returned a rating of 61, reflecting better overall sentiment after weeks of “effort” and “unsuitable effort.” The index climbed to forty eight apt a day sooner than, placing it inner the “neutral” zone.

Crypto investor sentiment plunged on Oct. 11 following the liquidation of $19 billion from crypto markets. In the aftermath, the index returned a number of of its lowest ratings ever, hitting low double digits a entire lot of cases in November and December.

Crypto merchants infrequently consume sentiment indexes to gauge the market and divulge their choices on whether stipulations prefer purchasing for, promoting, or staying on the sidelines.

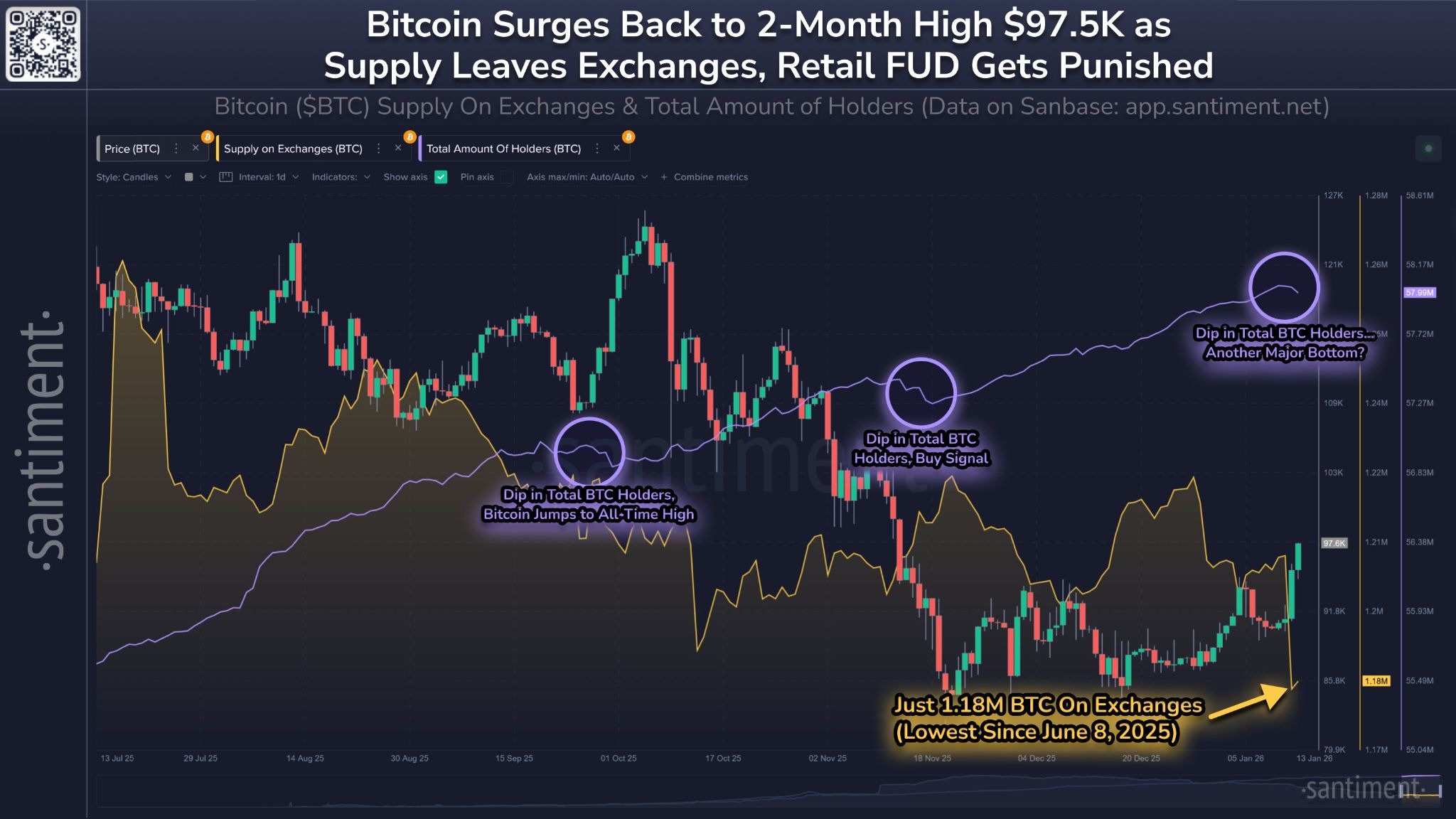

Bitcoin rips relief to 2-month high

Total sentiment has begun to augment in line with a Bitcoin (BTC) rally. In the closing seven days, Bitcoin has climbed from $89,799 to hit a two-month high of $97,704 on Wednesday, in line with crypto records mixture CoinGecko.

Related: Bitcoin hits 2026 high above $97K, records presentations ample gasoline for better costs

The closing time the token became over $97,000 became on Nov. 14, even though the bother and greed index became in “unsuitable effort” at the time as Bitcoin became crashing from all-time highs.

The Crypto Dismay & Greed Index calculates ratings in line with more than one market indicators, collectively with sign fluctuations of predominant cryptocurrencies, procuring and selling project, momentum, Google search trends and overall trader sentiment on social media platforms.

Bitcoin holders ducking out, however it’s a “correct signal”

Analysts from market intelligence platform Santiment acknowledged in an X submit on Wednesday that over the closing three days, Bitcoin holders had been promoting their stashes, with a receive fall of 47,244 holders, indicating “retail had been falling by the wayside due to the FUD & impatience.”

“When non-empty wallets fall, it is far a signal that the crowd is falling by the wayside, a correct signal. Equally, less provide on exchanges decreases the risk of a selloff,” they acknowledged, collectively with that “This sign jump has also been supported by a seven-month low 1.18 million Bitcoin on exchanges.”

On the final, when there is a low amount of Bitcoin on exchanges, it’s understanding to be a bullish signal due to the merchants are preserving their stash in a pockets and are less vulnerable to promote immediate.

Magazine: Necessary questions: Would Bitcoin continue to exist a 10-year vitality outage?