Amid fundamental trends in diversified markets and all the method thru industries, exhausting sources admire gold, silver, and cryptocurrencies appear to be teetering at the fringe of a enormous bull cycle, no longer less than in accordance to one crypto trading expert, who has referred to them as must-haves in portfolios.

Because it happens, well-known crypto analyst Michaël van de Poppe has seen the “extraordinarily low (…) valuations of Crypto & Gold, Silver when put next to the Buck & Equities,” adding that “we’re on the fringe of a enormous bull cycle in exhausting sources total, commodities included,” in his X post on May perchance perchance 22.

In diversified phrases, he urged that buyers might perchance well well merely unruffled accumulate in their portfolios exactly these “exhausting sources” – crypto, gold, and silver – right this moment, whereas they are unruffled cheap when put next to the US greenback and stocks, as the “big bull cycle” might perchance well well open up at any moment, judging by the chart patterns.

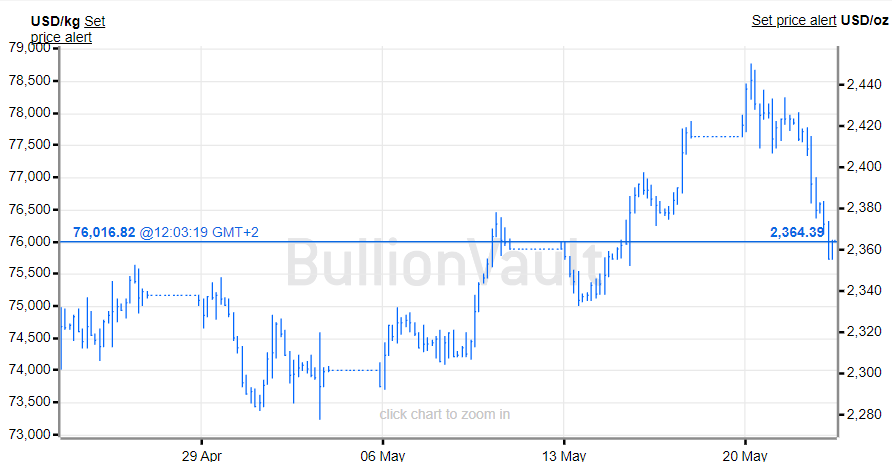

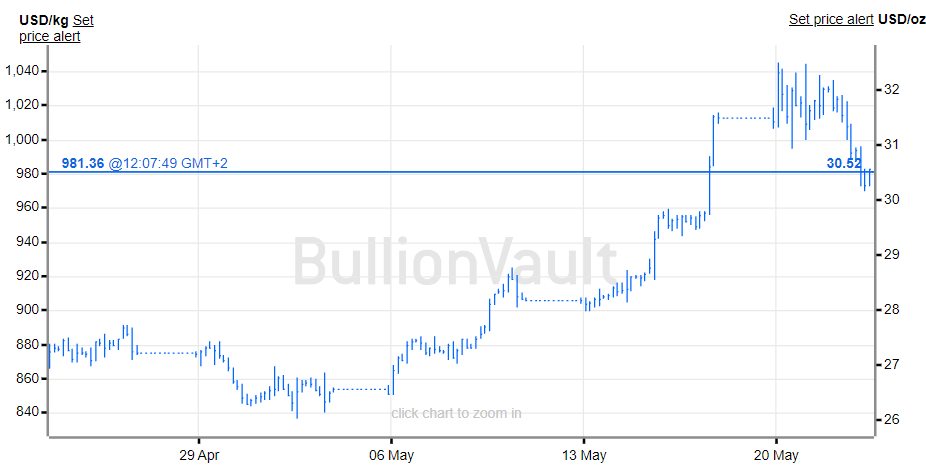

Precious metals designate analysis

Indeed, gold is currently trading at the value of $2,364.39 per ounce or $76,016.82 per kilogram, recording a decline of 0.75% on the day, shedding 0.83% all the method thru the week however unruffled recording an kind bigger of 2.85% on its monthly chart, in accordance to basically the most contemporary data retrieved on May perchance perchance 23.

At the equivalent time, the value of silver at press time stood at $30.52 per ounce or $981.36 per kilogram, which implies a 1.29% drop within the closing 24 hours however then as soon as more an kind bigger of 4% over the previous seven days and an collected attain of 13.72% all the method thru the past month.

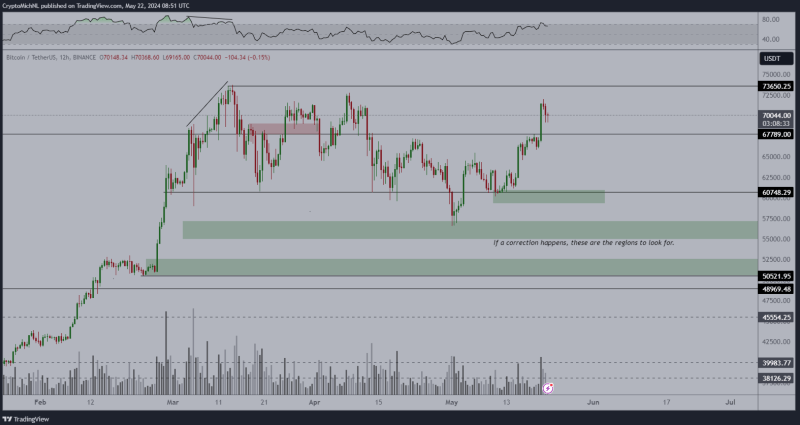

Cryptocurrencies designate analysis

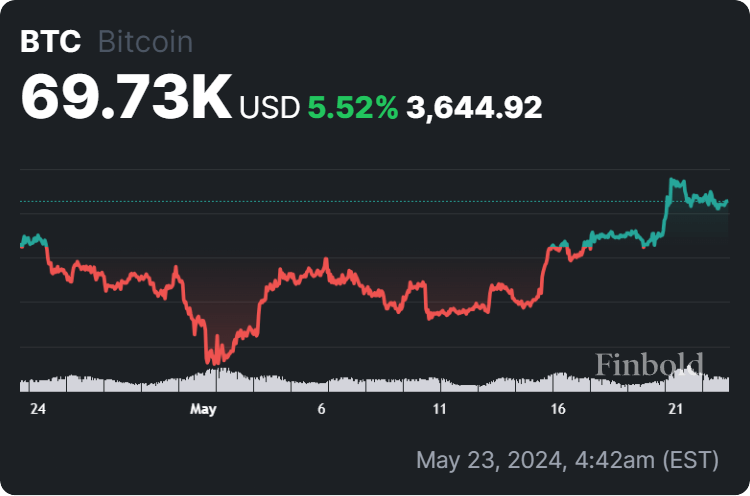

Within the period in-between, in phrases of digital sources, van de Poppe has earlier seen that the crypto market manual, Bitcoin (BTC), became as soon as “slowly consolidating,” adding that he became as soon as “waiting for a retest at the $68K stamp, earlier than a continuation upwards,” and reiterating that the “pattern is clearly upwards.”

Particularly, Bitcoin is currently changing fingers at the value of $69,730, which represents a modest loss of 0.49% on its day after day chart, whereas the flagship decentralized finance (DeFi) asset clings to the 5.07% make all the method thru the past week and a development of 5.52% within the closing month.

It can be price noting that van de Poppe has earlier highlighted that altcoins admire Ethereum (ETH) were unruffled closely undervalued, with most of them being “down 70% against Bitcoin,” sharing his expectations that altcoins would “carry out method better (…) within the impending months,” as per his X post on May perchance perchance 21.

Disclaimer: The sigh material on this place might perchance well well merely unruffled no longer be regarded as investment advice. Investing is speculative. When investing, your capital is at chance.