Data shows a massive option of lengthy liquidations cling occurred in the cryptocurrency market as Bitcoin and various sources cling plunged.

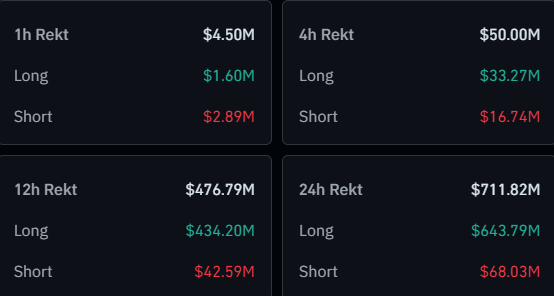

Crypto Liquidations Have Surpassed $712 Million Over The Past Day

In step with records from CoinGlass, chaos has occurred on the derivatives market following the volatility Bitcoin and the company cling long passed thru throughout the final 24 hours.

Below is a table that shows how the liquidations cling sought for the cryptocurrency sector within this window.

As is visible, nearly $712 million in cryptocurrency contracts cling seen forceful closure from their platform in the past day. About $477 million of these came throughout the final twelve hours alone.

Bitcoin and the altcoins, especially, cling seen a decline on this period, so it’s no longer gentle to search out out about that the liquidations cling overwhelmingly affected the lengthy investors. More namely, the holders betting on a bullish end result cling been pondering about bigger than 90% of the flush.

A mass liquidation event admire this most well liked one is popularly identified as a squeeze, and given the interesting imbalance against the bulls, this particular event would be known as a lengthy squeeze. One day of a squeeze, a massive quantity of liquidations score precipitated correct away and feed help into the circulate that triggered them. This unleashes a cascade of further liquidations, making such occasions moderately dangerous.

As for which of the particular particular person tokens contributed basically the most to the lengthy squeeze, the heatmap below shows it.

Bitcoin and Ethereum, the cease two cryptocurrencies through market cap, cling also come out on prime on this list, with the dilapidated watching liquidations of $221 million and the latter that of $116 million.

The third-ranked coin, on the opposite hand, hasn’t been XRP, but rather Solana, which is just a few spots decrease through market cap. SOL’s $32 million in liquidations will seemingly be down to the truth that it has seen a bigger decline than XRP.

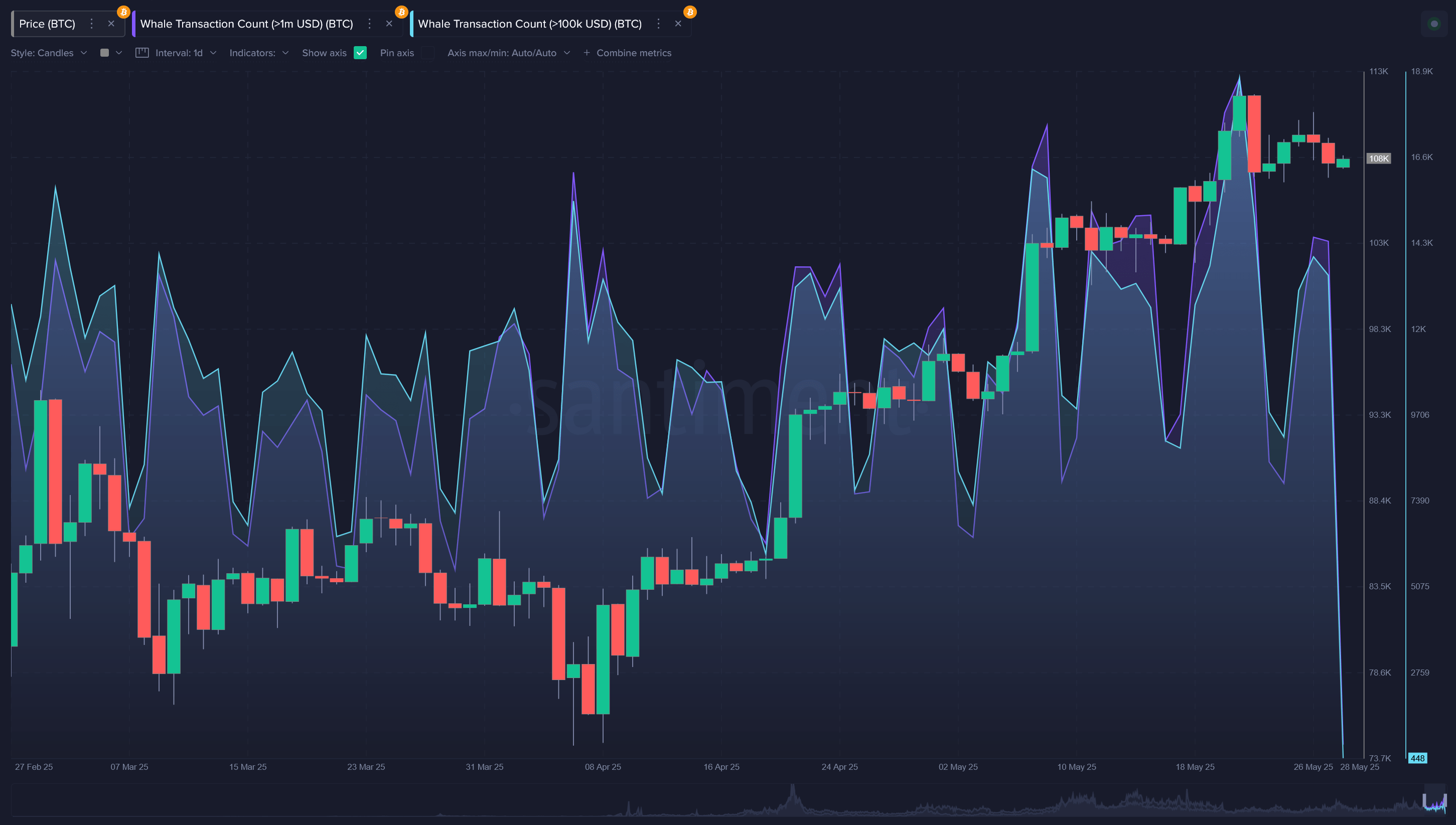

Whereas Bitcoin has seen a push down throughout the past day, its downfall in reality started much earlier, with the excessive around $112,000 from May fair Twenty 2nd performing as the cease up to now. In step with a characterize from the on-chain analytics agency Santiment, this peak coincided with a spike in whale exercise.

The indicator displayed in the chart is the “Whale Transaction Count,” which tells us about how many whale-sized transfers are occurring on the BTC community each day.

It would appear that both variations of this metric (monitoring transactions valued at bigger than $100,000 and $1 million) surged to a excessive level earlier on this month, a possible label that revenue-taking from these humongous entities compelled Bitcoin against a prime.

Bitcoin Impress

BTC noticed a dip below the $105,000 level earlier in the day, on the opposite hand it appears the coin has since noticed a minute rebound because it’s now help at $105,800.