Crypto prices will seemingly be spurred by crypto market advise legislation, stablecoins and a flood of alternate-traded products (ETP) in the fourth quarter, analysts advised Cointelegraph, after sources tied to digital treasuries dominated over the closing quarter.

In a report launched on Thursday, crypto asset manager Grayscale’s analysis personnel acknowledged crypto market advise legislation in the US, the CLARITY Act, represents “total monetary providers legislation,” and will be “a catalyst for deeper integration with the ordinary monetary providers industry.”

In the interim, the Securities and Alternate Commission’s approval of a generic itemizing same earlier for commodity-based mostly completely ETPs could maybe furthermore spark inflows on tale of it will enhance the “different of crypto sources accessible to US traders.”

The researchers furthermore acknowledged “crypto sources needs to be anticipated to income from Fed price cuts,” with the Federal Reserve slashing rates for the predominant time since closing 365 days on Sept. 17, with more seemingly on the system.

Even supposing JPMorgan CEO Jamie Dimon solid doubt on more price cuts, and acknowledged on Monday he thinks the Fed can bear a exhausting time cutting the hobby price except inflation drops.

Stablecoin chains could maybe emerge as winners this quarter

Talking to Cointelegraph, Edward Carroll, head of markets at crypto and blockchain investment firm MHC Digital Team, acknowledged he expects stablecoin advise to be a key driver of returns in Q4.

US President Donald Trump signed the GENIUS Act into legislation in July. It’s geared toward setting up mosey rules for price stablecoins, but is composed searching at for closing regulations before implementation.

“This needs to make certain medium- to long-duration of time for any chain being aged for stables, Ethereum, SOL, Tron, BNB, Eth layer 2s, but more basically to the companies constructing and providing the products to market,” Carroll acknowledged.

On the same time, he predicts institutional applications of tokenization will beginning to get traction, as elevated gamers beginning to pursue more tokenized cash market funds, monetary institution deposits, and alternate-traded funds (ETFs).

Bitcoin and altcoins can bear a bumper quarter, too

Pav Hundal, lead analyst at Australian crypto dealer Swyftx, advised Cointelegraph that extra cash is flowing into crypto through funds and computerized contributions, and a Bitcoin (BTC) rally toward the pause of the 365 days will gasoline an altcoin surge in Q4.

A report from monetary providers firm River launched earlier this month came upon that ETFs are gobbling up, on moderate, 1,755 Bitcoin per day in 2025.

“Unless the market is kneecapped by one thing unexpected, Bitcoin will seemingly hit quiet highs before the pause of the 365 days, and that will gasoline altcoins,” Hundal acknowledged.

“It’s been a rotational marketplace for all of 2025, with alt cash performing smartly after an preliminary Bitcoin rally. I don’t gape any trigger of that sample to alternate now. The cease performers for the duration of rotations bear been memecoins and DeFi applications love Pump.enjoyable, Hyperliquid and Aster.”

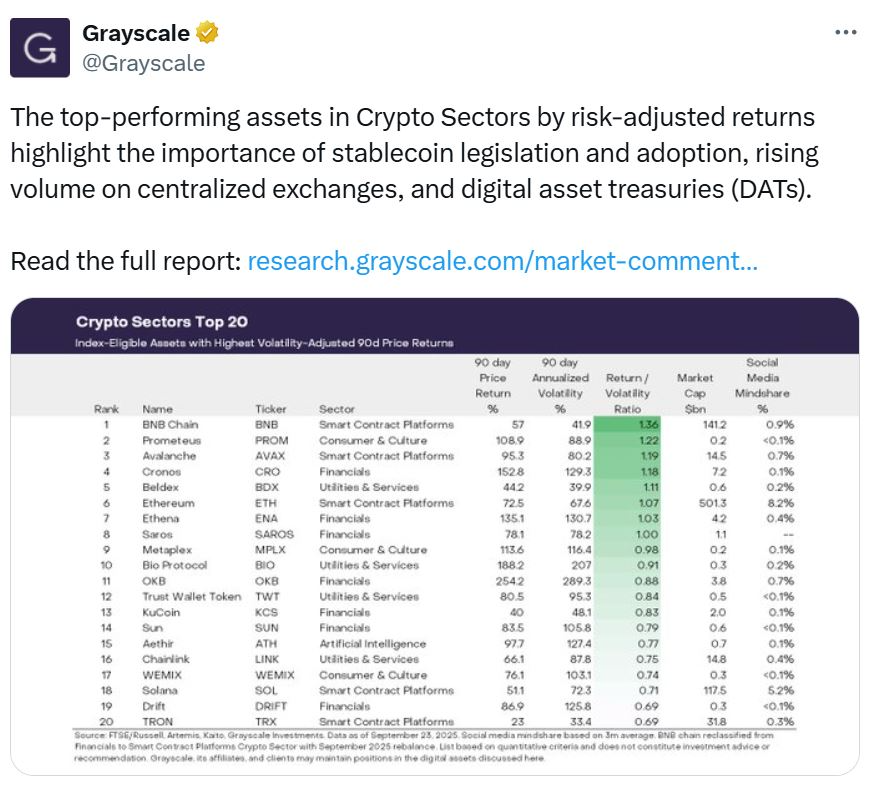

Closing quarter, Hundal acknowledged the titanic theme change into US-listed companies converting to digital asset treasuries, with Ether (ETH), Solana (SOL) and Hype rising as the tip performers in the earlier few months.

DeFi income-producing initiatives could maybe furthermore be a winner

Henrik Andersson, chief investment officer of Apollo Crypto, advised Cointelegraph he expects Q4 to embody ETF approvals in the US, along side for staked sources, and the CLARITY Act to pass.

“On a sector foundation, we deem income-producing initiatives in DeFi will continue to function very smartly. Stablecoins and RWA will very seemingly continue to be significant issues total.”

On the opposite hand, he furthermore acknowledged “price lower expectations in the US could maybe disappoint as the economy and labor market reputedly are doing better than the Fed feared when it lowered rates.”

While closing quarter, Andersson acknowledged Hyperliquid and Pump buybacks made titanic waves in crypto markets, along side the “proliferation of digital asset treasuries.”