Undertaking capitalist Chris Burniske says that the scorching dip in digital sources is conventional of any bull market cycle.

In a put up on the social media platform X, Burniske, the venerable head of crypto at Cathie Wooden’s ARK Invest and as much as the moment partner at Placeholder, aspects out other corrections in the 2021 bull market cycle that finally preceded fresh highs.

“Within the guts of 2021:

BTC drew down 56%

ETH drew down 61%

SOL drew down 67%

Many others 70-80%+

That you just would per chance give you all the explanations for why this cycle is a form of, however the mid-bull reset we’re going via isn’t extraordinary. Those calling for a plump-blown endure are faulty.”

At time of writing, Bitcoin (BTC) is down 20% from its all-time high, Ethereum (ETH) is down 50% from its all-time high while Solana (SOL) is down 51%.

Earlier this month, Burniske said that BTC’s lackluster designate efficiency looked worship a “mid-cycle high” paying homage to April, Can even simply, June of 2021, when “many said it was as soon as over, high-callers gloated, and then we ripped in 2H ’21.”

Outmoded Goldman Sachs govt and as much as the moment Proper Imaginative and prescient CEO Raoul Neutral correct friend echoes Burniske’s sentiments. Neutral correct friend, who has been vocally bullish on crypto, additionally believes the scorching correction is a crawl bump on the formula to fresh highs.

“You guys all wish to study patience…

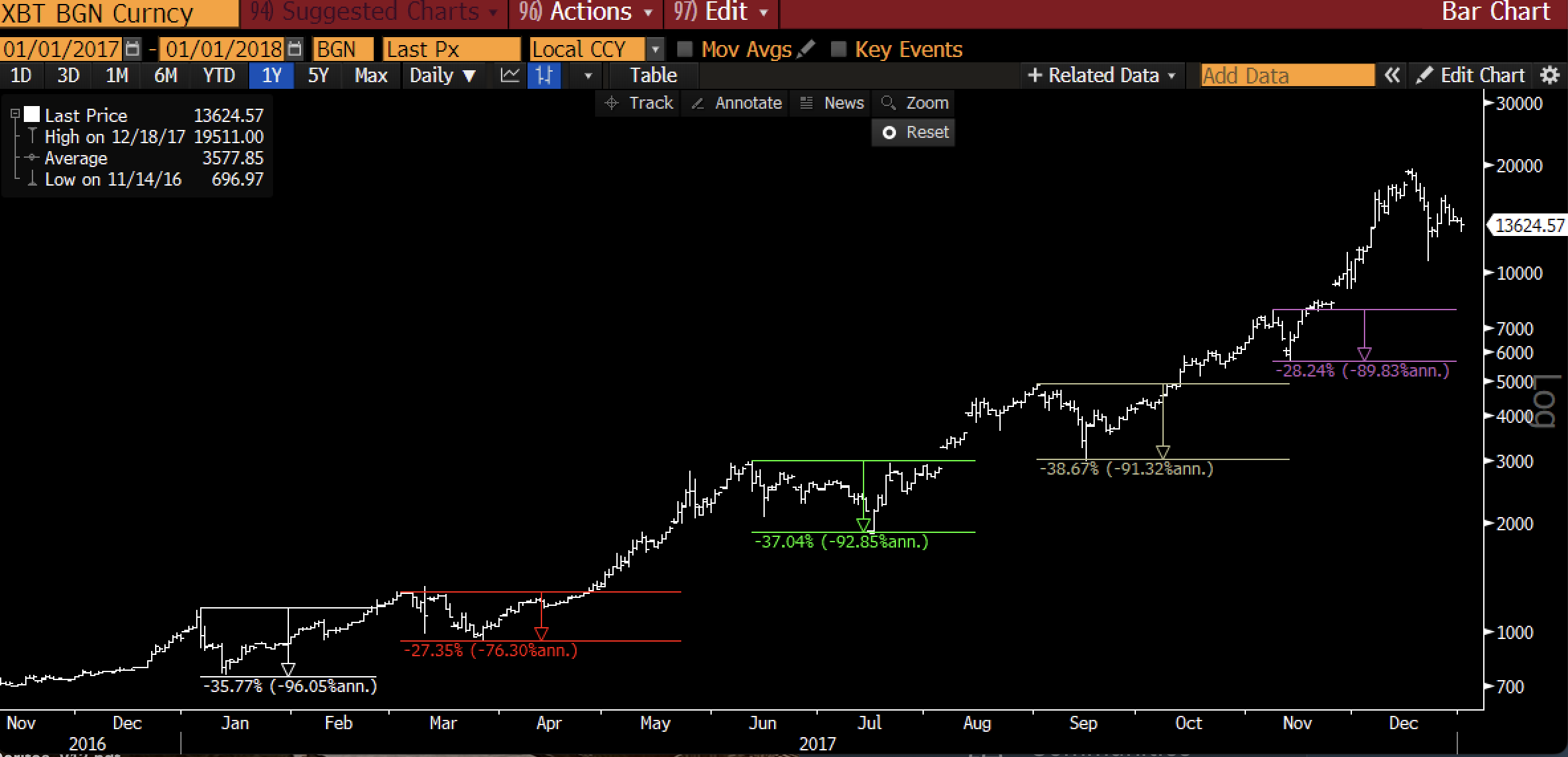

This was as soon as 2017. Very equal macro construction:

5 x 28%+ pullbacks in BTC

Most lasted 2 to three months sooner than a fresh high

Alts noticed 65% corrections.

All believe been noise.

Trail attain something else extra positive than discover at the display camouflage.”