Asian stock and crypto markets enjoy rallied within the leisure 24 hours, sparked by optimism following basically the most up to date US inflation file supporting expectations of a Federal Reserve rate chop. Positive components within the location prolonged a favorable type mumble by Wall Street, with tech stocks leading the payment.

In accordance with most up to date details, November US inflation changed into as soon as 2.7%, rather above the old month but in accordance to market expectations. This figure has prompted economists to forecast a 0.25% rate chop by the Federal Reserve subsequent week.

Asian equities enjoy mirrored the rally considered in US markets in accordance to reports. Japan’s Nikkei 225 closed 1.2% larger, supported by its export-heavy composition, whereas China’s blue-chip CSI 300 index added 1%, surpassing the 4,000-point establish. In Hong Kong, the Cling Seng climbed 1.6%, rounding out a day of substantial regional positive components.

Analysts enjoy attributed the uptick to sturdy performances in US tech stocks, which pushed the Nasdaq 100 up 1.9%. The Nasdaq Composite additionally broke unusual ground, closing above 20,000 parts for the main time.

“The sturdy response within the U.S., notably in tech stocks, has influenced Asian markets,” acknowledged Mitul Kotecha, head of emerging markets and macro method at Barclays. “The inflation numbers play to a persevered easing scenario, which is favorable for markets.”

Asian crypto and stock markets rally post-inflation rates announcement

Following the records of US inflation rates rising, Asian crypto markets experienced a miniature uptick. Ripple (XRP) is up by about 2% since the day earlier than today on the favored South Korean alternate Upbit. At press time, the coin is changing fingers at around 3,400 gained, up from a 24-hour low of three,389.

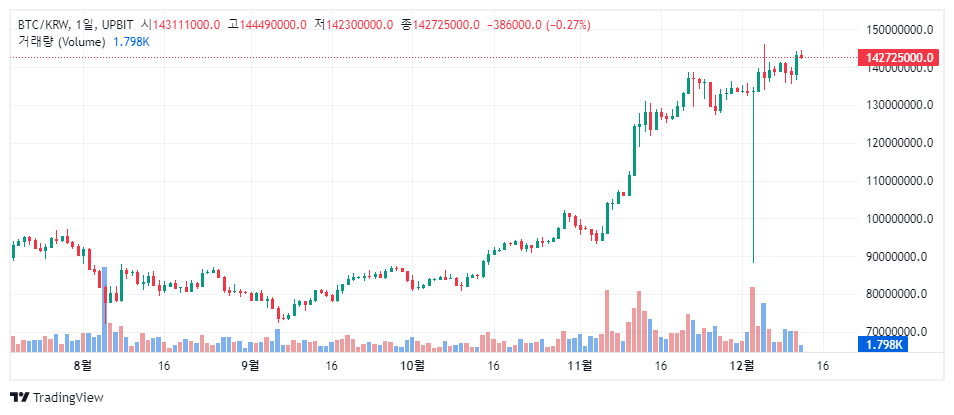

Bitcoin (BTC) recovered its $100,000 establish stage on global exchanges within the leisurely hours of December 11. It additionally jumped from 142,300,000 gained on Upbit and is now hovering across the 143,000,000 gained establish stage, per TradingView knowledge.

The largest crypto by market cap, BTC additionally experienced famous positive components within the wake of the US presidential election, mountain climbing 30% within the month following Donald Trump’s victory. This pronounce far outpaced the 14% enlarge posted by the Roundhill Swish Seven ETF (MAGS), which tracks Wall Street’s seven largest firms by market capitalization.

Asian stocks traded basically larger on December 12, bolstered by Wall Street’s positive components following a US inflation update that reinforced expectations for extra Federal Reserve make stronger. Traders within the location welcomed signs of economic resilience and protection adjustments in key markets.

In accordance with a Yahoo Finance perception, Chinese language equities climbed as leaders met in Beijing to debate economic targets and initiatives for the upcoming 365 days. Among the key bulletins changed into as soon as the growth of trial private pension functions across the nation, mumble to initiating up on December 15. The Shanghai Composite Index rose 0.9% to three,461.50, whereas Hong Kong’s Cling Seng Index jumped 1.4% to 20,441.57.

South Korea’s Kospi posted a resounding efficiency, advancing 1.6% to 2,482.12. Taiwan’s Taiex adopted swimsuit, gaining 0.6%, whereas Thailand’s SET edged up 0.2%.

In the intervening time, Australia’s S&P/ASX 200 slipped 0.3% to eight,330.30, and India’s Sensex dipped 0.2%, bucking the broader regional type.

Asia-Pacific leads global crypto adoption

Beyond frail markets, the Asia-Pacific situation reaffirmed its leadership in cryptocurrency adoption and innovation. The 2024 World Crypto Adoption Index printed that Central and Southern Asia and Oceania (CSAO) accounted for seven of the quit 20 most energetic international locations in every centralized and decentralized finance (DeFi) protocols.

The compare additionally printed Indonesia as a standout performer, recording over $30 billion (475.13 trillion rupiah) in cryptocurrency transactions between January and October 2024. This marked a staggering 350% pronounce compared with the identical interval in 2023, highlighting the location’s rising appetite for digital resources.

Asia’s prominence extends past adoption, because the continent has turn out to be a hub for crypto constructing. Since 2015, Asia’s part of worldwide cryptocurrency developers has risen from 13% to 32%, surpassing North The usa, whose part declined from 44% to 25%.

Lastly, the rating of crypto app customers in South Korea in November 2024 has been released. Upbit ranked first with 4.36 million customers, adopted by Bithumb and Pi Network with 2.24 million and 1.34 million customers, respectively. Coinbase, Binance, Bitget, and Bybit ranked fourth, fifth, sixth, and eighth, respectively, and MetaMask ranked tenth.

From Zero to Web3 Pro: Your 90-Day Career Open Knowing