Bitcoin has kicked off 2025 on an spectacular footing, flirting with the $100,000 assign again on its 16th anniversary. Since losing the $100,000 level on December 19, 2024, the premier cryptocurrency has struggled to include any important bullish momentum.

Nonetheless, the price of BTC seems within the restoration fragment within the meanwhile, with an nearly 5% amplify within the past week. According to a excellent crypto analyst on the social media platform X, potentially the most up-to-date mark setup suggests that Bitcoin is within the meanwhile at a pivotal juncture.

Bitcoin Designate Retests 50-Day MA — What Next?

In vogue crypto pundit Ali Martinez took to the X platform to present potentially the most up-to-date layout of the Bitcoin mark and the functionality impact on its future trajectory. According to the analyst, the flagship cryptocurrency’s mark is at a “important point.”

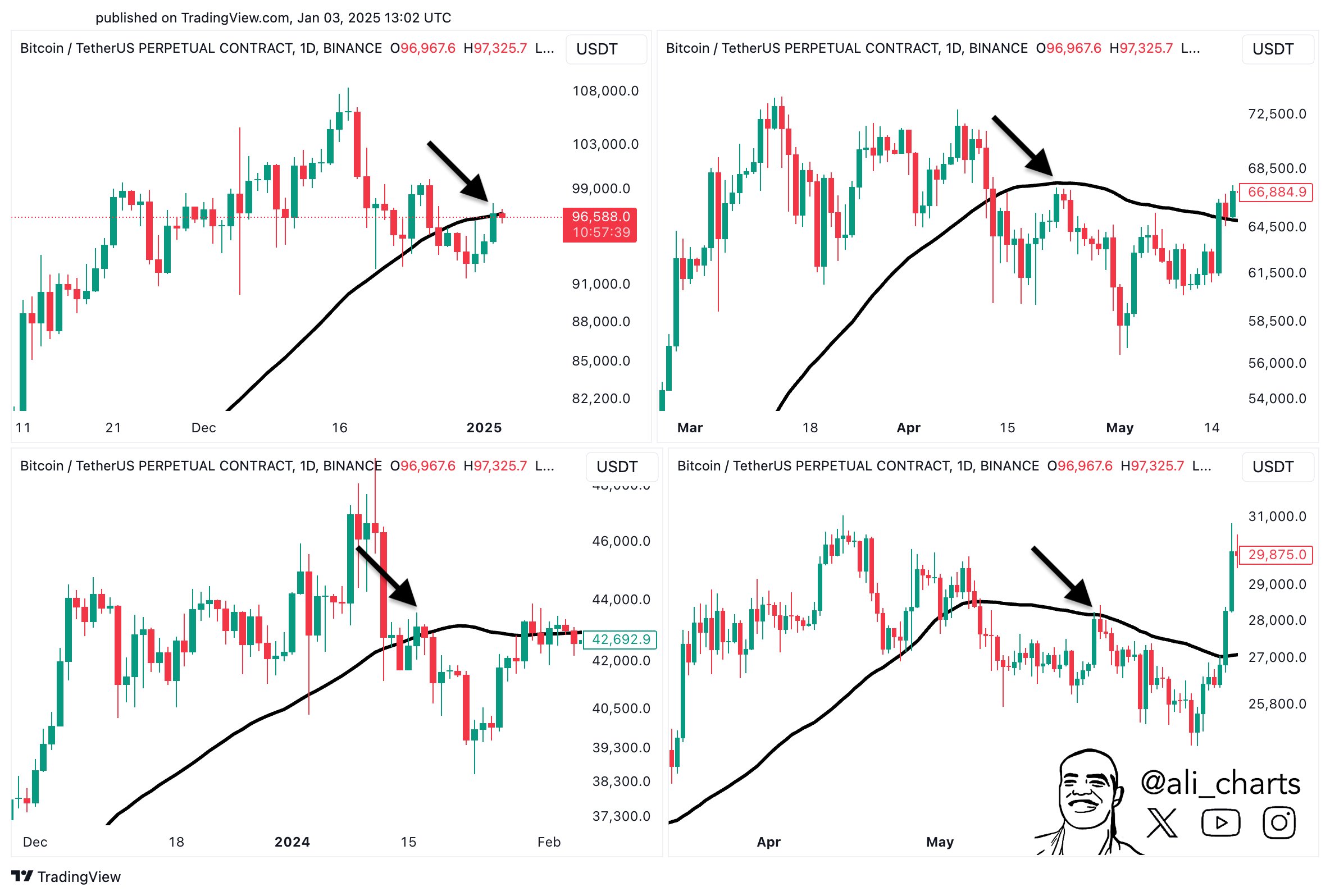

The reason within the lend a hand of this dispute is Bitcoin’s motion spherical the 50-day transferring average (50MA) on the day to day mark chart. The 50-day MA is a fundamental technical indicator conventional to watch the medium-term style of an asset’s mark (Bitcoin, on this converse of affairs).

In Bitcoin’s case — from the highlighted charts, the 50-day transferring average has served as important make stronger and resistance functions within the past. Evidently the Bitcoin mark successfully broke beneath the 50-day MA and has climbed lend a hand to retest the breached make stronger.

According to Martinez, the price of the premier cryptocurrency is in danger of transferring to the plot back once the retest is total. Nonetheless, the analyst infamous that a sustained shut above the 50-day transferring average could invalidate the bearish projection for Bitcoin and presumably signal the end of the continuing mark correction.

As of this writing, the price of Bitcoin stands at spherical $98,358, reflecting a 1% amplify within the past day. According to data from CoinGecko, the flagship cryptocurrency is up by nearly 5% within the last seven days.

Can Rising Change Outflows Trigger Fresh Bullish Momentum?

In a single other post on X, Martinez revealed that important quantities of Bitcoin were flowing out of exchanges within the past week. Files from CryptoQuant exhibits that over Forty eight,000 BTC (price bigger than $4.5 billion) were withdrawn from exchanges within the past seven days.

This funds’ motion signals a shift in sentiment, as investors are transferring their coins to non-custodial wallets presumably for long-term storage. This could suggest that investors are becoming extra and extra assured within the slay promise of the market chief.

The increased lope with the circulate of coins from centralized exchanges could also mark original buying for process, with investors picking to store their newly got sources off the buying and selling platforms. Indirectly, this swap outflow is on the full a bullish signal for the Bitcoin mark.