Despite the fears within the quick aftermath of the speak Bitcoin (BTC) alternate-traded fund (ETF) approvals, MicroStrategy (NASDAQ: MSTR) – rebranded as stunning Technique – has been a fundamental winner of 2024.

Despite rallying bigger than 420% from $63 on January 2 of the year to the cost of $289 on its closing day and at one point hitting the highs approach $421, extra most novel MSTR stock efficiency has been much less obvious.

The long length of consolidation, per the technical analysis (TA) conducted by the on-chain educated Ali Martinez on X, is nearing its pause, and Technique shares might seemingly rapidly invent a wide switch.

Here’s why MSTR stock also can invent a mammoth switch rapidly

Particularly, Martinez showcased that MSTR stock has been forming a symmetrical triangle chart sample since mid-November and that the length of tag consolidation is nearing its pause. The on-chain analyst also printed that Technique shares are poised for a switch doubtlessly as tremendous as 52%.

Soundless, the analysis left some things unclear. Though the present chart sample does, no doubt, screen that Technique stock is headed for a fundamental breakout, it stays largely unclear if this could perhaps well be bullish or bearish.

Historically, as MSTR shares have seriously change a Bitcoin proxy, one also can look the moves of the cryptocurrency market to be triumphant in some insight into where Michael Saylor’s company will be headed, however BTC has, itself, been trading with indecision.

Furthermore, Technique stock hasn’t been monitoring the coin’s fluctuations closely in most novel months and has been experiencing higher volatility than the digital asset.

Wall Avenue predicts if a relate or a bust is subsequent for MSTR shares

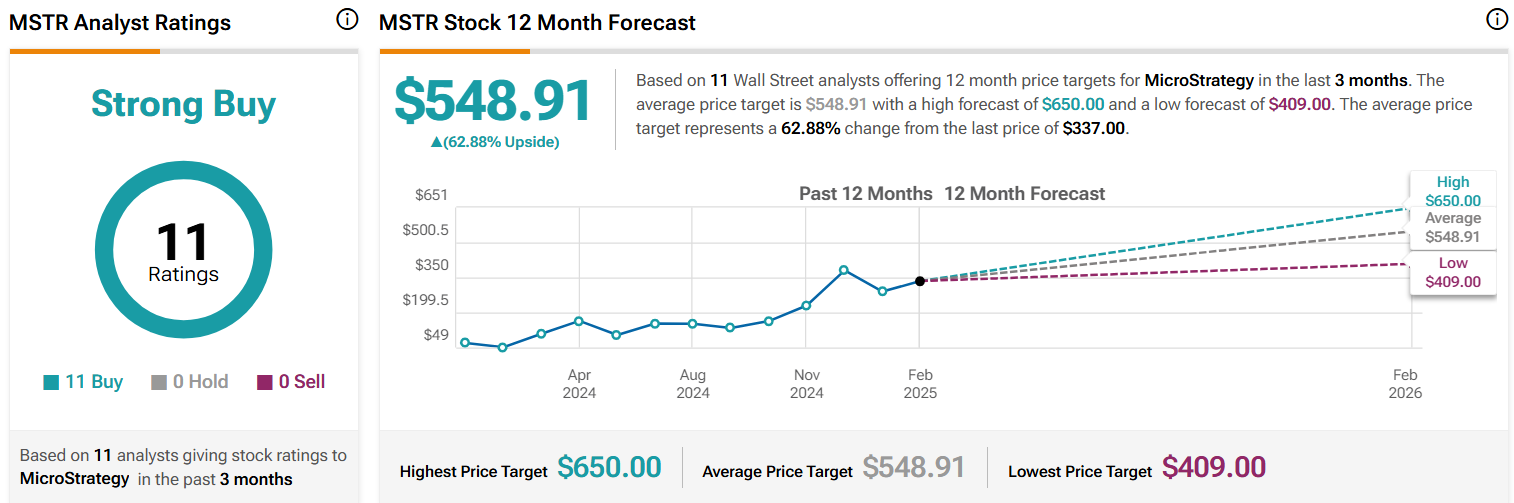

Wall Avenue analysts, alternatively, seem to estimate that MSTR shares will continue rising within the arrival twelve months, indicating that even a downward breakout would fresh extra of a ‘buy the dip’ opportunity than advise a calamity.

Indeed, the information Finbold retrieved from stock analysis platform TipRanks means that every person 11 rankings assigned within the closing three months subject Technique stock as a ‘exact buy’ with a median 52-week tag purpose of $548.91 – 62.88% above the press time tag.

Likewise, the most most novel forecasts had been optimistic, even supposing it is price pointing within the market had been most attention-grabbing two rankings in 2025 – one assigned on January 27 by Mizuho and the diverse on February 7 by Keefe, Bruyette & Woods.

Featured image thru Shutterstock