VIRTUAL designate has been hovering, up 382.50% in the final 30 days, making it the very very top platform for creating AI crypto brokers. Nonetheless, the momentum appears to be like to be cooling as VIRTUAL’s RSI currently sits at 50, reflecting a neutral market sentiment.

No matter the recent surge, the BBTrend has shifted detrimental after nearly two weeks of optimistic readings, signaling a weakening of bullish momentum. This might perhaps well designate a ability non permanent downturn except the style reverses and VIRTUAL can regain its upward trajectory.

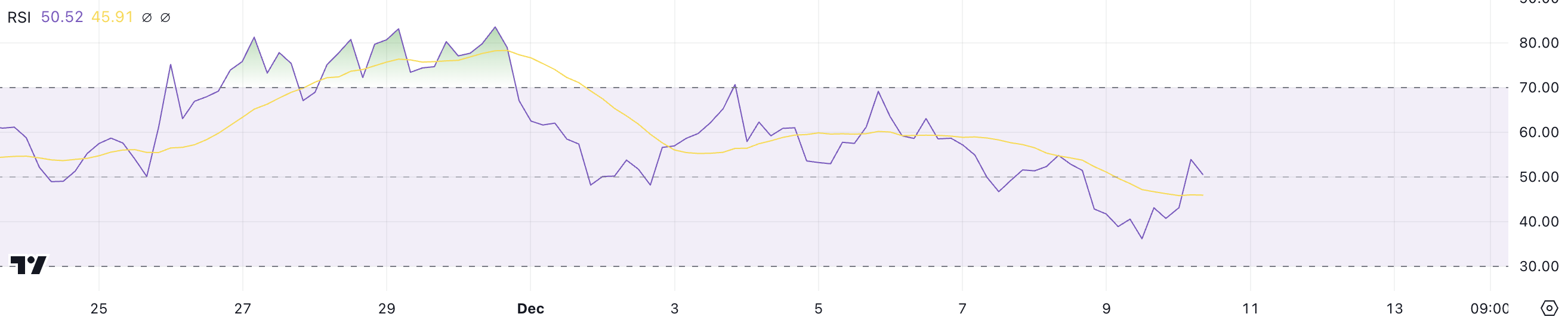

VIRTUAL RSI Is At designate Unbiased

VIRTUAL RSI is currently at 50, after final above 70 between November 26 and November 30. This shift indicates a decrease in the bullish momentum that had previously pushed the price into overbought territory.

The Relative Energy Index (RSI) is a momentum oscillator that measures the fee and swap of designate movements, with values ranging from 0 to 100. An RSI above 70 veritably means that an asset is overbought, while values below 30 designate oversold stipulations.

With VIRTUAL’s RSI now at 50, it reflects a neutral market sentiment, indicating that the price is neither overbought nor oversold. This means that the market is currently in a consolidation phase, with neither solid procuring for nor promoting rigidity.

If RSI stays at this level, VIRTUAL designate might perhaps well perhaps commerce inner a fluctuate, and the next switch will likely count on whether or no longer momentum shifts in direction of synthetic intelligence yarn in the next weeks.

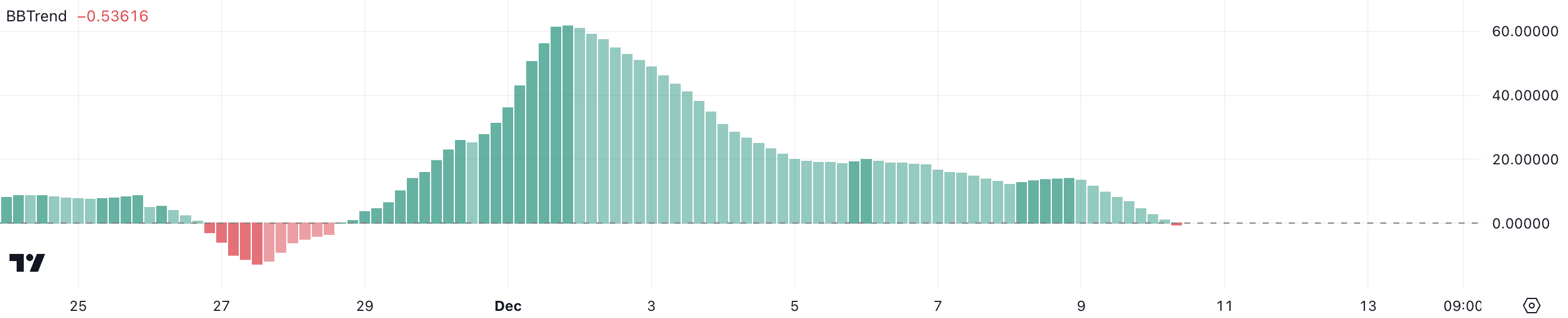

VIRTUAL BBTrend Grew to became Detrimental After Practically 2 Weeks

VIRTUAL’s BBTrend grew to became detrimental after staying optimistic since November 29, reaching a height of 61 on December 1. The novel reading of -0.fifty three indicates a shift in the style, suggesting that the bullish momentum has weakened vastly.

BBTrend is a trademark derived from the Bollinger Bands that measures the route of the style and helps assess whether or no longer the market is in a bullish or bearish phase. A honest BBTrend veritably indicators upward momentum, while a detrimental reading indicates a ability downturn.

The recent decline in BBTrend from a height of 61 to -0.fifty three suggests a ability reversal in VIRTUAL designate style. After a protracted duration of optimistic readings, this shift might perhaps well perhaps signal that VIRTUAL is facing increased promoting rigidity, presumably leading to non permanent designate declines.

If the detrimental style continues, VIRTUAL designate might perhaps well perhaps skills additional downward saunter.

VIRTUAL Label Prediction: Can VIRTUAL Reach $2 In December?

VIRTUAL’s EMA strains remain bullish, indicating that the overall style is restful optimistic. Nonetheless, the narrowing distance between the non permanent EMA strains suggests a weakening momentum. This might perhaps well signal a ability slowdown or reversal.

If the uptrend regains energy, VIRTUAL might perhaps well perhaps test the resistance at $1.83. If that level is broken, it might most likely most likely well perhaps rise to test its old all-time excessive of $1.ninety nine, reached on December 5, as AI crypto brokers proceed to attract attention. Yet every other crucial indicator is that VIRTUAL is up nowadays, as the numerous 4 greatest AI coins, fair like RENDER and TAO, are declining by 12% and 18%, respectively.

On the numerous hand, if the novel uptrend turns into a downtrend, VIRTUAL designate might perhaps well perhaps face a correction, with ability attempting out of enhance at $1.21. This would designate a ability 26% decline from novel ranges.