From Volatility to Validation

Crypto’s prolonged dual carriageway from speculation to adoption reached a brand contemporary chapter in 2025. As soon as considered as an experimental enviornment of interest, blockchain now powers trillions in annual transactions and is backed by global monetary giants. The commercial matured by plan of volatility, political uncertainty, and technological overhaul — rising stronger, sooner, and increasingly integrated into the enviornment economy.

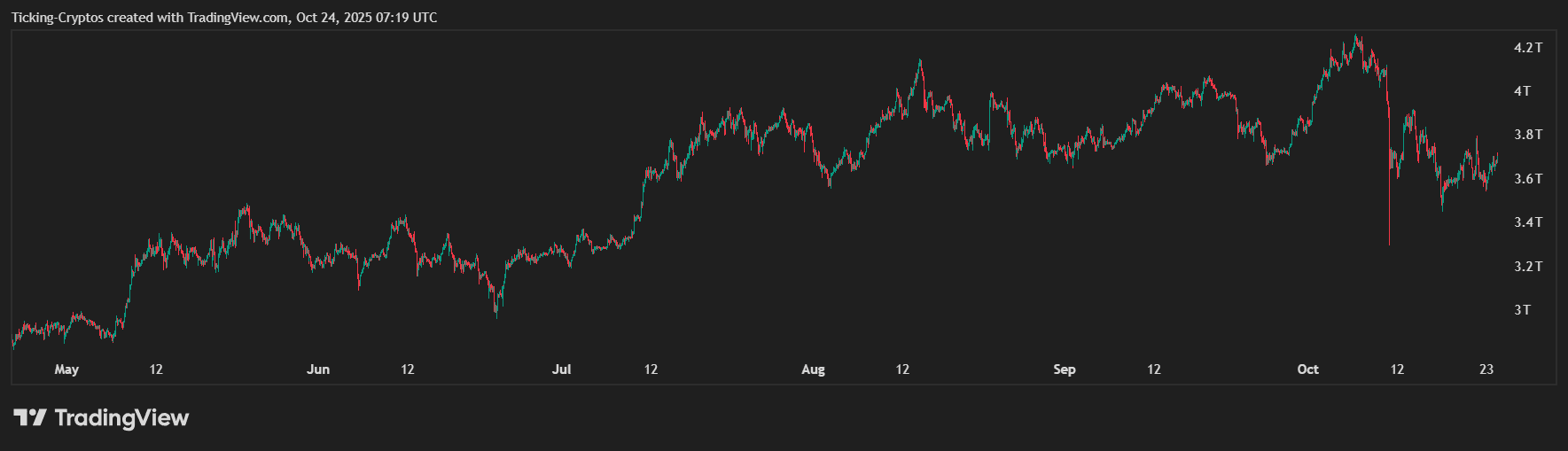

Total crypto market cap in USD – TradingView

With around $4 trillion in market capitalization and millions and thousands of users, the story of 2025 is no longer about hype — nonetheless about integration. Crypto is just not any longer parallel to former finance; it’s changing into its digital extension.

Institutional Contain: The Turning Point for Belief

This modified into the twelve months establishments stopped staring at and began participating. Veteran giants luxuriate in BlackRock, Constancy, JPMorgan, and Visa expanded their crypto choices, while fintech companies equivalent to Stripe, PayPal, and Robinhood constructed native blockchain merchandise.

The delivery of $Bitcoin and Ethereum exchange-traded merchandise (ETPs) — now maintaining over $175 billion — opened the floodgates for institutional capital. These regulated devices made crypto accessible to pension funds, asset managers, and companies for the foremost time.

Regulations luxuriate in the GENIUS Act and CLARITY Act equipped the regulatory foundation that the U.S. lacked for years. With bipartisan enhance and clearer definitions for stablecoins, market structure, and tokenized assets, builder self belief surged. The U.S. has now was one in every of crypto’s strongest jurisdictions in place of its cruelest critic.

Stablecoins: The Precise Backbone of Digital Finance

If one constructing defines crypto’s maturity, it’s the upward push of stablecoins. As soon as tools for merchants, they’ve evolved into basically the most attention-grabbing greenback switch mechanism in historical previous — sooner and more cost effective than banks or card networks.

Stablecoins now resolve over $46 trillion yearly, with regards to Three times Visa’s transaction quantity. Adjusted for staunch financial activity, that’s $9 trillion, eclipsing PayPal’s yearly throughput fivefold.

Their position has was macroeconomic: over 1% of all U.S. dollars now exist in tokenized create on public blockchains, and stablecoins collectively protect $150 billion in U.S. Treasuries, making them the 17th-ideal holder globally. As foreign central banks diversify away from Treasuries, stablecoins are ironically reinforcing greenback dominance.

With persevered institutional adoption and utilization in rising markets luxuriate in Argentina and Nigeria — the place inflation and forex instability persist — stablecoins are now no longer criminal a crypto product; they’re the infrastructure of a brand contemporary monetary layer.

The Onchain Economy: Precise Express, Precise Boost

Previous speculation, blockchain ecosystems are generating tangible financial activity. Networks now tackle 3,400 transactions per second, a hundredfold development since 2020, rivaling Nasdaq’s throughput at a fraction of the cost.

$Solana has solidified its position as a high-efficiency blockchain for decentralized apps, DePIN networks, and NFTs, generating billions in revenue. In the period in-between, $Ethereum Layer 2 networks — in conjunction with Arbitrum, Terrible, and Optimism — diminished transaction payments to lower than one cent, making onchain operations scalable for mainstream adoption.

The upward thrust of staunch-world assets (RWAs) and decentralized finance (DeFi) is bridging the hole between former and digital finance. Tokenized Treasuries, money-market funds, and private credit ranking now total $30 billion in rate, showing that the next wave of capital markets might well maybe reside entirely onchain.

Crypto Meets AI: The Convergence Era Begins

Artificial intelligence and crypto are increasingly converging. AI’s increasing need for verifiable identification, info ownership, and self reliant transactions naturally aligns with blockchain. Decentralized identification projects luxuriate in World possess already verified over 17 million users, while protocols equivalent to x402 enable AI agents to transact autonomously — a seemingly $30 trillion market by 2030.

As AI centralizes around about a tech giants, blockchain affords the counterweight: an open, verifiable system proof in opposition to censorship and monopolization.

World Traits: Adoption Without Borders

Crypto utilization is changing into more geographically diverse. Emerging economies are utilizing crypto for survival — remittances, payments, and savings — while developed nations treat it as investment infrastructure. Mobile pockets activity surged in Latin The US, Africa, and Asia, the place users bypass unstable currencies for blockchain-primarily primarily primarily based that you simply might mediate choices.

In the period in-between, decentralized exchanges and perpetual futures platforms luxuriate in Hyperliquid are no longer easy centralized devices, processing trillions in quantity. NFT activity, though subdued from 2022 highs, has shifted from speculation to utility — signaling the evolution of digital ownership.

Plan forward for Crypto: Crypto Enters Adulthood

Seventeen years after Bitcoin’s delivery, crypto has transitioned from a fringe experiment to a pillar of the stylish economy. The ecosystem now has three wanted factors:

- Infrastructure: scalable, interoperable, and worth-efficient.

- Distribution: powered by establishments and fintech networks.

- Regulation: enabling responsible innovation.

Because the next cycle unfolds, search info from crypto to underpin global payments, mission systems, and AI economies. The realm is no longer criminal adopting blockchain — it’s being rebuilt on it.