The phrase “debasement commerce” as a crypto legend has change into common. It’s this conception of getting out of government-backed sources, equivalent to bonds or fiat currencies, and into “laborious” sources love gold or Bitcoin.

Bitwise CIO Matt Hougan now no longer too lengthy within the past posted on X that the debasement commerce theory is gaining steam and can just be common into 2026. So, what is this theory, and why is it gaining traction now?

What is the Debasement Commerce Theory in Bitcoin

The Debasement Commerce theory in Bitcoin refers to merchants purchasing Bitcoin as safety against the declining value of fiat currencies.

As governments enlarge money provide thru debt and monetary stimulus, each and each unit of currency loses purchasing vitality. This activity veritably known as currency debasement.

Issues the market is underestimating:

1) The possibility that sovereigns purchase bitcoin in size; within the next couple of years

2) The possibility that the US passes the Clarity Act in dreary-2025/early-2026;

3) The price at which tokenization and stablecoins will grow;

4) The truth that the… https://t.co/sZNdMnExuB

— Matt Hougan (@Matt_Hougan) October 28, 2025

Bitcoin’s fastened provide of 21 million cash and independence from central banks construct it a beautiful hedge in distinction erosion.

In this gape, Bitcoin functions as a “digital laborious asset,” a lot like gold. It preserves value when believe in passe money weakens.

The commerce has acquired momentum as world debt rises and inflation issues persist. It permits merchants to tackle Bitcoin as portion of a broader technique to safeguard wealth from monetary dilution.

Increasing Uncertainty

Satoshi Nakamoto created Bitcoin as a response to the 2008 monetary disaster. Its genesis block, when the community first went stay in 2009, contained a message referencing monetary institution bailouts.

So there’s unquestionably no request of, despite the thriller surrounding Bitcoin’s founders, that the cryptocurrency became created as a salve for passe monetary chaos.

“I judge that BTC’s basic thesis became continuously some variation of the debasement commerce,” acknowledged Andrew Tu, an government at crypto market maker Efficient Frontier. “Starting from the genesis block wherein Satoshi references the bailout for banks.”

The monetary markets general seem to be very reactionary to US coverage. That’s why the market looks to commerce impulsively or on a whim with the Trump administration.

The latest October 10 market rupture as a consequence of tariff fears is an instance of this. Even supposing recovery became nearly as swift.

If truth be told, zooming out, the value of Bitcoin has risen 50% during the last year, despite market choppiness from week to week.

Debasement Bullish or Bearish for Crypto Merchants?

The term “debasement” sounds excessive, one thing that ought to be a issue for market contributors.

Alternatively, the term will likely be extra of a myth to present for gyrating markets, typically at the whim of US policymakers or diversified world occasions.

Those discovering out the markets on each day foundation would possibly per chance presumably additionally just occupy a diversified knowing on debasement, pulling in bearish sentiment general.

“No subject all of the uncertainty and economists asserting a recession and/or endure market became extremely likely in 2023, almost definitely in 2024, and 50/50 in 2025,” eminent Jeff Emrby, Managing Accomplice of Globe 3 Capital. “It’s too early to call compatible now, but we’re awaiting to call for one other bull market year in 2026.”

If the debasement commerce conception turns into one thing a full bunch other folks focus on in 2026, as Bitwise’s Hougan predicts, those who occupy believed in Bitcoin for an awfully very lengthy time acquired’t be bowled over.

This passe to be known as being “libertarian” or a “cypherpunk.” It wasn’t necessarily in vogue at the time, and became portion of Bitcoin’s counterculture vibe up till around 2016. It would possibly per chance presumably additionally just be in vogue now.

“It’s lovely powerful the very foundation of the Bitcoin value myth,” acknowledged Witold Smieszek, Director of Investments for Paramount Digital. “So in that means it’s nothing novel for the musty guard who bought into crypto thru a combination of economics and cypherpunk values.”

Bitcoin Rotation

Doable crypto merchants occupy many extra alternatives in entrance of them versus the cypherpunk days when only Bitcoin became accessible.

The incidence of Layer-1s and extra favorable rules has resulted in corporations expressing ardour in varied chains, which can additionally consequence in significant value will increase for those underlying tokens.

However it completely’s likely Bitcoin that suits the debasement myth most effective.

“BTC with its laborious provide cap has continuously been viewed by Bitcoiners as a hedge against the fiat system that we currently occupy,” acknowledged Efficient Frontier’s Tu.

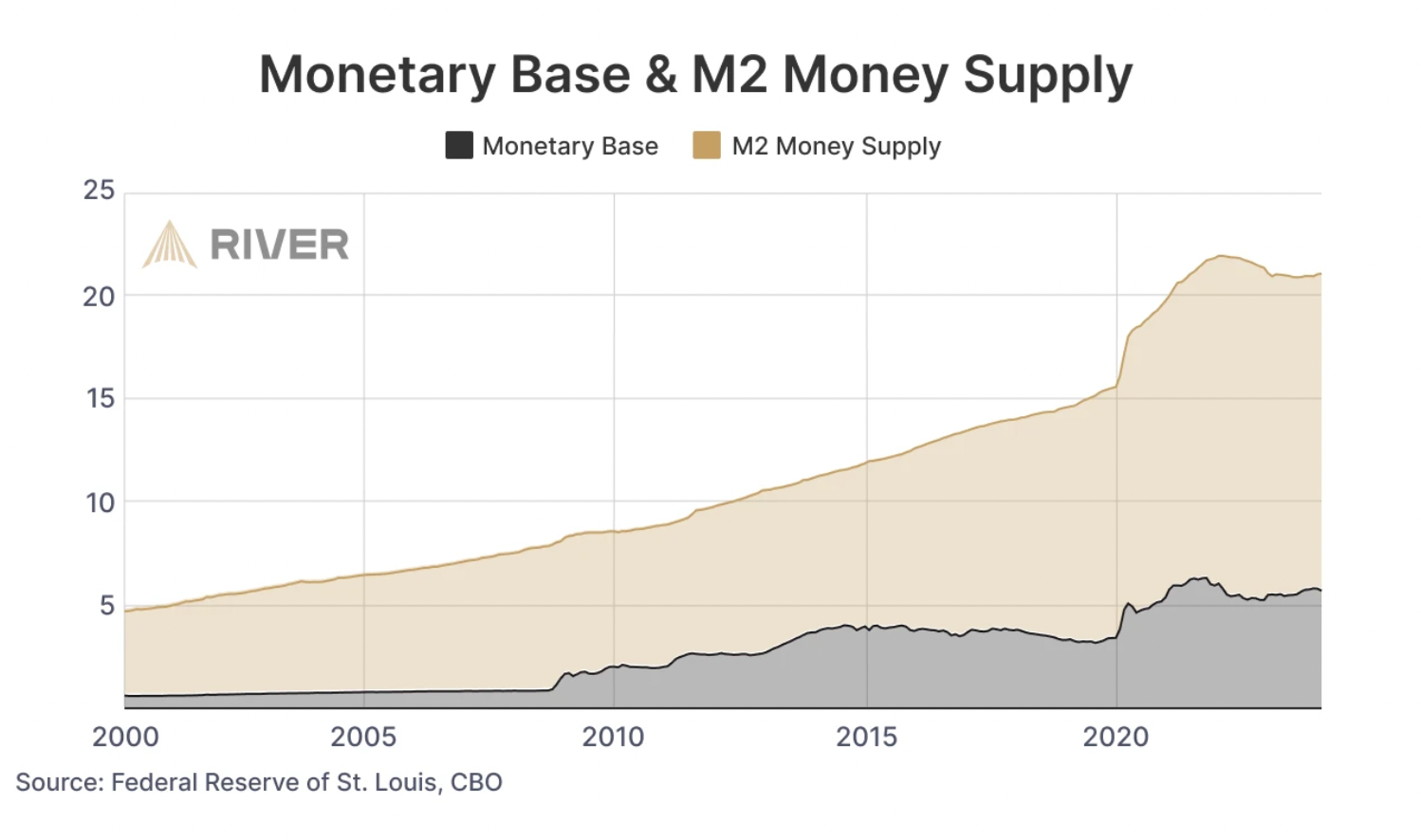

For the reason that 2020 pandemic-technology money printing, the total M2 money provide, which is cash and its equivalents, jumped from around $15 trillion to over $20 trillion.

Cheap and straight forward money has resulted in rotation into Bitcoin and a increased imprint – BTC became as shrimp as $4,000 all the diagram thru the 2020 lockdowns. However that doesn’t suggest there acquired’t be a rotation out within the face of diversified macro occasions.

Volatility would possibly per chance presumably additionally just now no longer continuously seem relaxing for inexperienced crypto holders, but it’s unquestionably correct for merchants, with on each day foundation Bitcoin quantity all the diagram in which thru exchanges at $17 billion, per info aggregator Newhedge.

“If the market crashes for the reason that AI bubble pops or one thing, then we can perhaps mild survey the BTC and general crypto market, and presumably gold within the short-term sooner than outperformance within the medium-term, rupture as properly,” added Andrew Tu from Efficient Frontier

The post May well “Debasement Commerce” Be The Ultimate Bitcoin Story for 2026? seemed first on BeInCrypto.