Bittensor (TAO) saw merchants assemble a bullish spell on the each day chart from July seventh, 2024, reflecting over 65% development within the closing two weeks. Label sustained at a truly grand question of zone ahead of rising.

As of writing, the war to propel higher continued with a shrimp stop taken within the direction, as the 200-day EMA band acted as a hurdle that wished to be cleared for unprecedented positive aspects to pop out.

Bittensor (TAO) Statistics In Ingredient:

Fixed with CoinMarketCap, TAO region trading volume stands at $60.709 Million. The market cap is $2.323 Billion. Within the meantime, the liquidity is inclined at (2.61%), which might well indicate market balance. Investors wants to be cautious ahead of stepping in (DYOR).

However, despite the inclined liquidity, by formula of market cap, TAO ranked forty fourth crypto among the many pinnacle 50 cryptocurrenciess on CoinMarketCap.

Bittensor has given colossal returns to its merchants, which exceeds over 1500%, peaking at $755 (ATH) from October 2023 to March 2024. However, it became as soon as adopted by earnings booking, which loosened spherical 70% of its development.

No topic the autumn, TAO/USDT: MEXC displayed that by mid-Could perchance 2023, it became as soon as at an all-time low stage. The cost is practically 900% higher.

Fixed with tokenomics, 7.092 Million TAO (33.78%) of the provision is in circulation out of the final provide of 21.0 Million TAO. Within the meantime, the FDV, as of writing, stands at $6.875 Billion.

TAO Derivatives Knowledge

As per TAO derivatives info prognosis, 3.43% extra contracts were opened ($47.70 Million) OIs in total.

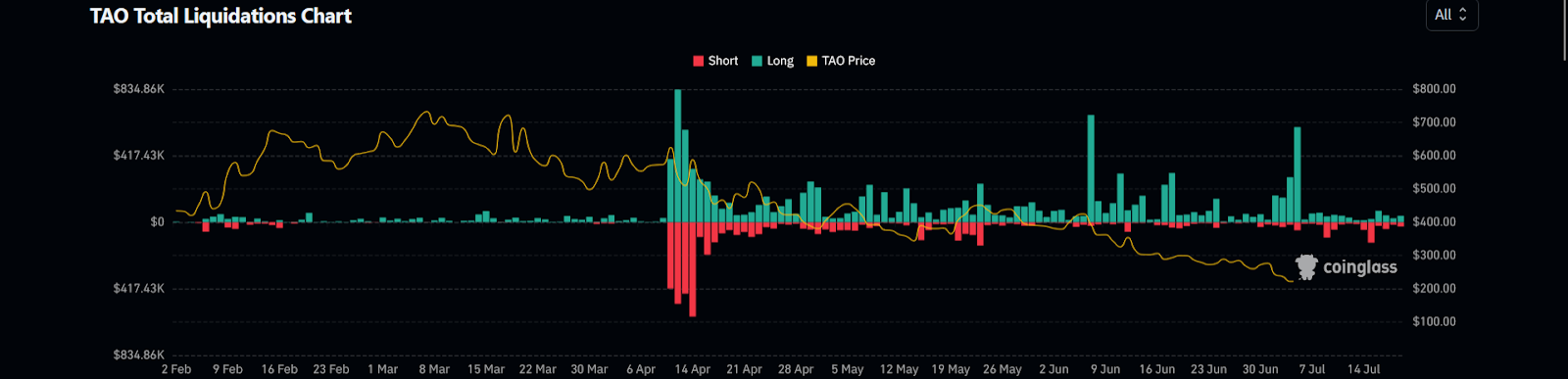

Its derivative volume has also surged, amounting to a total of $98.80 Million. Liquidation info became as soon as also accurate. It favoured largely bulls, as extra shorts were liquidated than longs. Intraday, the interruption in mark witnessed at the 200-day EMA, which usually is a signal of earnings booking.

Within the meantime, the shorts in 24 hours amounted to no longer up to longs at $42.5K, whereas the prolonged liquidation quantity became as soon as higher at $61.06K.

Bittensor (TAO) Label Construction Overview

From January 8th, 2024, to March seventh, 2024, TAO rose over 290%, where the associated price accelerated vastly from $193 to $755.86. However, the associated price encountered a provide zone and failed to harness additional positive aspects on the each day chart.

After failing to surpass $756, the associated price entered a trip of lower lows, going help to the initial question of zone within the following 4 months by July 5th. However, the associated price one more time surged with the broader market bullish sentiment and rose over 65% within the past two weeks, and practically 38% development within the past 1 week.

Sam_TCR

As of writing, the associated price managed to interrupt the upper border of the channel. It looks relish a bullish pattern, exactly the falling wedge’s breakout. Therefore, if the breakout continues, then the upper targets lie spherical $370, and $430, respectively.

On the opposite, if the associated price declines and trades help into the pattern, then this pattern would lose its significance, and a bearish point of view or sideways point of view might well prevail. However, if the associated price slips to $260, then the principle enhance would be the question of zone at $200, and the 2nd enhance would be at $135.

Indicators are bullish: MACD confirmed a bullish unsuitable with a increasing histogram at 13.75, and RSI jumped from 14-SMA towards overbought, which flashed at 63.12.

TAO has surged over 65% within the past two weeks however confronted resistance at the 200-day EMA. No topic inclined liquidity, TAO stays within the pinnacle 50 crypto checklist by market cap. Investors wants to be cautious because of the unstable market.

The cost gallop suggests a bullish breakout, with doable targets of $370 and $430. However, a damage under the pattern might well lead to a decline towards $200 and even $135.