Company The United States’s fears of a looming economic recession absorb evaporated as fast as they emerged early this year.

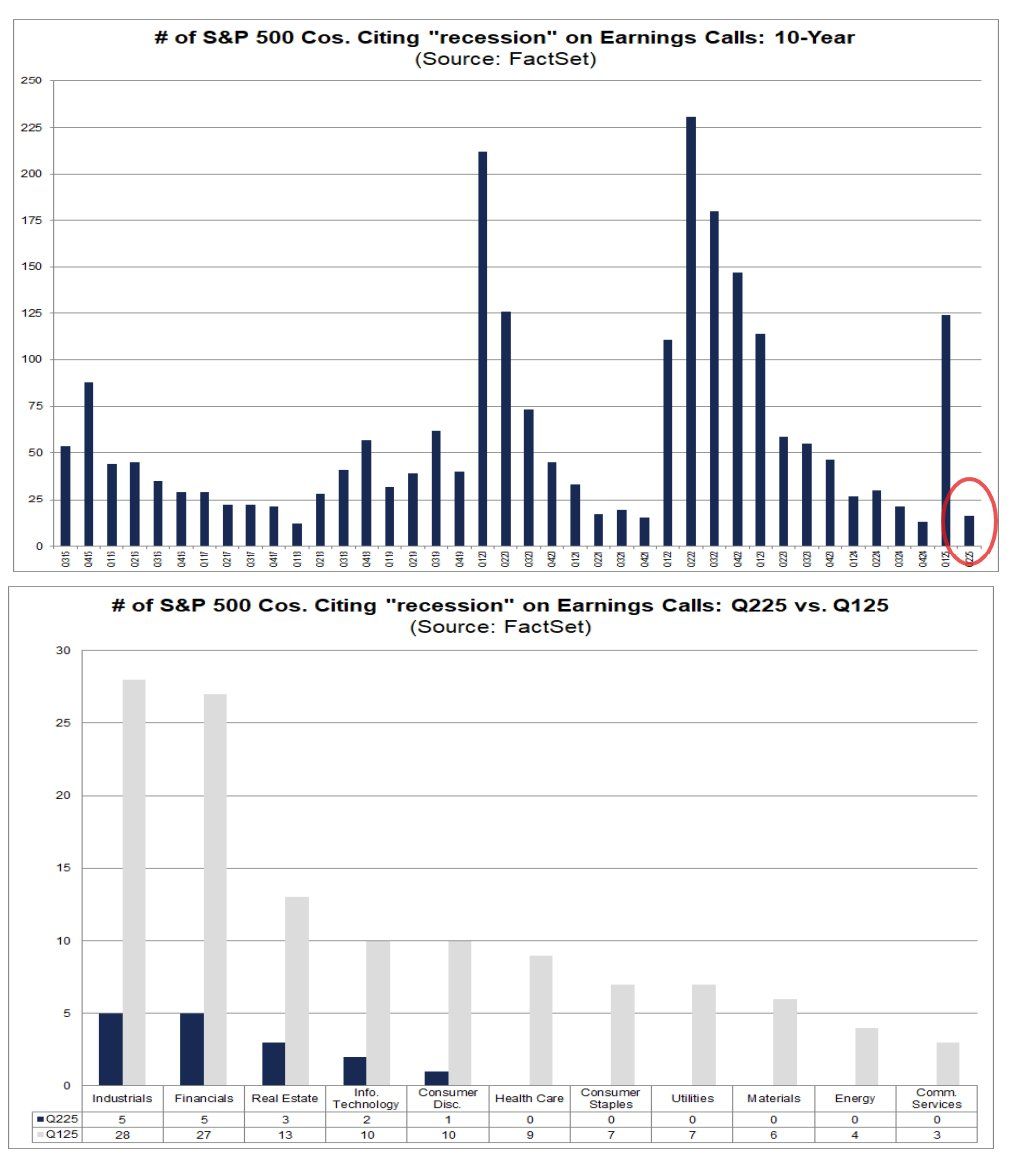

The preference of S&P 500 firms that talked about the notice “recession” throughout their second-quarter earnings call dropped sharply to factual 16, down sharply from 124 within the first quarter, based mostly completely totally on recordsdata source FactSet. A recession is defined as two consecutive quarters of detrimental economic development, as measured by the imperfect domestic product.

“Recession became as soon as uttered factual 16 cases so a ways on earnings calls this quarter (4%), down from 124 in Q1 and the 10-year moderate of 61. After Q4 ’24 it became as soon as the least of any quarter since Q4 ’21,” Neil Sethi, managing accomplice at Sethi Associates, said on X, quoting FactSet.

The decline comes as some observers apprehension that President Donald Trump’s trade tariffs are starting up to impress the economic system.

Likely company leaders are working beneath the conclusion that the elevated tariffs will within the end be “watered down” by negotiations, in space of excellent a protracted-period of time economic burden.

Trump only within the near previous unveiled sweeping tariffs besides these announced in April in a lope aimed toward sparking a manufacturing development. That has lifted the moderate U.S. tariff charge to twenty.1%, the very ideal sustained stage since the 1910s, based mostly completely totally on estimates launched by the World Change Organization and the International Financial Fund.

Markets, too, absorb largely looked previous tariff-introduced on recession fears, with the S&P 500 rising 28% since the early April dip. Bitcoin, the main cryptocurrency by market fee, has risen to $122,000 from roughly $75,000, a 62% surge in four months, CoinDesk recordsdata recount.

In step with JPMorgan, merchants absorb been specializing in resilient company earnings and the expected economic restoration following the period in-between slowdown.

Extra than 80% of S&P 500 firms absorb only within the near previous reported their second-quarter earnings, with over 80% beating earnings expectations and seventy 9% surpassing earnings forecasts. That’s the strongest efficiency in four years.

Read: Here Are 3 Bullish Causes Why JPMorgan Sees S&P 500 Rallying Basic Larger