An analyst identified for making crypto bottom calls thinks that memecoin Pepe (PEPE) and one Solana (SOL) challenger are gearing up for breakout rallies.

Pseudonymous analyst Bluntz tells his 273,500 followers on the social media platform X that PEPE and Sei (SEI) are amongst the market’s leaders after breaking out of bullish reversal patterns.

“Many altcoins with blatant in-your-face accumulation going on here, extraordinarily arduous to be bearish in my stare.

SEI and PEPE are some standouts, in my stare.”

SEI, the trader appears to be like to counsel that the Solana rival has broken out from a rounding bottom pattern. The technical formation is regularly viewed as a bullish reversal pattern because it indicates that investors have gathered the asset with out allowing the sign to switch decrease.

At time of writing, SEI is trading for $0.30, down 1.44% on the day.

As for PEPE, the trader shares a chart suggesting that the meme token has broken out from an inverse head-and-shoulders pattern, one more bullish reversal formation. The pattern coincides with the conclusion of an ABC corrective wave, which skill that an asset is poised for a surge.

“PEPE coming in hot with the accumulation wreck.”

At time of writing, PEPE is worth $0.0000078, a 1.2% decrease within the final 24 hours.

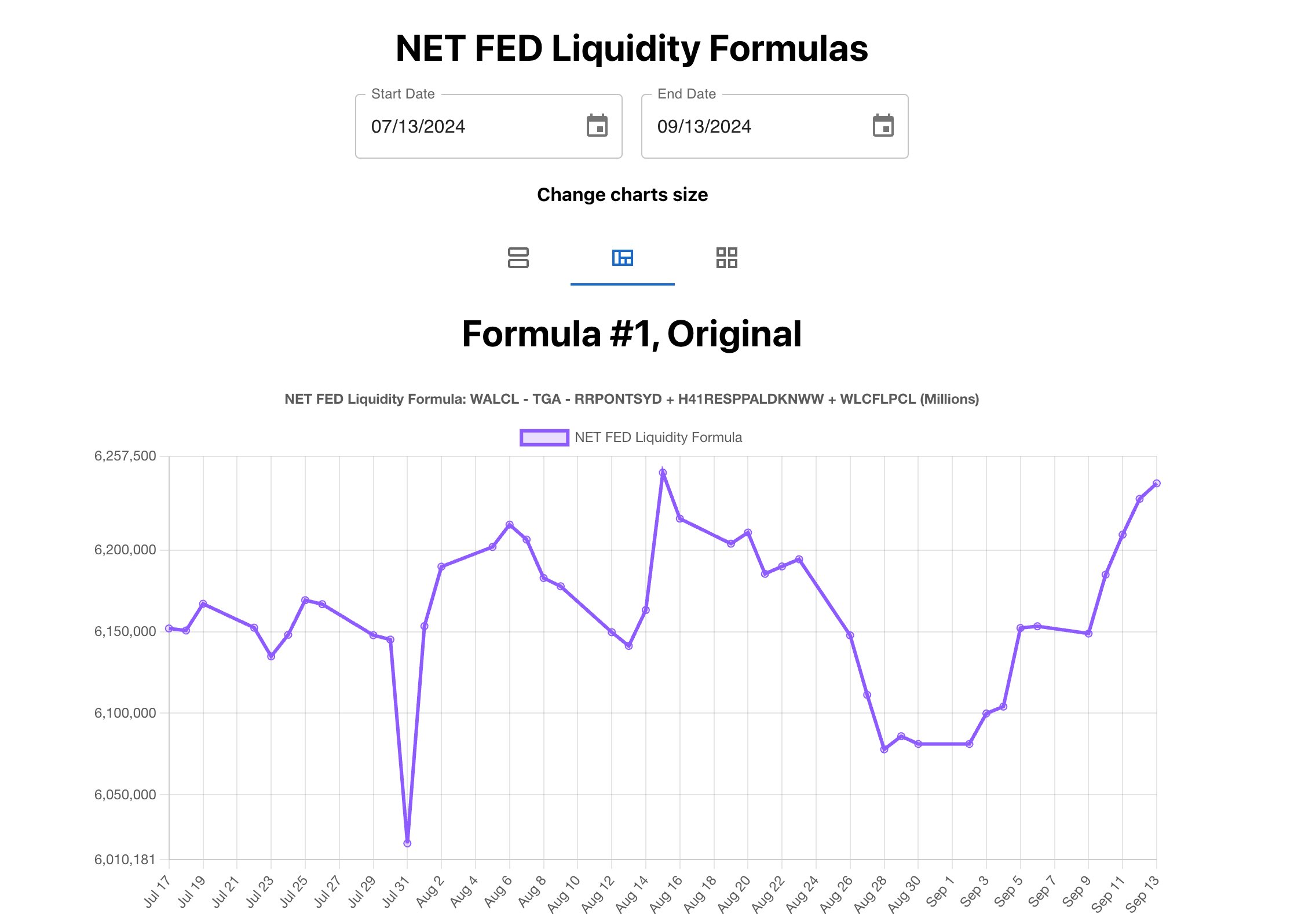

Turning to Bitcoin, the analyst believes that BTC is conclude to sparking rallies amid rising liquidity injections from the Federal Reserve.

“You didn’t proceed the Fed liquidity injection thanks to ‘mUH SePTemBeR iS TypIcaLLy BeARiSh’ did you anon? BTC.”

Traders on the total see liquidity influxes as a bullish signal because it indicates that there’s more capital that would be invested in risk sources comparable to Bitcoin and crypto.

Bluntz previously predicted that Bitcoin will rally to a new all-time excessive around the $100,000 stage.

“Serene my scandalous case for BTC, bears are about to catch murdered in my stare.”

At time of writing, Bitcoin is trading for $60,200, a puny dip within the final 24 hours.

Generated Image: Midjourney