With finest about a days left till the tip of 2025, CoinGlass has released its three hundred and sixty five days-stop yarn for 2025.

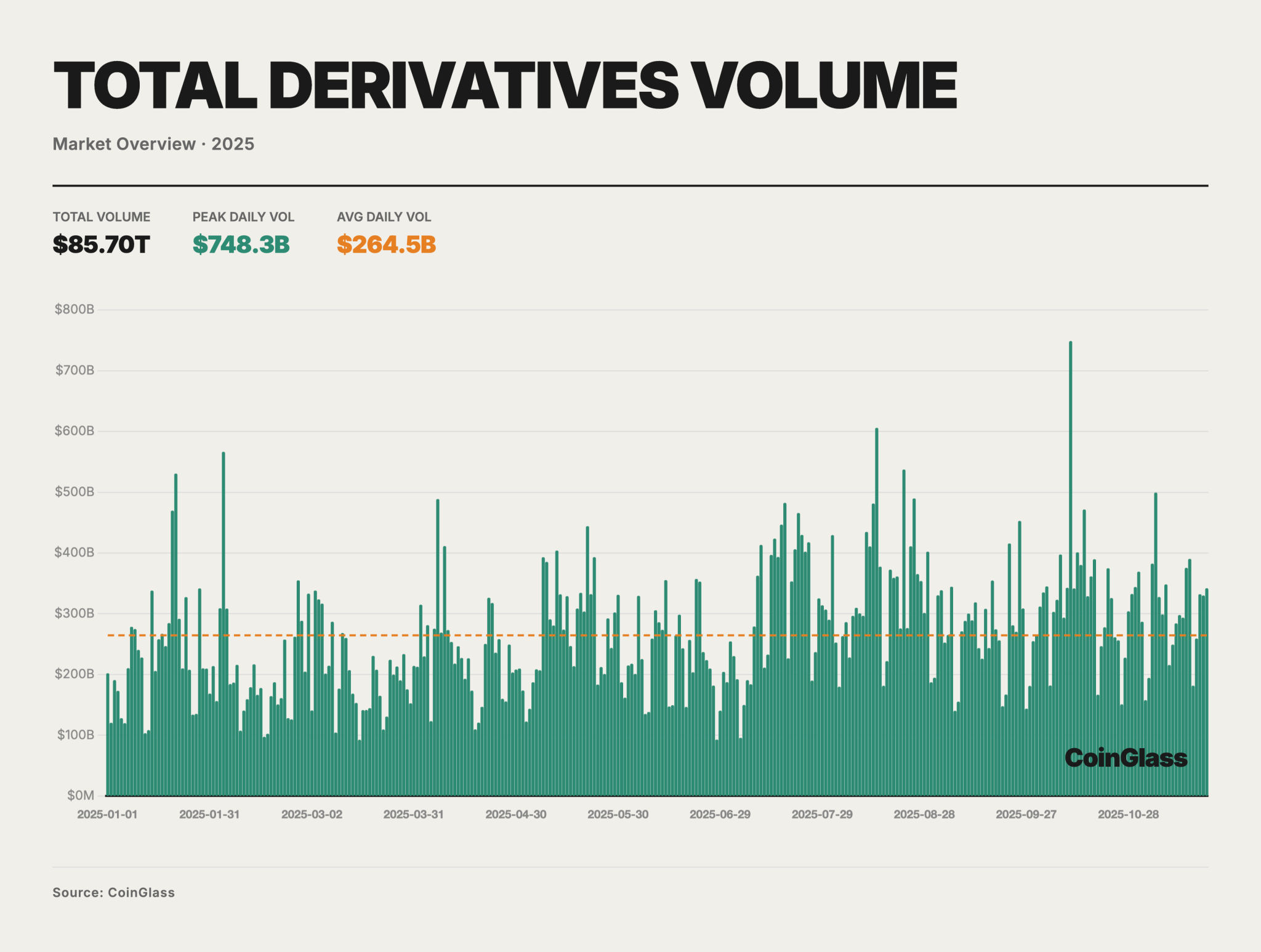

Per CoinGlass’ yarn, the total trading volume of the cryptocurrency derivatives market can be approximately $85.7 trillion in 2025, with an reasonable day to day trading volume of $264.5 billion.

2025 is the three hundred and sixty five days of DAT!

The yarn highlighted that 2025 is the three hundred and sixty five days of DATs (Depth of Activated Transactions). DAT companies elevated their Bitcoin holdings from 600,000 BTC in the starting up of the three hundred and sixty five days to 1.05 million BTC by November, shopping approximately 5% of the total Bitcoin present.

The total trading volume in the crypto derivatives market reached approximately $85.7 trillion all three hundred and sixty five days prolonged, with a day to day reasonable of $264.5 billion. Global crypto derivatives initiate positions fell to their lowest stage of the three hundred and sixty five days in the major quarter, spherical $87 billion, following a discount in leverage, earlier than with out observe increasing in the center of the three hundred and sixty five days to reach a yarn excessive of $235.9 billion on October seventh.

The fourth quarter became once additionally no longer easy, and a pointy reset in early October worn out over $70 billion in positions, representing roughly a third of total initiate positions, via a unexpected delegitimization tournament.

CoinGlass attributed the decline and liquidations to US President Donald Trump’s resolution to impose a 100% tariff on items from China.

No subject this decline, three hundred and sixty five days-stop initiate positions reached $145.1 billion, a 17% develop since the starting up of the three hundred and sixty five days.

The total nominal payment of liquidated prolonged and rapid positions reached $150 billion, whereas day to day liquidations averaged between $400 million and $500 million.

These purges were concentrated mainly in October and November.

“Sudden coarse occasions going on in 2025 subjected original collateral mechanisms, liquidation rules, and unpleasant-platform risk transfer unparalleled stress assessments.”

Binance Took the Lead!

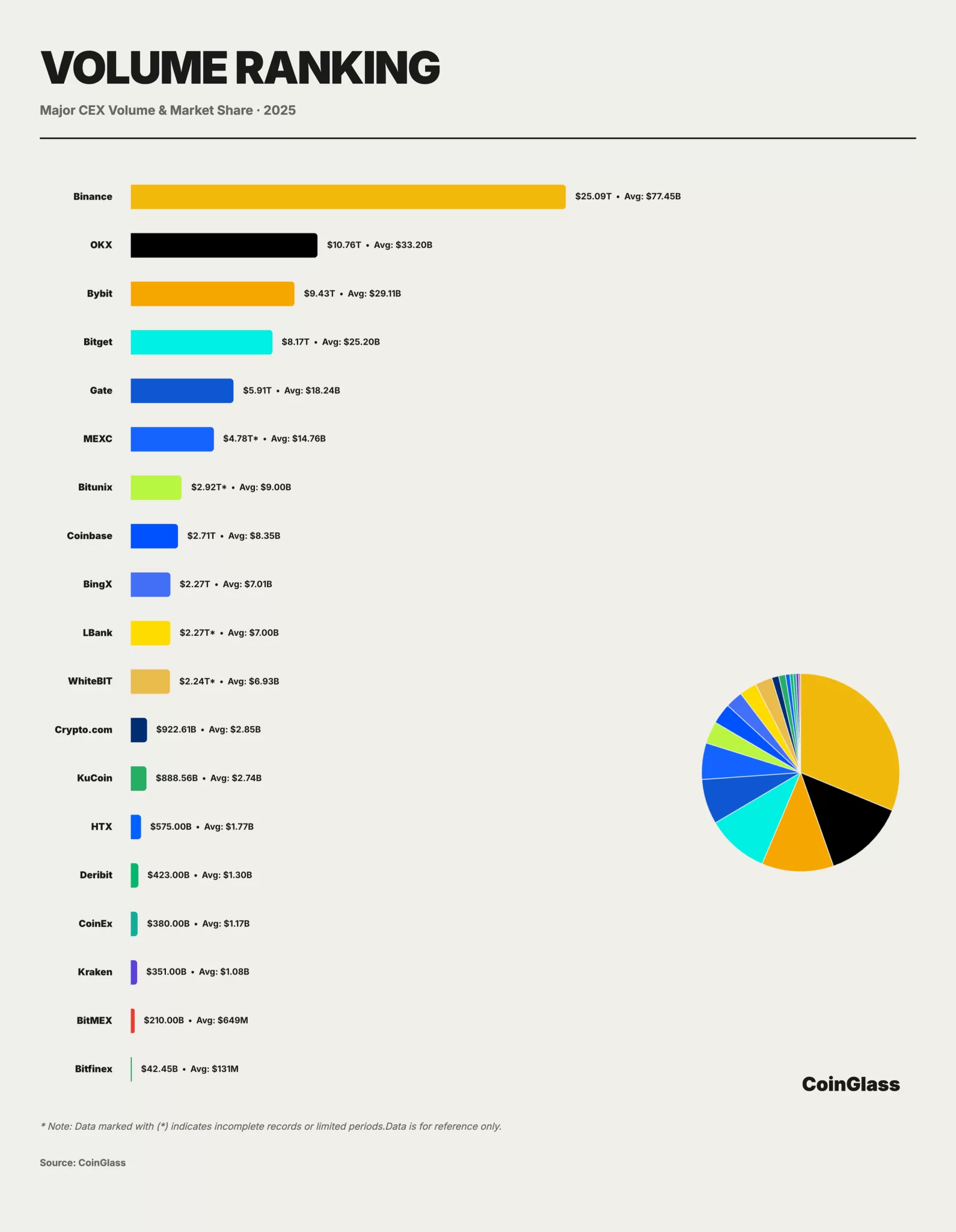

Per the CoinGlass yarn, Binance led the market with a total derivatives trading volume of approximately $25.09 trillion.

This accounts for about 30% of worldwide trading volume, meaning that about $30 out of every $100 traded takes role via this exchange. Binance became once followed by OKX with a volume of $10.7 trillion, Bybit with $9.4 trillion, and Bitget with $8.1 trillion. These four exchanges accounted for about 62.3% of the total market fragment.

*Right here is no longer investment advice.