In response to mounting concerns over transparency, Coinbase has unveiled a Proof of Reserves (PoR) for its wrapped Bitcoin token, cbBTC.

This transfer targets to make sure customers that every cbBTC is backed 1:1 by Bitcoin (BTC) held by the alternate.

Coinbase Finds cbBTC Proof of Reserves

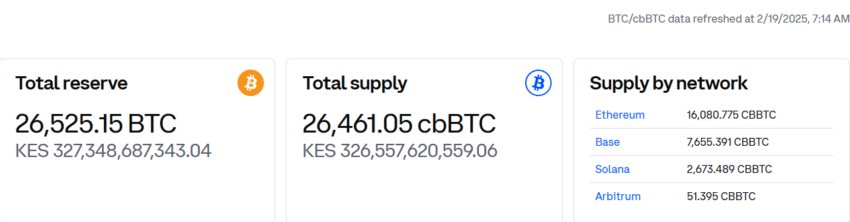

In line with the PoR data, the Coinbase alternate holds an entire reserve of 26,525.15 BTC, with a corresponding cbBTC present of 26,461.05 tokens.

The distribution of cbBTC at some level of diversified networks is as follows: Ethereum hosts 16,080 cbBTC, Irascible contains 7,655.391 cbBTC, Solana holds 2,673.489 cbBTC, and Arbitrum has 51.395 cbBTC.

Coinbase moreover disclosed the specific Bitcoin addresses and their balances, improving the transparency of its reserves. In line with the data, the wallet keeping the ideally suited section of these reserves contains 690 BTC, worth roughly $65.8 million at most modern charges. Meanwhile, 40 wallets protect 480.984 BTC each. The final BTC is disbursed among diverse diversified wallets.

This stutter comes on the heels of criticism from prominent figures within the cryptocurrency community. Justin Sun, founding father of Tron, beforehand lambasted cbBTC for its perceived lack of transparency and centralization.

As BeInCrypto reported, Sun expressed concerns that cbBTC lacked Proof of Reserve, was once unaudited, and may perchance freeze balances at any time. Sun warned that such centralized control can also consequence in asset seizures essentially based totally totally on authorities actions.

“cbBTC lacks Proof of Reserve, no audits, and can freeze any individual’s balance anytime. In level of truth, it is factual ‘belief me.’ Any US authorities subpoena can also rob all of your BTC. There is no such thing as a better illustration of central monetary institution Bitcoin than this. It’s a miserable day for BTC,” Justin Sun wrote on X.

While Coinbase’s introduction of PoR for cbBTC addresses some transparency issues, person apprehensions persist.

“You moreover talked about proof or reserve for Solana but it came about to be horrifying and our transactions had been stuck for over 24 hours,” a person on X challenged.

The person references most modern incidences provocative delays in Solana (SOL) transactions on the platform, causing execution waits exceeding 14 hours. This resulted in speculation that Coinbase can also simply be staking customers’ SOL with out consent, causing delays attributable to the unstaking course of. Such practices like raised questions in regards to the alternate’s liquidity and operational integrity.

“Deposit SOL to Coinbase, they steal your SOL and stake it to form yield off your deposits, and oops — if each person wants SOL , they don’t like your liquidity,” one person summarized.

Particularly, Coinbase Toughen ascribed the delays to “technical and blockchain issues.” Nonetheless, customers known as for sure proof of its liquidity and operational integrity. In mild of these events, the cryptocurrency community continues to advocate for elevated transparency and accountability from centralized exchanges.

Coinbase’s implementation of cbBTC Proof of Reserves is a step toward rebuilding belief. On the opposite hand, ongoing scrutiny suggests that customers dwell vigilant about managing and securing their assets on such platforms.