The change expands its derivatives offering, offering uninterrupted access to XRP and Solana futures for US merchants.

Key Takeaways

- Coinbase will provide 24/7 XRP and Solana futures trading starting June 13.

- The change’s continuous trading is a first for a CFTC-regulated derivatives platform in the US.

Coinbase announced on the present time this might maybe prolong its 24/7 futures trading to encompass XRP and Solana (SOL) contracts starting June 13, aiming to provide US merchants compliant access to altcoin derivatives amid intelligent regulatory dynamics.

Starting June 13, we’re enabling 24×7 trading for $XRP and Solana ( $SOL ) futures, unlocking real-time access to U.S. merchants, reflecting the continuously-on nature of crypto markets.

— Coinbase Institutional 🛡️ (@CoinbaseInsto) Might per chance well well also 29, 2025

The movement follows Coinbase Derivatives’ most contemporary activation of 24/7 trading for Bitcoin and Ethereum futures, which made the entity the first CFTC-regulated derivatives change to provide spherical-the-clock access to crypto futures contracts in the US.

Adore Bitcoin and Ethereum futures, the upcoming open of 24/7 XRP and SOL futures trading is anticipated to take care of the hole between old model US trading hours and world crypto markets.

The movement also positions Coinbase to capture a colossal allotment of world derivatives waft.

In accordance with the agency, derivatives now scheme up higher than 75% of world crypto trading quantity. With the unusual choices, the agency seeks to tap into that rising demand, giving US merchants extra instruments to protect energetic in a market that by no formulation sleeps.

“The appearance of 24/7 CFTC-regulated markets is a recreation-changer for the industry,” said Andy Sears, CEO of Coinbase Financial Markets, in a statement.

XRP and Solana futures alternate heats up alongside Bitcoin and Ether

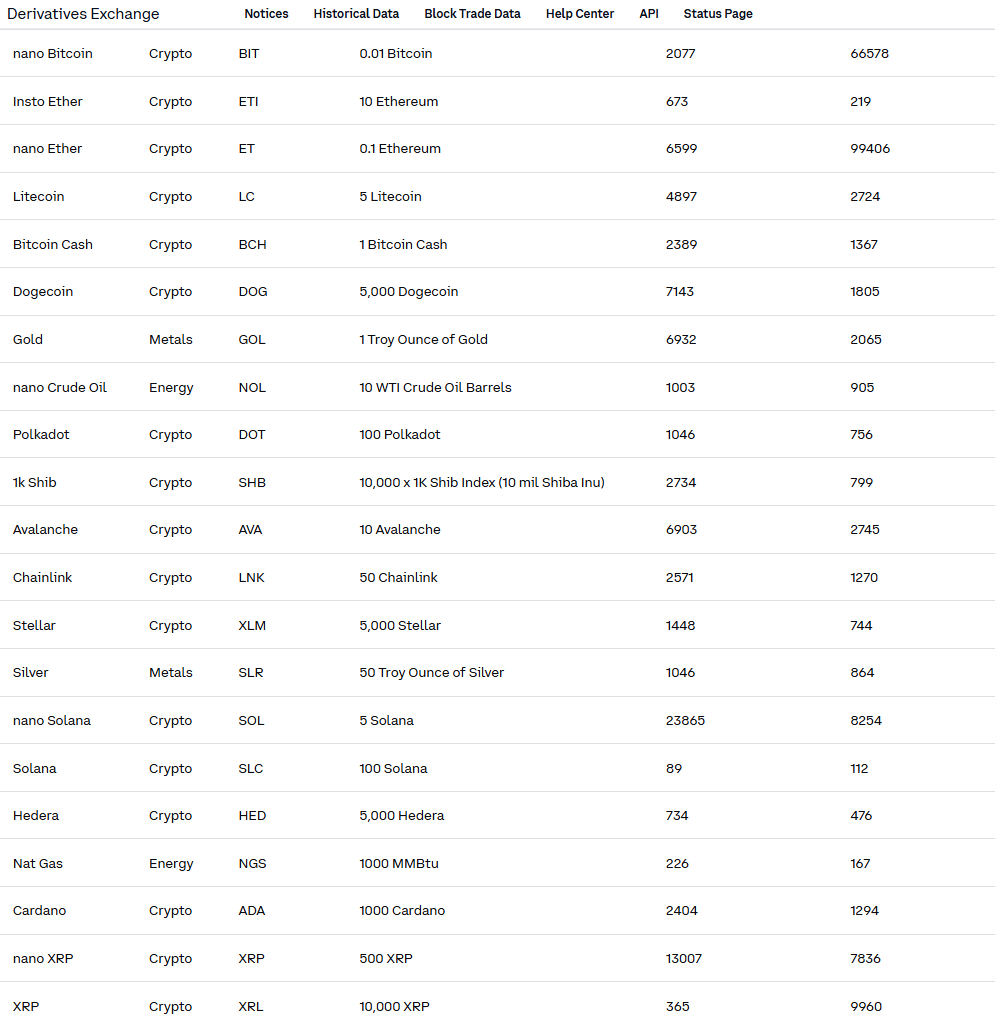

Coinbase launched Solana futures contracts in February, and merely launched XRP and nano XRP futures contracts closing month. No matter the brand new start, both sources are already exhibiting robust traction.

In accordance with files from the Thursday trading session, nano Solana led all contracts in on daily basis trading quantity with over 23,000 contracts, whereas XRP futures, across both nano and current sizes, recorded a blended quantity exceeding 13,000.

Bitcoin and Ether remain foundational to Coinbase’s derivatives offering, nonetheless this early momentum means that merchants are embracing altcoin derivatives alongside Coinbase’s extra established contracts.