Wall Toll road enormous Citigroup is weighing plans to provide cryptocurrency custody and fee services and products, aiming to capitalize on a market bolstered by Trump-generation regulatory approvals and pro-trade legislation.

Biswarup Chatterjee, a Citigroup executive, suggested Reuters that the monetary institution’s initial focal point would likely be custody services and products for “excessive-quality property backing stablecoins.”

Chatterjee works within Citigroup’s services and products division, which manages treasury, payments, money management and other challenge alternatives for smooth firms.

The monetary institution is also exploring custody offerings for crypto-linked trade-traded products, which can per chance presumably furthermore encompass Bitcoin (BTC) and Ether (ETH) trade-traded funds (ETFs).

“There desires to be custody of the equivalent amount of digital currency to toughen these ETFs,” Chatterjee acknowledged.

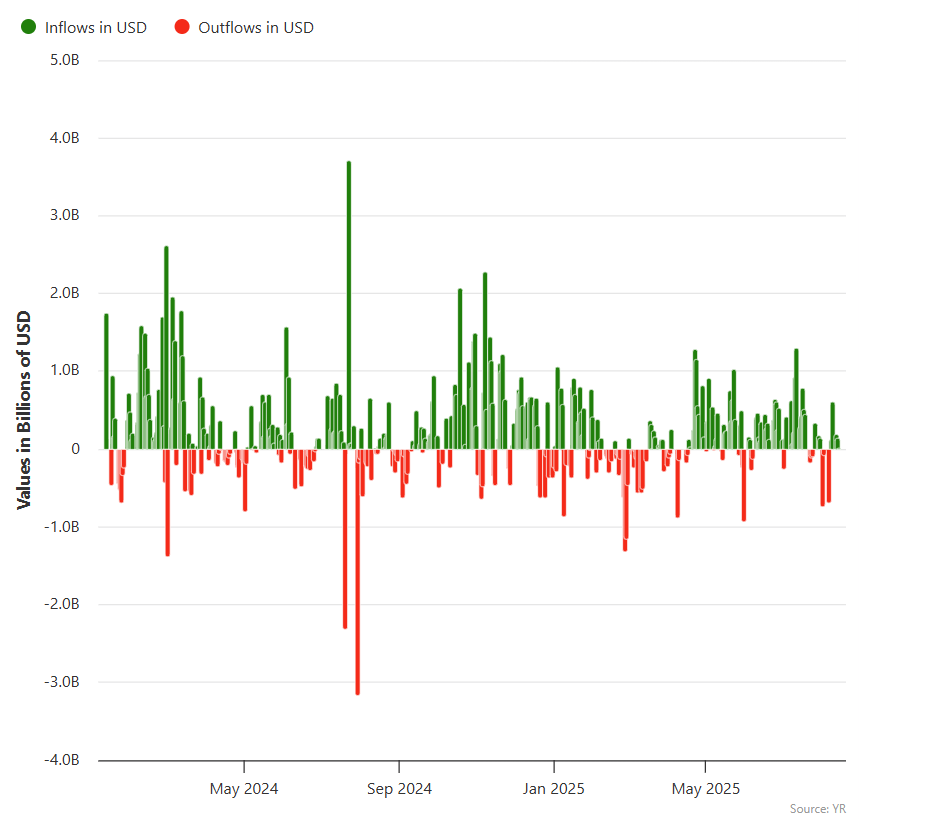

Bitcoin ETFs have surged in popularity since their debut in early 2024. In defending with Bitbo, the 12 US area Bitcoin ETF issuers now protect almost 1.3 million BTC — about 6.2% of the total circulating present.

BlackRock’s iShares Bitcoin Belief (IBIT) is the largest, with an estimated market cost of spherical $88 billion.

After a dreary birth, Ether ETFs have viewed a surge of inflows, with BlackRock’s Ethereum fund becoming the third-quickest in ancient past to reach $10 billion in property.

Linked: SEC approves in-kind creations and redemptions for crypto ETPs

Custody, payments wouldn’t be Citi’s first pass into crypto

Citigroup’s exploration of custody and fee services and products wouldn’t designate its first foray into the cryptocurrency market.

Earlier this year, the monetary institution partnered with Switzerland’s SIX Digital Exchange to leverage blockchain expertise to toughen private markets thru tokenization.

Citi has been eyeing tokenization since as a minimum 2023, when it described the expertise as the next “killer exhaust case” in crypto — estimating it would possibly per chance per chance per chance presumably furthermore reach a $5 trillion market valuation by 2030.

Citi became once also reportedly among several Wall Toll road giants, at the side of JPMorgan, Wells Fargo and Monetary institution of America, exploring the probability of issuing a joint stablecoin.

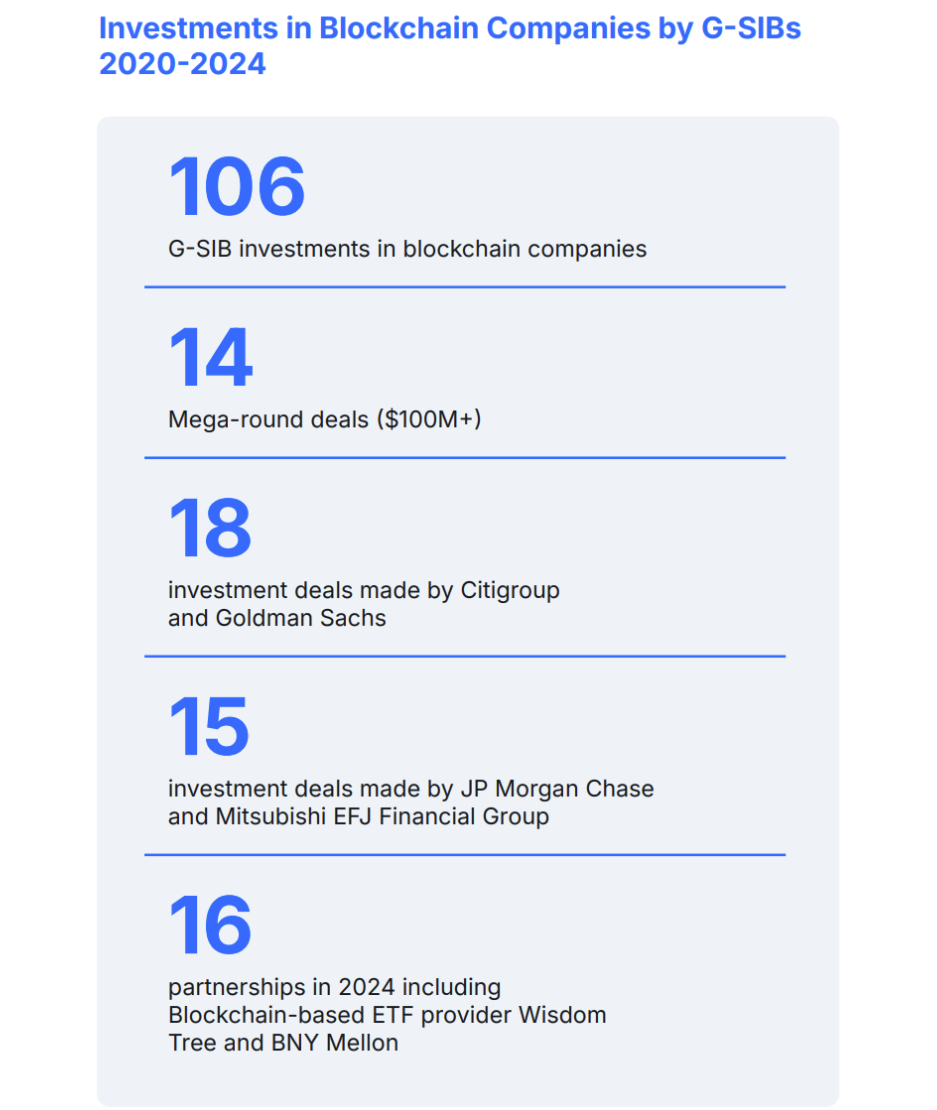

A most modern picture by Ripple, CB Insights and the UK Centre for Blockchain Technologies ranked Citigroup among the most active institutional merchants in blockchain firms, with 18 deals between 2020 and 2024.

Traditional monetary establishments have been buoyed by Trump-generation efforts to manufacture regulatory clarity for the crypto sector — initiatives that have prolonged to the US Securities and Exchange Commission and the most modern passage of the US GENIUS Act, a key stablecoin legislation.

In July, the Home of Representatives passed the CLARITY market structure bill, the Anti-CBDC Surveillance Issue Act and the GENIUS Act.

Linked: Crypto Biz: Wall Toll road giants bet on stablecoins