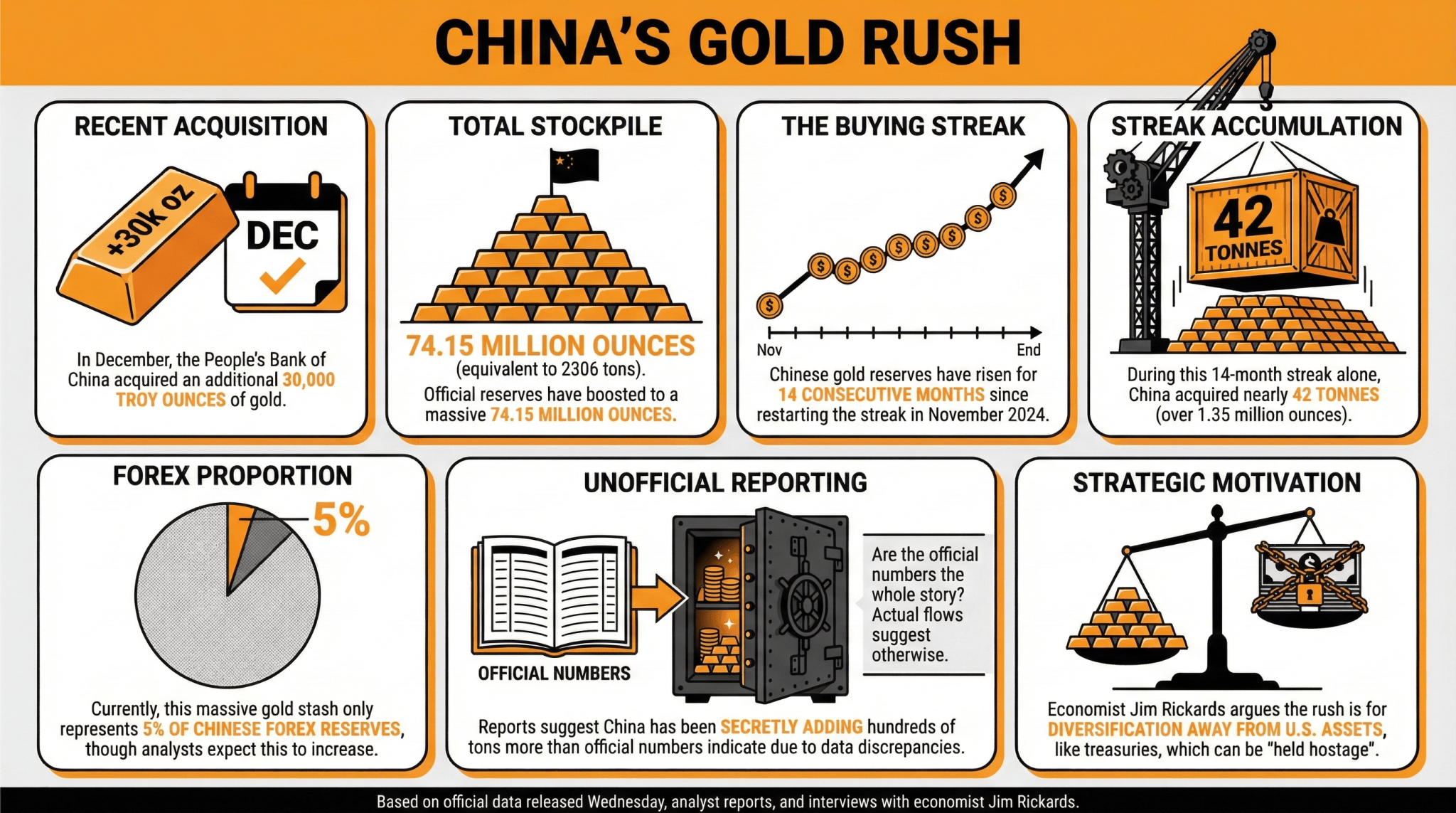

The Of us’s Monetary institution of China purchased 30,000 troy ounces of gold in December, per legitimate figures, extending its 14‑month shopping stagger. China is among the countries with the most appealing gold reserves, officially maintaining extra than 74 million troy ounces of the treasured steel.

China Ramps up Gold Purchases, Continues 14-Month Attempting to procure Scurry

China has persevered its gold slump, shopping extra gold in December.

In accordance with legitimate files launched on Wednesday, the Of us’s Monetary institution of China purchased 30,000 troy ounces of gold in December, boosting its reserves to 74.15 million ounces (2,306 a lot). That is the 14th month wherein Chinese language gold reserves procure risen, a pattern among central banks.

The Chinese language gold reserves had been persistently rising since November 2024, when China restarted its shopping stagger after a transient length. For the duration of this stagger, China has purchased merely about 42 tonnes of gold (over 1.35 million ounces).

Even so, China’s gold stash handiest represents 5% of the Chinese language forex reserves, with analysts claiming that this percentage might perhaps well per chance amplify because the nation seeks to hedge towards several components.

Nonetheless, stories counsel China has been secretly alongside with plenty of of a lot extra than what legitimate numbers level to, as these figures and real flows exhibit discrepancies.

In a up to date interview, legendary economist Jim Rickards mentioned that one in all the important thing causes in the support of the central monetary institution gold slump and the frequent sign hike in the gold and silver markets used to be the need for diversification from U.S.-linked assets, alongside with treasuries, which is ready to be held hostage by the U.S. authorities.

That is in maintaining with its retreat from U.S. debt and the sizzling efforts to internationalize the yuan, alongside with its digital model on this equation.

Essentially the latest Venezuelan wretchedness can velocity up this course of, as geopolitical tensions toughen the utilize of gold as a hedge towards geopolitical dangers, fiscal uncertainty, and the weaponization of the U.S. greenback.

Read extra: Jim Rickards’ Explosive Predictions: Gold to $10,000, Silver to $200 in 2026

FAQ

- How worthy gold did China private in December?

In December, the Of us’s Monetary institution of China purchased 30,000 troy ounces of gold, growing its reserves to 74.15 million ounces (2,306 a lot). - How lengthy has China been growing its gold reserves?

China’s gold reserves procure risen for 14 consecutive months, restarting a shopping stagger begun in November 2024. - What percentage of China’s forex reserves attain its gold reserves picture?

China’s gold reserves account for roughly 5% of its forex reserves, a resolve that analysts demand can also merely amplify because the nation diversifies. - What components are riding China’s gold slump, per consultants?

Economists cite the need for diversification from U.S.-linked assets and geopolitical tensions as key causes for the push into gold as a hedge.