For the past few months, XRP rate has been caught between $2.60 and $3.40. In September, the altcoin moved by most effective 5%. As XRP trades inside of a exact differ, we’ve leveraged the developed analytical capabilities of ChatGPT 5.0 to originate a doubtlessly effective buying and selling strategy.

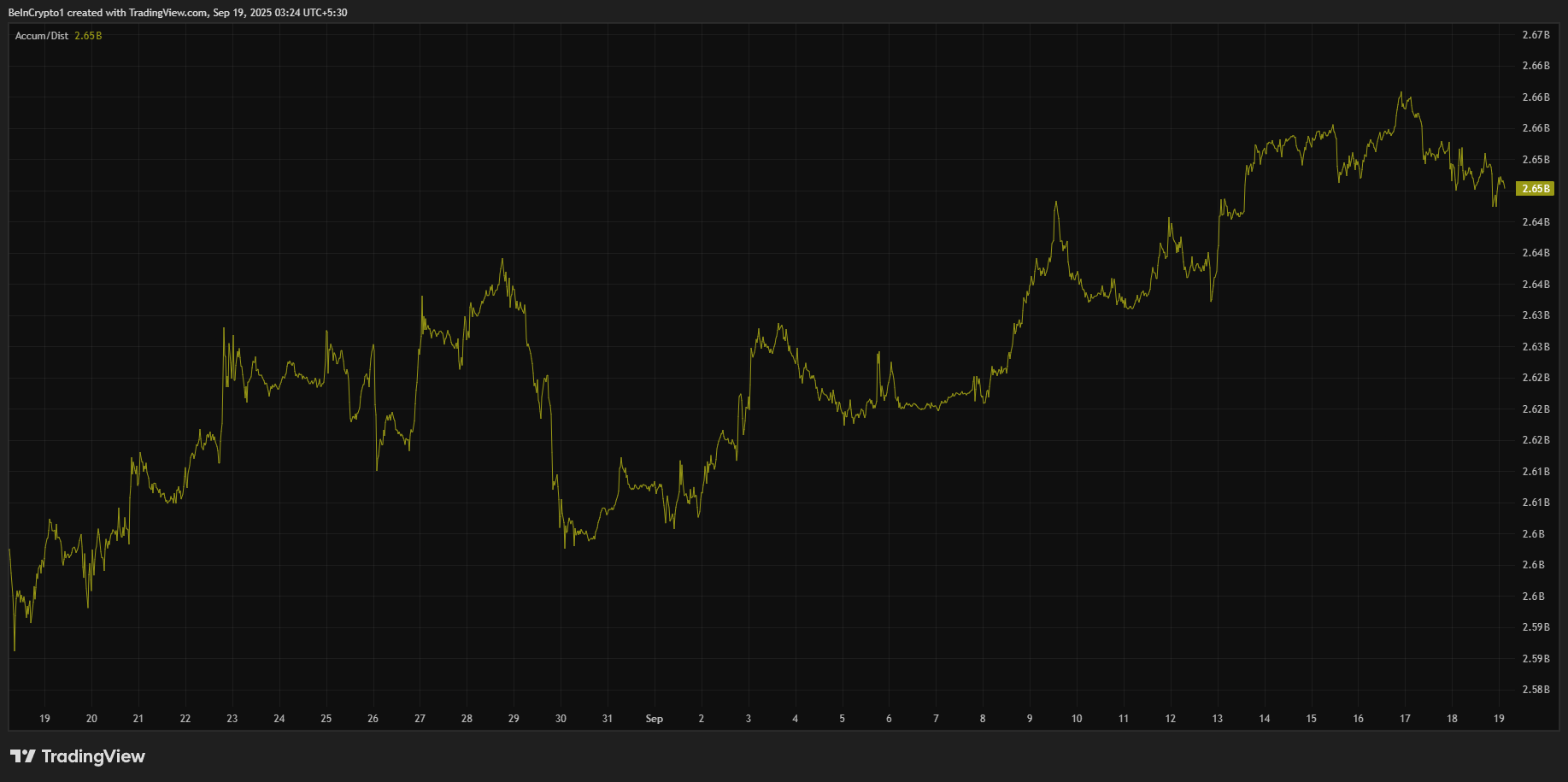

Particularly, the prompts supplied essentially the most modern XRP market tendencies, distinguished rate analytics such because the historic RSI and Accumulation/Distribution pattern, and varied key indicators.

This strategy reflects insights from contemporary-period AI fashions and can no longer be taken as investment advice, as buying and selling stays volatile.

Market Context

XRP has been buying and selling round $3.00–3.10 at some stage in September 2025. Loyal make stronger sits between $2.70 and $2.80, whereas resistance is visible shut to $3.30–3.70. These ranges absorb been examined over and over, showing the assign investors and sellers are most active.

A lot of catalysts form the outlook. The Rex-Osprey hybrid ETF inaugurate on September 18 would possibly free up institutional inflows. US monetary protection is easing, with rate cuts adding make stronger for menace resources.

On-chain recordsdata shows blended signals: whales absorb offloaded big amounts of XRP, nonetheless accumulation earlier this month confirms solid search recordsdata from at decrease ranges.

Collectively, this creates a marketplace for consolidation. XRP is neither strongly trending nor breaking down, nonetheless it is a ways making ready for a decisive switch.

Building the 10x XRP Trading Technique

For beginners and intermediate merchants, a core-satellite strategy balances prolonged-time length conviction with active buying and selling. This method preserving a big portion as a core investment whereas using a smaller portion to hold shorter swings.

- Core preserving (60%): Buy and withhold thru 2025 to supply attention to prolonged-time length beneficial properties.

- Swing buying and selling (40%): Actively replace round make stronger and resistance to compound profits.

This methodology reduces menace, ensures you don’t omit predominant upside, and builds self-discipline.

Entries and Accumulation

Dapper entries develop the difference between chasing hype and capturing price. The right accumulation zone is $2.70–3.00, the assign XRP has stumbled on solid make stronger.

A step-by-step entry thought:

- Buy 40% of your boom if XRP dips shut to $2.80.

- Add 20% if rate reclaims $3.10 with solid quantity.

- Like 40% in money to deploy both on deeper dips ($2.50–2.60) or on a confirmed breakout above $3.50.

Scaling into positions cherish this avoids going all-in at one level and affords flexibility in speedily-absorbing markets.

Taking Profits and Managing Exits

Profits are very most realistic managed in phases. Swing merchants would possibly furthermore serene target resistance zones first.

- Take 20–25% profit if XRP reaches $3.70–4.00.

- Rebuy on dips aid to $3.00–3.20 if momentum holds.

For the prolonged-time length core, the significant is patience.

- Lock partial profit if XRP reaches ~$5 to stable beneficial properties.

- Just like the remainder for bigger targets within the $8–10 differ.

- If conditions align — ETF inflows, institutional adoption, and a solid bull cycle — XRP would possibly stretch in opposition to greater rate components within the prolonged-time length.

Danger Controls To Defend Capital

Every strategy wants certain suggestions to guard in opposition to losses. For XRP, a halt loss is critical.

- Decrease 20–30% of holdings if the associated price closes below $2.50 for a pair of days.

- Like XRP to no greater than 15–20% of your total crypto portfolio.

- Once XRP trades above $4, use a 10–15% trailing halt to stable profits because it climbs.

These measures make sure one shocking switch does no longer wipe out beneficial properties or capital.

How a 10x Return Could Unfold

The journey to a 10x return is intrepid nonetheless no longer very no longer seemingly. More location ETF launches would possibly order new liquidity, whereas Ripple’s skills continues to acquire traction in tokenization and remittances.

If world markets enter a leisurely-2025 bull lag, XRP would possibly succor disproportionately as one amongst the few resources with regulatory clarity.

Routine For Dapper Merchants

A straightforward routine helps withhold emotions out of decisions.

- Weekly: Be aware RSI and Accumulation/Distribution to measure momentum.

- Month-to-month: Rebalance between core and swing positions.

- Constantly: Steer certain of chasing rallies, and buy shut to make stronger zones as a substitute.

- Video display: ETF flows, whale wallet movements, and Fed protection decisions.

This rhythm ensures you stay aligned with both technical signals and elementary catalysts.

Closing Ideas

The smartest strategy now is to derive shut to $2.70–3.00, replace resistance zones at $3.70–4.00, and let a core preserving lag in opposition to $8 or beyond.

Scaling entries, staged exits, and strict menace controls give merchants a structured direction whereas keeping the door open for a attainable 10x switch.

The post ChatGPT Suggests Dapper XRP Trading Technique For Skill 10x Gains regarded first on BeInCrypto.