Speculation a pair of likely U.S. recession in 2024 has been rampant, with several indicators pointing to this possibility.

In this form of scenario, different monetary resources, including Bitcoin (BTC), is on the total affected, all in favour of the asset has shown susceptibility to events in archaic finance.

Particularly, Bitcoin has but to be tested in a recessionary atmosphere, so its efficiency would possibly be carefully watched. Therefore, Finbold consulted OpenAI’s most modern artificial intelligence (AI) instrument, ChatGPT-4o, for insights on how Bitcoin would possibly per chance per chance maybe change within the route of a recession.

Components affecting Bitcoin in a recession

The AI instrument highlighted several components that would influence Bitcoin’s model. ChatGPT-4o renowned that some have historically perceived Bitcoin as “digital gold” or a obtain-haven asset within the route of economic uncertainty.

If this perception persists, demand for Bitcoin would possibly per chance per chance maybe amplify within the route of a recession, using its model up. On the opposite hand, within the route of indecent monetary stress, the AI platform renowned that traders would possibly per chance per chance maybe prefer liquidating resources, including Bitcoin, to duvet losses or obtain money, potentially using its model down.

Central banks would possibly per chance per chance maybe put into effect quantitative easing or lower hobby charges to counteract a recession, main to bigger liquidity available within the market. This would possibly per chance maybe enhance Bitcoin’s model as more money enters the monetary machine. Bitcoin would possibly per chance per chance maybe attract traders attempting for an inflation hedge if inflation is high, further pushing its model up.

The regulatory atmosphere will moreover play a truly major role. Certain regulatory dispositions would possibly per chance per chance maybe fortify Bitcoin’s attraction as an investment, increasing its model, while harmful regulatory actions would possibly per chance per chance maybe suppress its model, even amid a recession. Elevated institutional adoption would possibly per chance per chance maybe enhance Bitcoin’s model within the route of economic downturns.

Lastly, market dynamics, such as Bitcoin’s present and overall cryptocurrency market trends, will influence its model.

Bitcoin model prediction

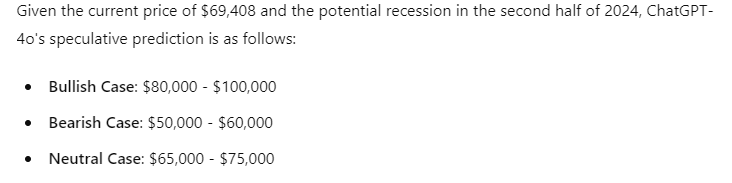

In accordance to the identified components, ChatGPT-4o outlined three attainable scenarios for Bitcoin’s model within the 2nd half of 2024 within the match of a recession.

In a bullish scenario, if Bitcoin is perceived as a obtain-haven asset, inflation is high, and monetary policy is accommodative, Bitcoin’s model would possibly per chance per chance maybe upward thrust vastly, potentially reaching $80,000 to $100,000 or bigger, searching on the recession’s severity and the reaction of archaic monetary markets.

In a bearish scenario, if traders see liquidity, face regulatory crackdowns, or if there’s a astronomical sell-off in possibility resources, Bitcoin’s model would possibly per chance per chance maybe decline from $50,000 to $60,000 or lower, searching on the extent of the sell-off.

In various locations, in a neutral scenario, Bitcoin would possibly per chance per chance maybe change interior a unfold if the recession’s influence is sensible and the components influencing Bitcoin’s model steadiness every other out. On this danger, Bitcoin would possibly per chance per chance maybe bolt around $65,000 to $75,000.

Bitcoin untested within the route of a recession

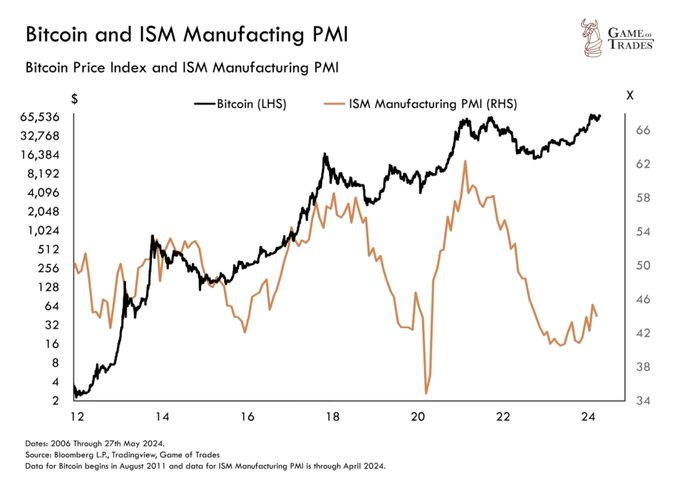

In holding with Bitcoin’s imaginable reaction to a likely recession, investment examine platform Sport of Trades highlighted that Bitcoin remains carefully influenced by broader economic cycles, as evidenced by its shut relationship with the ISM Manufacturing PMI.

In an X (formerly Twitter) put up on June 7, the consultants warned that a likely recession within the 2nd half of 2024 would possibly per chance per chance maybe vastly influence Bitcoin’s model. This warning stems from the truth that Bitcoin has now no longer but been extensively tested in such an economic atmosphere, leaving its future efficiency amid a recession unsure.

Bitcoin model diagnosis

By press time, Bitcoin became once shopping and selling at $69,350 with day-to-day losses of about 2.6%. On the weekly chart, Bitcoin is up 2.61%.

Within the period in-between, Bitcoin continues to consolidate under the $70,000 label, and breaching this level would possibly be central to helping the crypto target novel highs.

Disclaimer: The remark material on this dwelling mustn’t be opinion to be investment advice. Investing is speculative. When investing, your capital is at possibility.