Help in February, our newsletter deployed an array of generative synthetic intelligence (AI) chatbots to forecast bitcoin’s mark by year’s stop. Sixty-six days own since elapsed, and with April 2025 drawing to a shut, we revisited the experiment to gauge the sizzling trajectory of AI-primarily based bitcoin mark predictions.

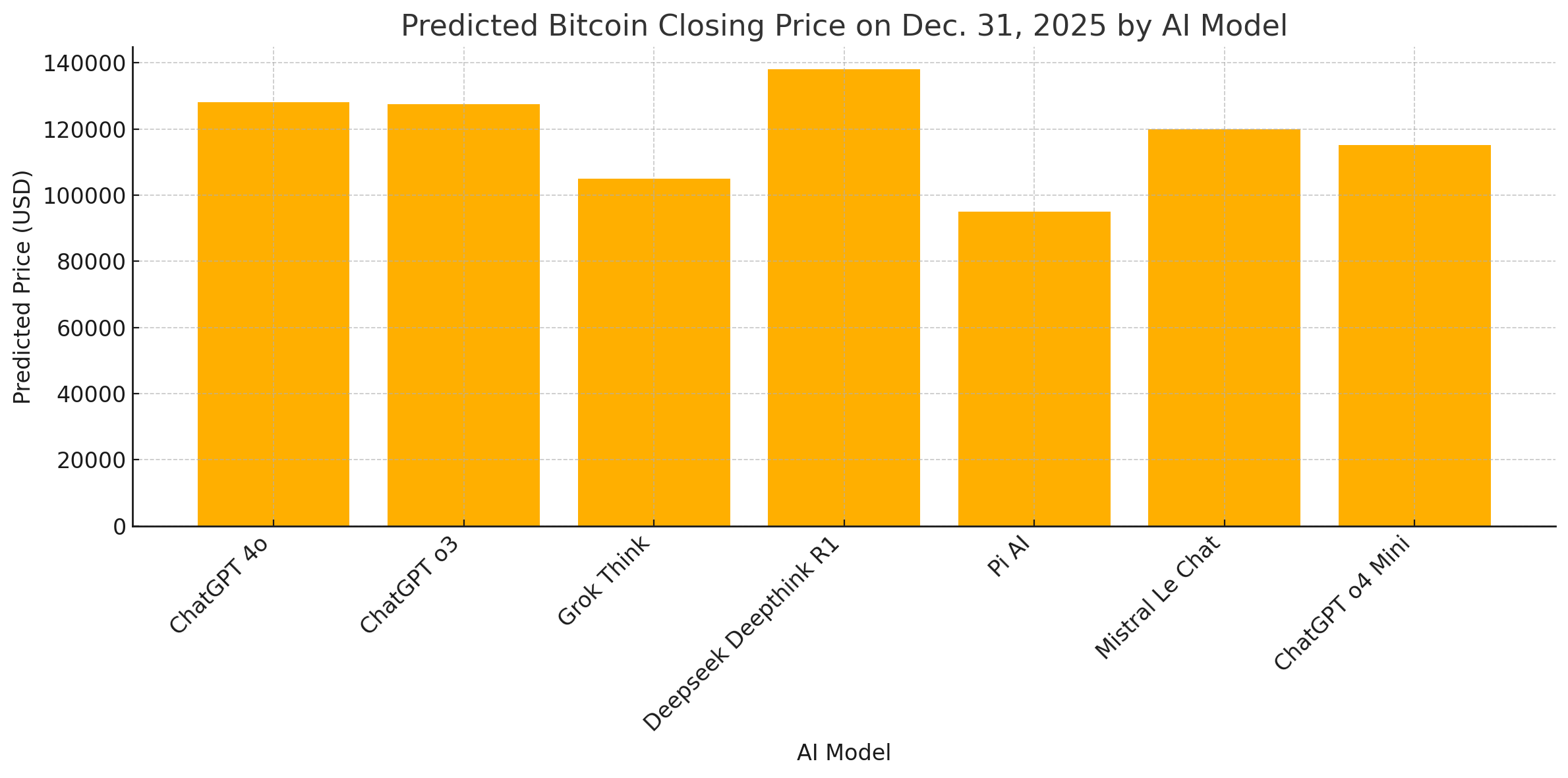

6 Out of seven AI Fashions Forecast a Bitcoin Tag Climb by 365 days’s Quit

On the time of writing, bitcoin ( BTC) is gliding at $95,072 per unit, after a month characterised by pronounced market fluctuations following U.S. President Donald Trump’s “Liberation Day” unveiling of sweeping tariffs. After we first performed this check in February, BTC was once navigating around $96,000 per coin, and over the intervening weeks, it descended under the $75,000 rate.

The experiment enlists a huge assortment of AI chatbots, drawing from platforms comparable to OpenAI, Deepseek, Grok, amongst others. Seven sure AI model responses had been gathered, even supposing three are diversified variations of ChatGPT (4o, o3, o4 Mini). For this exercise, the suggested was once modified finest a dinky of, adjusting for the sizzling date and prevailing alternate rate. The notify suggested employed was once:

This theoretical exploration ventures into forecasting bitcoin’s valuation by the shut of Dec. 31, 2025. In mid-January 2025, BTC reached an all-time high of $109,356 per coin. Donald Trump, serving as the 47th U.S. President, has, by April 2025, presented major uncertainty contained within the macroeconomic sphere as a result of his intensification of change conflicts and the introduction of sweeping tariffs. For the time being, bitcoin ( BTC) trades at 95,072 per coin on April 25, 2025. As a sage crypto analyst within the domain of bitcoin and digital currencies, your activity is to prognosticate the attainable path this cryptocurrency would possibly rob, factoring on this serious political transformation, and to give a succinct rationale on your prediction in three to four sentences. You own gotten to search out out the closing mark of BTC on Dec. 31, 2025, and produce your anticipated U.S. buck worth for bitcoin on the day’s stop. What is your projection?

ChatGPT 4o resolution:

Given the info, I project that bitcoin ( BTC) will shut at $128,000 on Dec. 31, 2025. Trump’s aggressive tariff measures and rising change tensions are inclined to spice up world economic instability, encouraging both institutional and retail merchants to check refuge in decentralized resources love bitcoin. Moreover, with BTC’s diminished issuance following the April 2024 halving, constrained provide will seemingly collide with heightened demand for hard resources, fueling extra appreciation. Barring any indecent regulatory crackdowns or technological failures, bitcoin appears to be like poised to capitalize on these macroeconomic dynamics by year’s stop.

ChatGPT o3 resolution:

Grok “Judge” model resolution:

Deepseek “Deepthink R1” model resolution:

Projected Closing Tag of Bitcoin on Dec. 31, 2025: $138,000

Rationale: Heightened macroeconomic uncertainty from Trump’s change insurance policies and tariffs would possibly simply power institutional and retail merchants toward Bitcoin as a hedge against inflation and geopolitical risk, reinforcing its “digital gold” story. No topic short-term volatility from broader market reactions, Bitcoin’s scarcity, put up-halving provide dynamics (assuming 2024), and lengthening adoption as a non-sovereign asset would possibly propel it past its prior all-time high. By leisurely 2025, easing initial alarm and sustained demand for decentralized resources amid protectionist insurance policies would possibly simply culminate in a forty five% upward push from April’s $95,072, settling shut to $138,000.

Pi AI resolution:

Mistral AI’s Le Chat resolution:

ChatGPT o4 Mini resolution:

I project bitcoin will shut at $115,200 on Dec. 31, 2025. The persistence of “Liberation Day” tariffs—averaging 27 p.c on U.S. imports—continues to rattle provide chains and push merchants toward non-sovereign stores of worth turn0search5. Within the intervening time, put up-halving reductions in newly minted bitcoin, coupled with sustained on-chain demand from institutions looking for an inflation hedge, should always unruffled toughen a slack mark climb into year-stop. In this atmosphere of policy-pushed uncertainty and dwindling issuance, bitcoin’s scarcity top rate is at risk of power it above its mid-Jan. 2025 height.

A Overall Expectation of Upward Momentum

The series of AI forecasts finds a necessary consensus: most fashions preserve up for bitcoin closing 2025 with gains reasonably than stagnation or losses. Even supposing projections vary in magnitude, the commonplace expectation of upward momentum reflects a belief in bitcoin’s resilience amid world uncertainty. This trend suggests rising self belief in decentralized resources as ragged financial systems face mounting power.