Worldcoin and Hyperliquid rank among the dwell two cryptocurrencies by weekly features. CoinGecko files shows that WLD and HYPE won virtually 35% in the previous week. The two tokens could well presumably well lengthen their stamp rally next week.

Worldcoin (WLD) has rallied for seven consecutive weeks, seen in the WLD/USDT weekly stamp chart. In the final 24 hours, WLD won virtually 2% and virtually 35% in the final seven days. Worldcoin’s rally is seemingly pushed by a sequence of announcements from the Sam Altman-led AI agency regarding the mission’s growth plans.

Hyperliquid (HYPE) added 7% to its stamp on the day, up virtually 35% in the final seven days. The mission’s contemporary features are attributed to HYPE accumulation and quiz from crypto elites cherish Arthur Hayes, gentle BitMEX CEO and co-founder of Maelstrom.

Desk of Contents

Worldcoin and Hyperliquid stamp forecast

Worldcoin posted seven consecutive weeks of features, and the rally persevered this week. WLD stamp could well presumably well lengthen its rally per technical indicators on the weekly timeframe. A 32% expand could well presumably well push WLD to examine psychologically valuable resistance at $2.

RSI reads 51, crossing above the fair level at 50 and MACD flashes consecutively inexperienced histogram bars, signaling a favorable underlying momentum in WLD stamp development.

In the event of a flashcrash or market-extensive correction, WLD could well presumably well streak to augment at $0.914.

The on a normal foundation stamp chart helps a same thesis with WLD focusing on resistance at $1.641, the lower boundary of an FVG. This marks virtually 8% climb for WLD from the contemporary stamp level of $1.538.

The $0.835 make stronger is mandatory to WLD as the AI token continues its upward development. RSI has crossed above 70, into the “overbought” zone and MACD indicators sure underlying momentum in WLD stamp development.

WLD faces resistance at $2, marked as R2 on the WLD/USDT on a normal foundation stamp chart.

HYPE is 13% away from its closest resistance, at R1, marked by $40 on the on a normal foundation timeframe. HYPE began its upward development on April 7, 2025. The token could well presumably well gather make stronger at $32 in the event of a correction.

Momentum indicators on the on a normal foundation timeframe make stronger extra features in HYPE, RSI climbed towards 83 and is sloping upwards. MACD is flashing inexperienced histogram bars above the fair line, signaling the underlying sure momentum in HYPE stamp development.

The 2024 high of $42.252 is a key purpose for HYPE, it comes into play as soon as the token flips resistance at $40 into make stronger.

WLD and HYPE on-chain prognosis

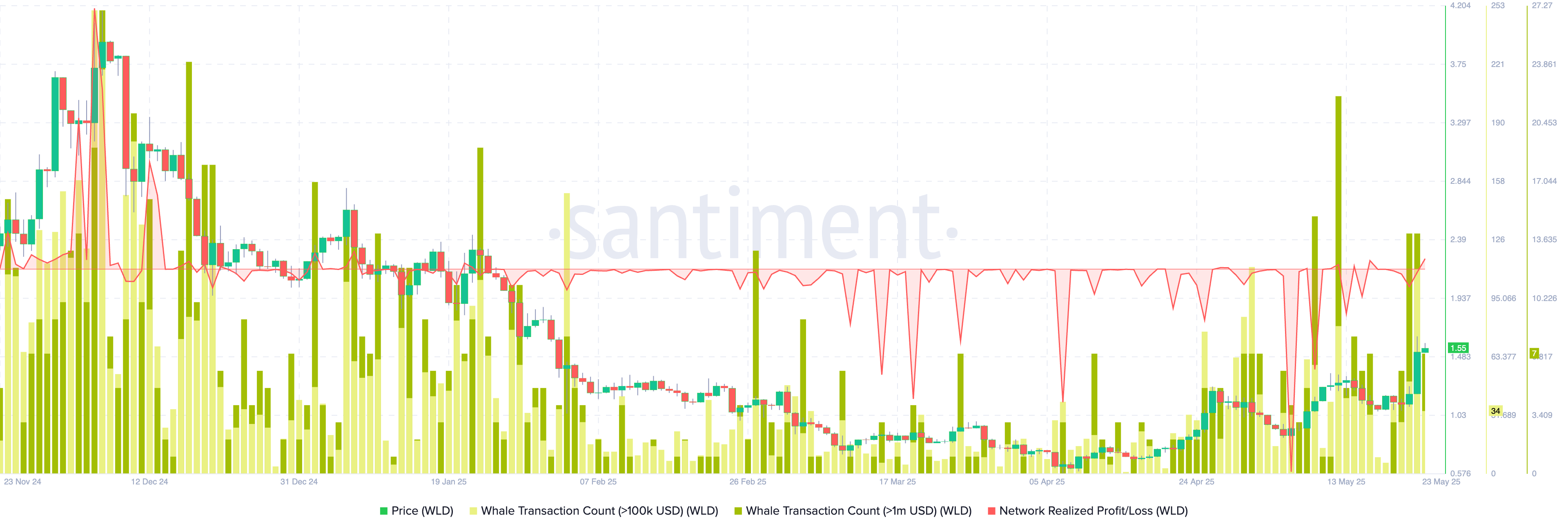

Worldcoin’s on-chain indicators make stronger a bullish thesis for WLD in the upcoming weeks. Community realized earnings and loss, a metric that identifies the catch earnings/loss of all tokens moved on a given day shows consistent loss realization from merchants right through the principle phase of 2025.

NPL shows seemingly capitulation in WLD, most frequently followed by a rise in a token’s stamp. The whale transaction depend in two segments, valued at $100,000 and $1 million and greater shows spikes this week.

Natty wallet merchants moved their WLD tokens realizing features on their holdings, in a rather dinky volume when put next with the depend of merchants taking losses in the previous few weeks. This shows promoting tension on WLD is rather low and there could be scope for stamp get next week.

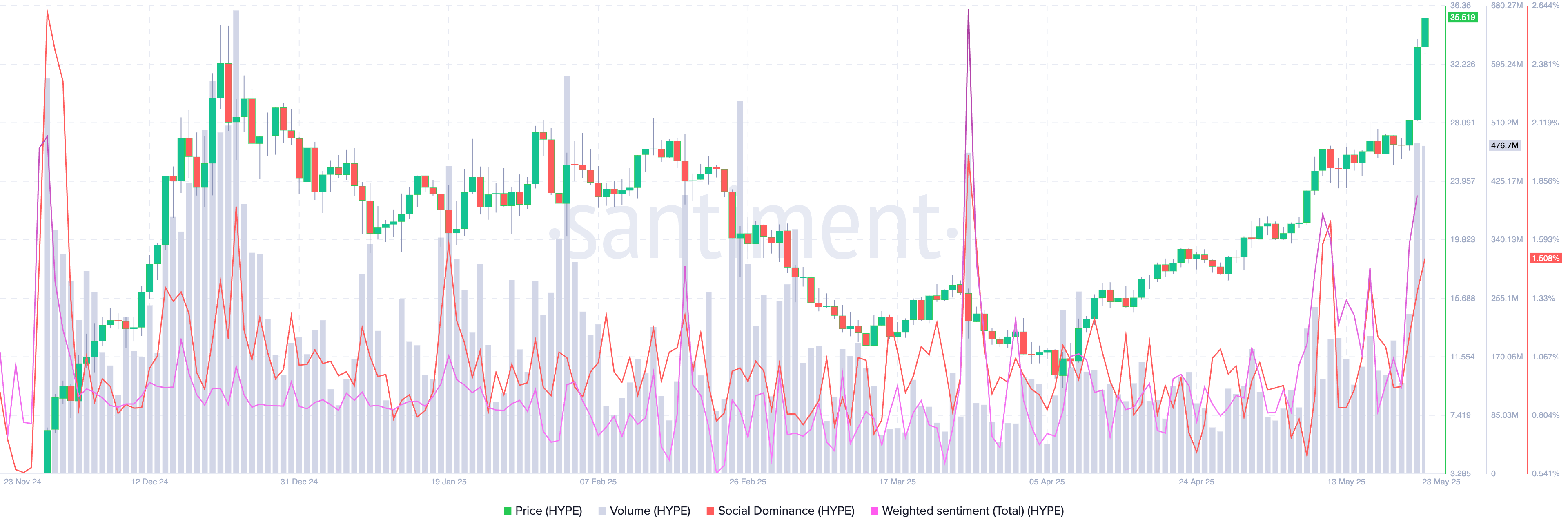

Hyperliquid’s on-chain metrics cowl a spike in alternate volume, weighted sentiment and social dominance alongside the rally. HYPE stamp rallied this week, riding up the share of HYPE’s mentions across social media platforms and weighted sentiment became more and more sure.

Whereas a spike is illustrious in social dominance and weighted sentiment, it remains rather low when when put next with the huge sure spike noticed in March 2025. This became followed by a correction in HYPE and the token began its upward development in the second week of April 2025.

Derivatives merchants bullish on HYPE rally, WLD hype fades

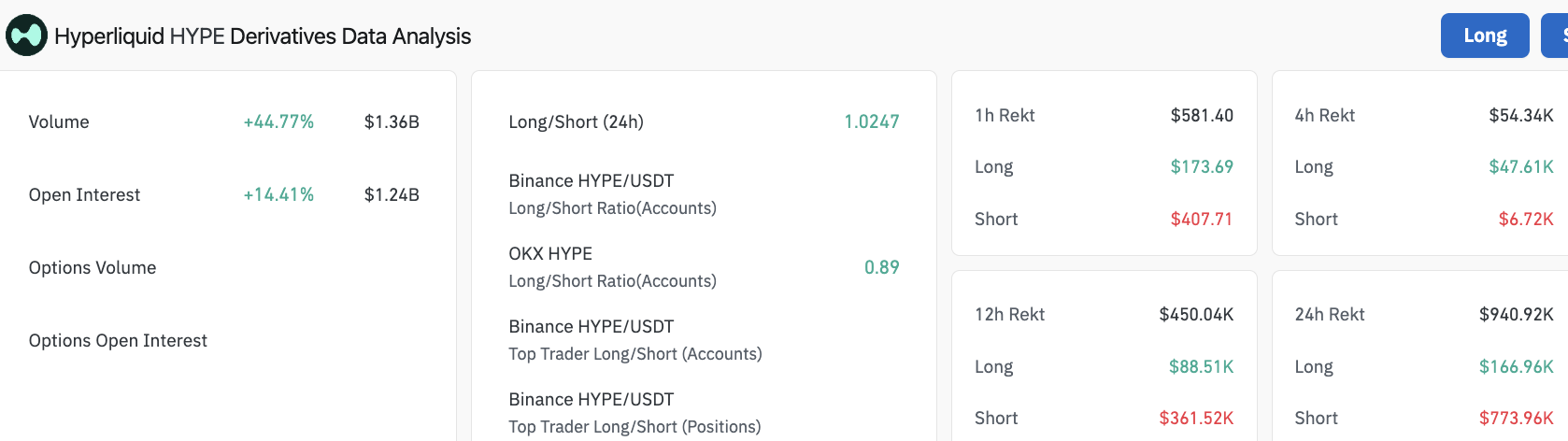

Derivatives files from Coinglass shows that long/immediate ratio exceeds 1 for HYPE. This implies merchants are bullish on get in HYPE stamp, and immediate positions dominate liquidations in the 24 hour timeframe.

The entire liquidations for the final 24 hours are $940,000, a majority of immediate positions paid for longs, per Coinglass files.

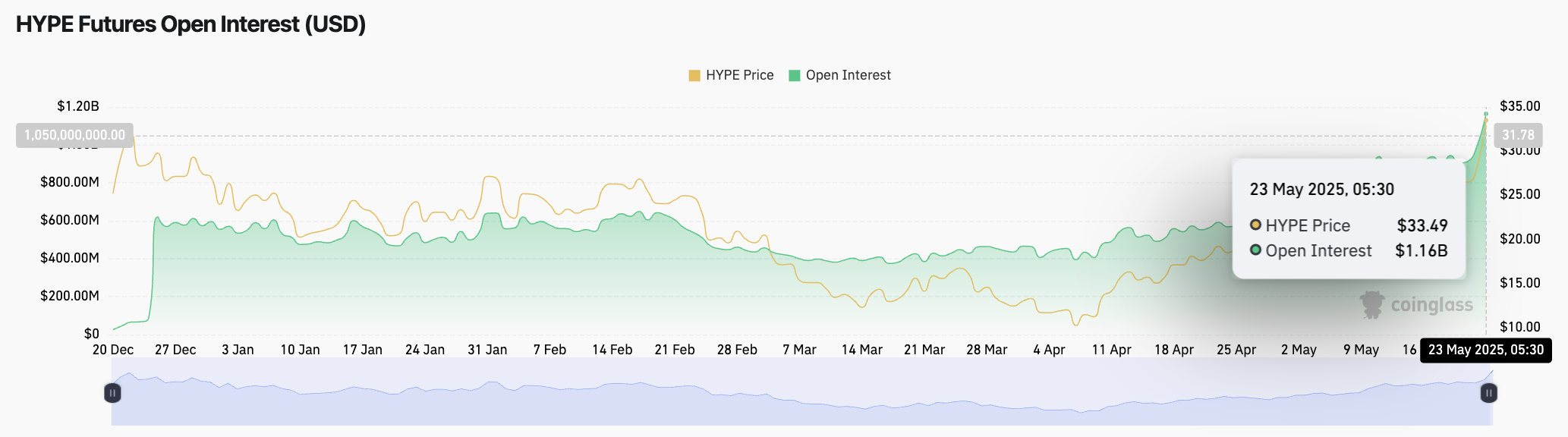

The futures originate hobby chart for HYPE shows that OI is at its very top level since December 2024. OI has climbed to $1.16 billion, at some point of the ongoing stamp rally and this marks the entire stamp of originate derivatives contracts in HYPE.

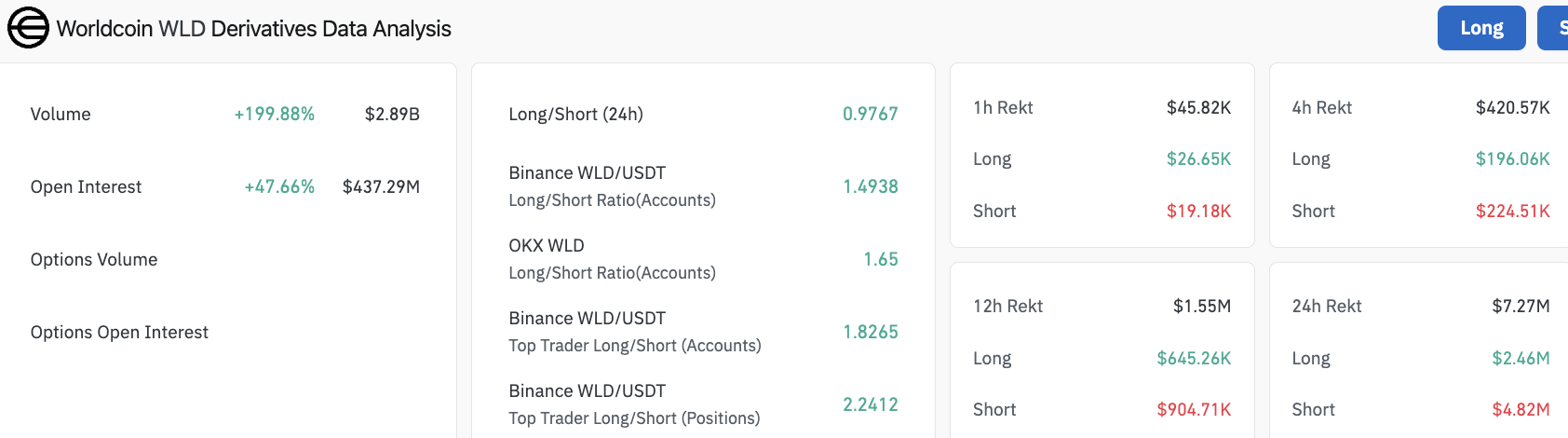

Worldcoin derivatives files prognosis shows virtually 50% expand in OI in the final 24 hours. Equal to HYPE, immediate liquidations exceed long and the entire volume of liquidations stands above $7 million.

The long/immediate ratio is under 1 and shows derivatives merchants could well presumably merely now not be as bullish on WLD stamp get and sidelined merchants must exercise caution when opening a alternate in the AI token.

Catalysts riding features in WLD and HYPE

For WLD, indubitably one of many largest catalysts is the announcement of Worldcoin’s growth and the instruct token sale to a16z and Bain Capital Crypto. Files of a instruct aquire of $135 million in WLD has fueled a bullish sentiment among merchants.

Thru its decent legend, the Worldcoin team mentioned that the funding became a instruct aquire of non-discounted tokens, by two of the “earliest backers” of the mission.

The funding comes from two of World’s earliest backers and long-length of time holders — a16z and Bain Capital Crypto.

This wasn’t a project spherical. It became a instruct aquire of non-discounted liquid tokens.The circulating offer of WLD has thus elevated correspondingly.…

— World (@worldcoin) Would possibly 21, 2025

Hyperliquid has made diverse announcements about bridges built to transfer tokens to the HYPE ecosystem, contemporary listings and partnerships. On the opposite hand, a recent tweet from Maelstrom co-founder Arthur Hayes has supported the social media mentions of HYPE.

Early on Friday, Messari Crypto reported that a Hyperliquid immediate-vendor obtained liquidated for $23 million as the token posted virtually 90% features.

Hyperliquid immediate vendor liquidated for $23M after HYPE soars to ATH pic.twitter.com/v3cdZu5DQL

— Messari (@MessariCrypto) Would possibly 23, 2025

Tether and its accomplice Plasma Foundation energy zero-price stablecoin transfers and the initiative became extended to the Hyperliquid alternate, adding to the record of catalysts.

The on-chain perpetual alternate’s contemporary listings, partnerships and the arrival of zero-price stablecoin transfers in its ecosystem are currently the largest catalysts riding features in HYPE token.

Disclosure: This text doesn’t negate funding advice. The instruct material and provides featured on this page are for educational applications only.