Merchants became optimistic this week as Bitcoin surpassed $97,000, paving the technique for capital rotation to GameFi, DeFi and Layer 2 tokens.

ImmutableX’s IMX token stands out among the the leisure with double-digit gains on Friday. The native utility token of the gaming platform rallied 10% sooner than erasing gains on the fracture of the week, and printed over 5% weekly gains.

The ImmutableX (IMX) chain addresses the scalability and price of the Ethereum blockchain. IMX posted over 30% gains within the past month and hovers around key resistance at $0.70.

Table of Contents

ImmutableX mark evaluation

ImmutableX is bullish on a whole lot of time frames. The day-to-day and weekly mark charts trace the IMX token’s underlying bullish momentum. The IMX/USDT day-to-day mark chart reveals the gaming token is 12% under its closest resistance level at $0.70.

Any other key resistance level is $0.78, identified as R2. On the day-to-day timeframe, enhance is at $0.50.

Momentum indicators RSI and MACD enhance a bullish thesis for IMX token. RSI reads 61, and is mountain climbing greater, successfully under the “overbought” zone that begins at 70. MACD flashes green histogram bars above the just line, which manner there is an underlying bullish momentum in IMX mark pattern.

The IMX/USDT 12-hour mark chart reveals the chance of a correction within the gaming token over the weekend. MACD flashes red histogram bars under the just line, and the closest enhance ranges for the gaming token are $0.55 and $0.50.

The weekly mark chart mimics the day-to-day chart, RSI is sloping upward, MACD is flashing a green histogram bar after consecutive red histogram bars. IMX has an underlying sure momentum on the weekly timeframe.

IMX mark prediction

If the gaming token’s bullish momentum is sustained, the IMX mark might well maybe test resistance labeled R2 on the day-to-day timeframe at $0.785. IMX currently trades at $0.627, as regards to the $0.70 resistance.

Virtually 12% rally might well maybe push IMX to test R1 at $0.70. The decrease boundary of the Gorgeous Rate Gap at $0.508 is a key enhance for the gaming token. The $0.508 level comes into play if there is a flash smash or a correction in IMX.

RSI and MACD enhance a bullish thesis for ImmutableX’s native token, merchants might well maybe demand extra gains in IMX within the arriving week. Sidelined shoppers maintain to acknowledge for a correction under $0.60 so that you might well add to their positions or aquire the dip in IMX.

IMX on-chain and sentiment evaluation

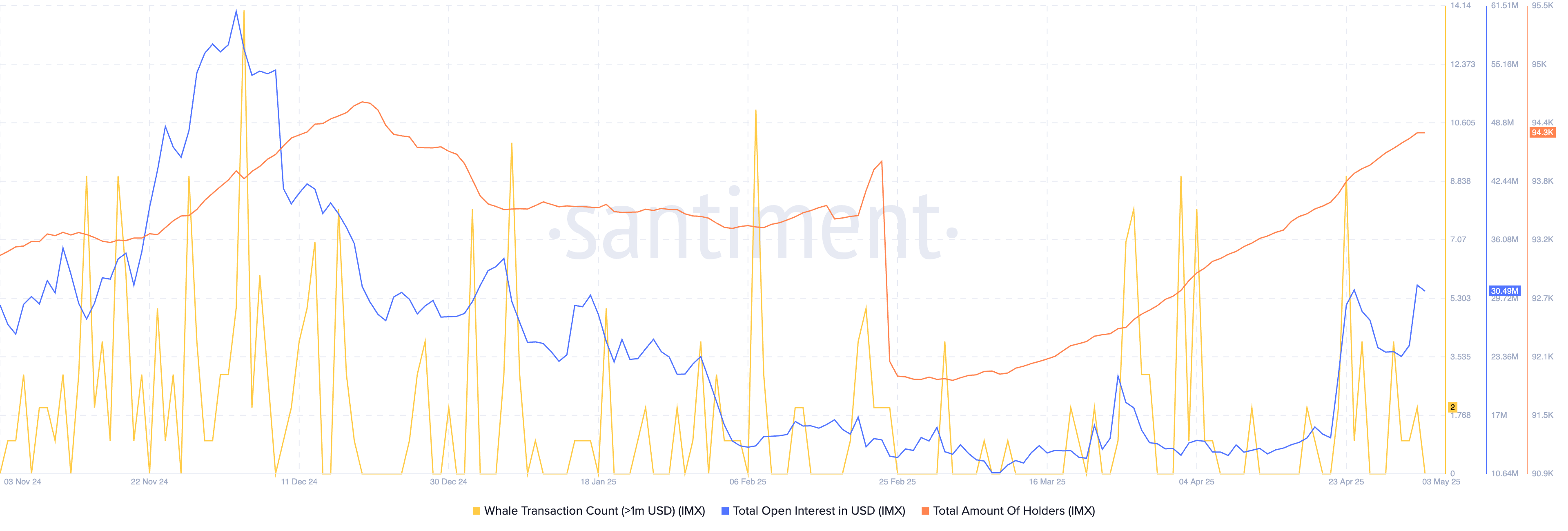

On-chain records intelligence platform Santiment reveals that the total preference of IMX holders has elevated at a favorite tempo between February 25 and May maybe maybe well maybe also 2. IMX token holder depend has climbed to 94,300.

The total start passion recorded a paunchy sure spike on May maybe maybe well maybe also 2 sooner than receding. Open Hobby climbed to $30.49 million, a quite high quantity of start contracts for a gaming token.

Entire depend of whale transactions valued at $1 million and better is down, after a whole lot of consecutive spikes in transaction depend.

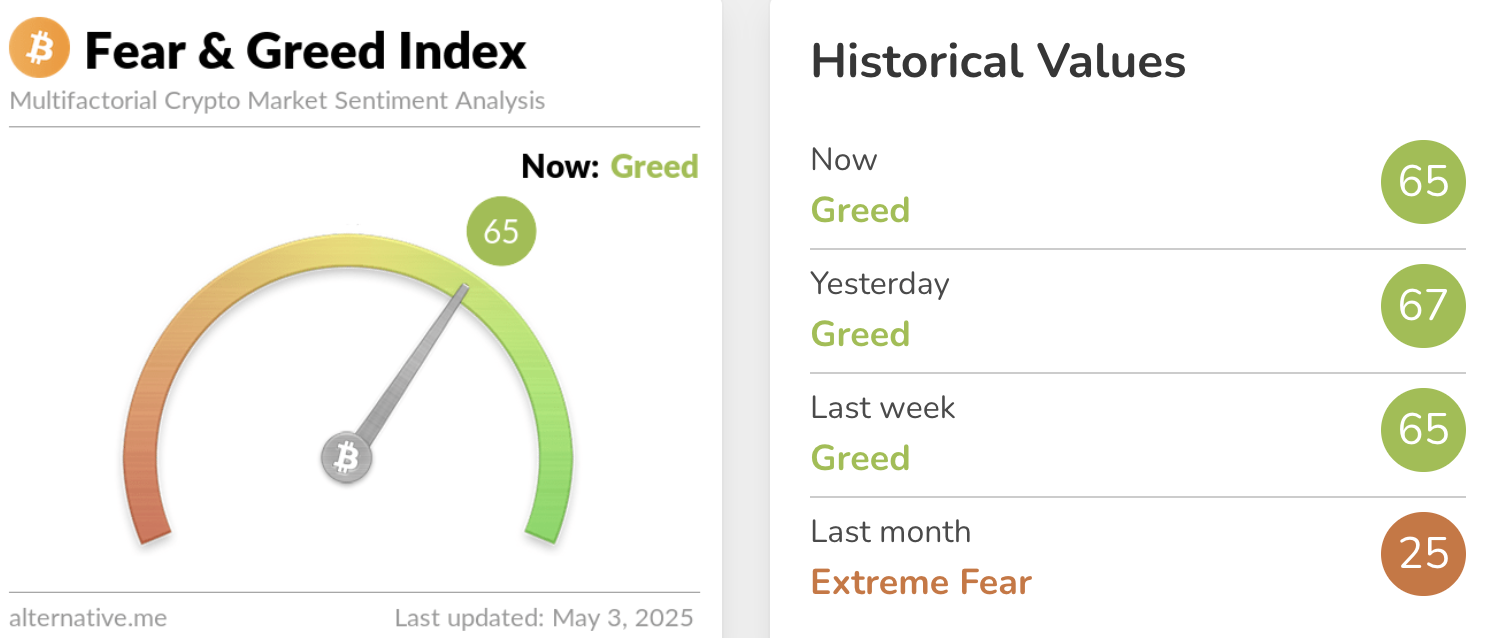

The Crypto Terror & Greed Index on Substitute.me reads “Greed,” a turnaround from the “low danger” sentiment among market contributors last month. The indicator’s mark ranged between 65 and 67 last week and on the time of writing.

Market contributors’ sentiment is slowly bettering and turning bullish, per the indicator.

Catalysts driving gains in IMX token

Web3 gaming engagement climbed in Q1 2025 after a slowdown within the last quarter of 2024. A boost in person divulge, passion in video games, and person engagement ended in native tokens of gaming blockchain platforms to mask a rally of their costs.

NFT might well moreover maintain misplaced relevance amidst the market turmoil, barring just a few blue-chip projects like Burly Penguins, then again records gathered by Messari reveals that the pullback became modest.

IMX announced its plans of merging into the zero-knowledged Immutable zkEVM chain to manufacture a single unit, labeled “Immutable Chain.” The first technical pattern at a time when Web3 gaming gathers consideration within the ecosystem, has acted as a catalyst for IMX mark rally.

Rising preference of token holders drives consistent search records from across exchange platforms and supports extra gains within the web3 gaming token. Coupled with bullish on-chain and technical divulge, IMX is in a divulge to lengthen gains.

GameFi market insights

Messari’s “Remark of ImmutableX Q1 2025” story notes that the practical day-to-day transactions on IMX climbed 5.7% QoQ. Web3 gaming development supported the upward push, IMX notes an underlying network divulge resilience at the same time as gaming engagement contracts on competitor platforms.

NFT gross sales quantity had been hit 1.6% QoQ, the pullback to $78.3 million is even handed modest, while in Q4 when ImmutableX’s competitors famed a decline in NFT gross sales, the platform recorded a 55.3% elevate.

The pattern lined up for leisurely 2025, IMX’s merge into the Immutable Chain might well maybe act as a key catalyst and enhance a sure as regards to the last quarter of 2025. The IMT token’s releases slated for the year embody video games like Immortal Rising 2, and MARBLEX’s upcoming titles.

The U.S. Securities and Alternate Commission has softened its stance on crypto and web3 companies under the Trump administration. The SEC concluded its investigation into Immutable and took no enforcement action. The closing of the Wells Leer issued to the gaming platform serves as a sure pattern and a likely fracture to regulatory hurdles confronted by the gaming token in 2025.

Disclosure: This text does no longer symbolize investment advice. The train material and affords featured on this web page are for instructional purposes only.