President-elect Donald Trump has signaled that his administration will device stop a friendlier ability to bitcoin and cryptocurrency, that may perhaps well well additionally influence the manner they are taxed within the US and out of the country.

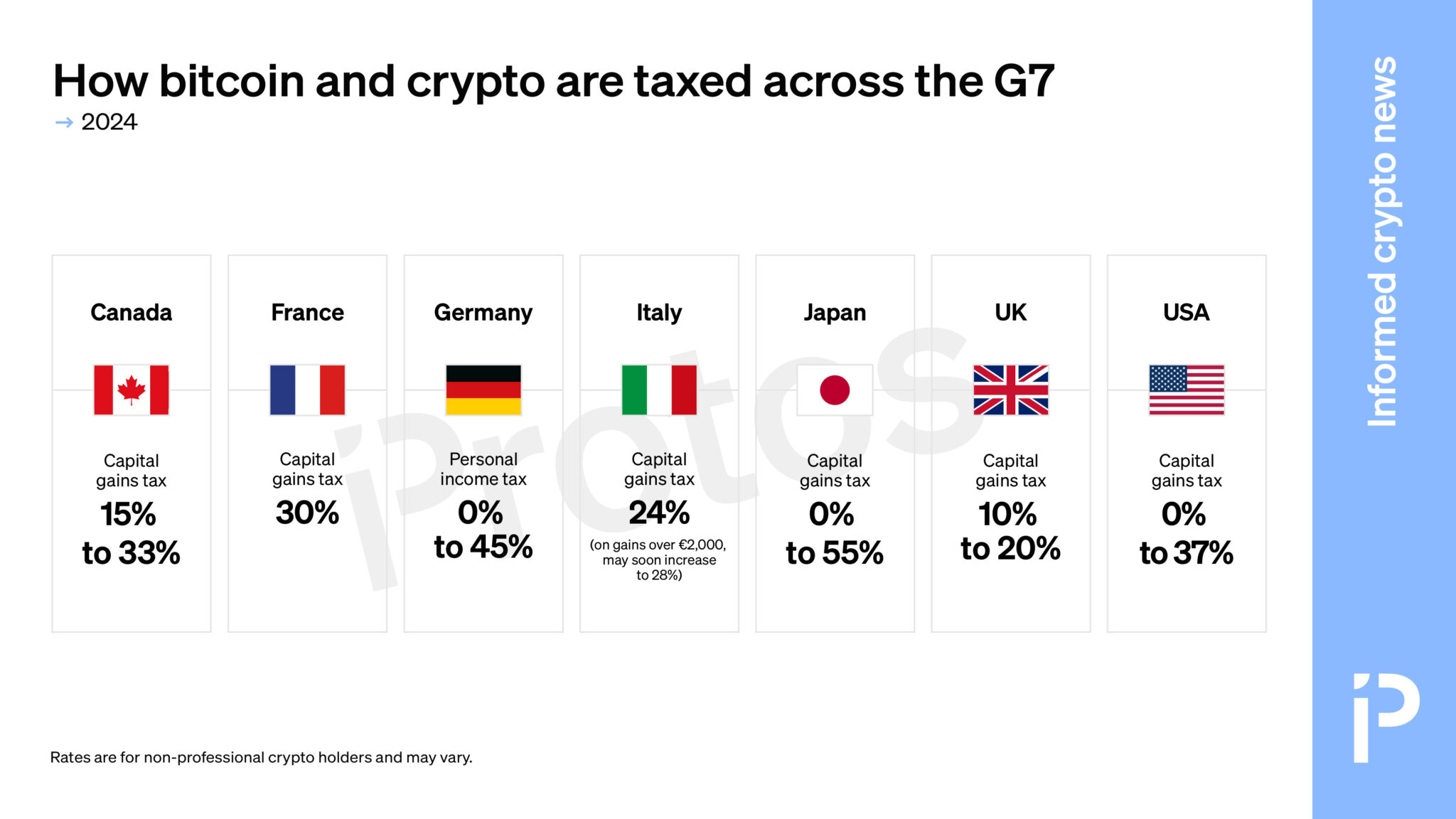

Within the US, bitcoin and crypto are currently viewed as property. Rapid gains (lower than one twelve months) are taxed between 10% and 37%, counting on earnings. Equally, long-term bitcoin and crypto gains are taxed between 0% and 20%.

US crypto holders may perhaps well well additionally employ their capital losses to offset their gains. For most individuals, the tax time limit is the identical as for other resources: April 15.

Up to the north, Canada taxes faithful 50% of an informal investor’s capital gains. Tax rates apply Federal Earnings Tax and Provincial Earnings Tax, which device bitcoin and crypto are taxed between 15% to 33% counting on earnings. Gains will most definitely be offset by 50% of capital losses.

Learn more: CHART: How bitcoin and crypto are taxed within the EU

Across the pond within the UK, capital gains tax ranges from 10% to twenty%. The UK also taxes mining, staking, and lending rewards between 20% and forty five% (earnings tax).

France, meanwhile, simply has a 30% flat rate on bitcoin and crypto capital gains for the casual investor. Gains below €305 are tax free. Here’s equal to Italy, where the flat rate is 24% on bitcoin and crypto gains over €2,000. These days, a rate hike to 42% has been floated but widely contested, and ought to likely alternate to 28%.

In Germany, the bustle is between 0% and forty five% counting on earnings. At final, in Japan, gains exceeding 200,000 Japanese Yen ($1,300) are taxed between 15% to 55% counting on earnings.

Please show masks these tax rates are for casual traders, are no longer exhaustive, and are area to alternate.