Chainlink (LINK) has struggled to sustain momentum after a failed strive to breach the $26 resistance stage against the live of January. This setback precipitated a decline, causing LINK to plunge below the $20 rate.

For a most well-known restoration, Chainlink now depends on the actions of its investors to execute the finest moves.

Chainlink Investors Like An Different

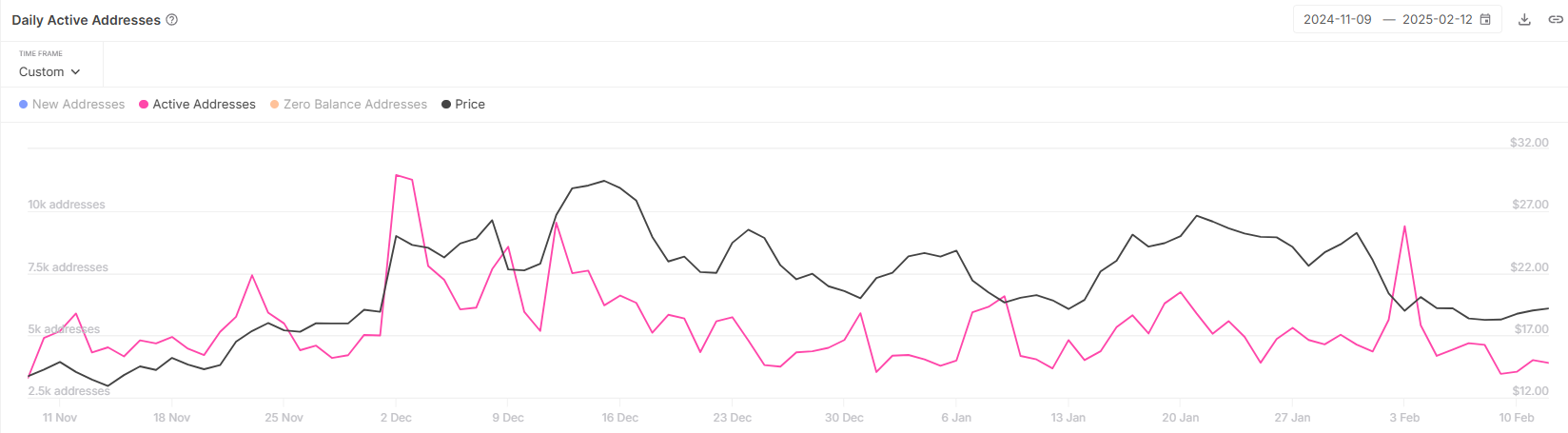

Currently, Chainlink’s vigorous addresses possess dropped to a two-month low of three,400, a resolve now not viewed since November 2024. This decline in vigorous users indicates a waning curiosity from investors, as fewer participants are conducting transactions on the network. This implies that the sentiment among LINK holders is largely skeptical.

The discount in vigorous addresses indicators that many investors are adopting a wait-and-search attain, likely ensuing from basically the most modern sign struggles. This lack of engagement and hesitance might maybe per chance also extra weigh on Chainlink’s sign, as diminished transaction exercise tends to correlate with restricted upward momentum available within the market.

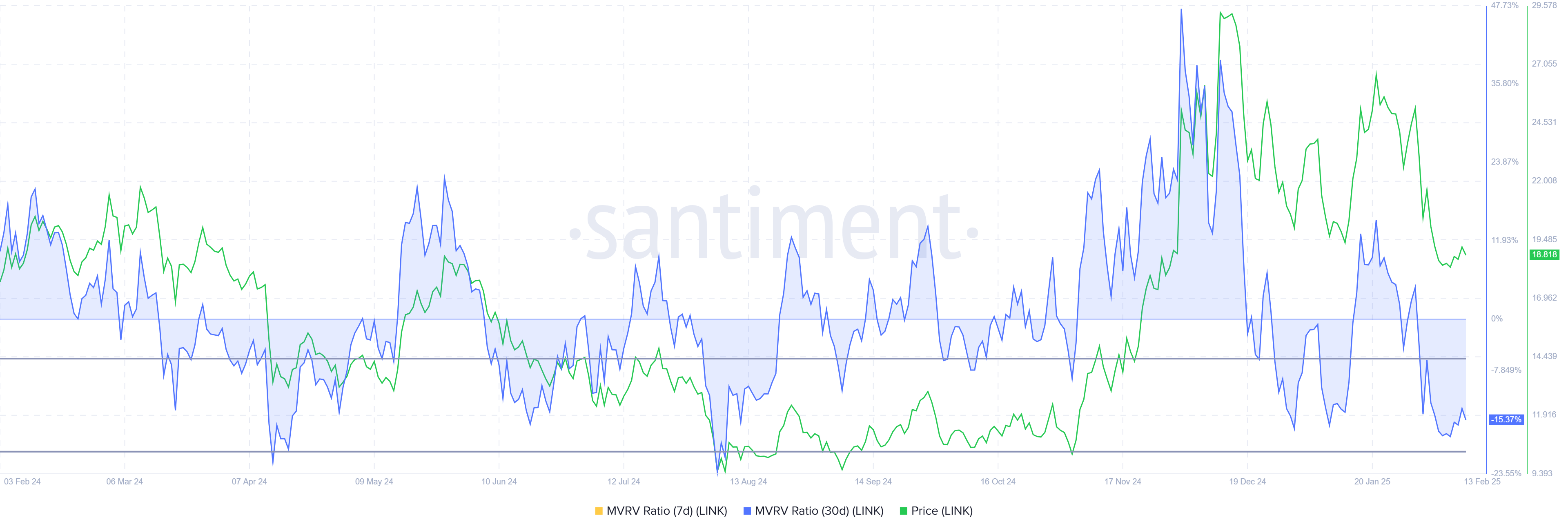

Chainlink’s broader momentum is also beneath strain, as reflected by the Market Imprint to Realized Imprint (MVRV) ratio, which is currently at -15%. This implies that individuals who sold LINK within the closing month are facing losses of 15% on moderate. The MVRV ratio is now within the different zone, between -8% and -19%, signaling seemingly for a reversal.

Historically, when the MVRV ratio dips into this fluctuate, it suggests that investors are halting gross sales and as an different selecting to get at lower costs. If this sample continues, it might well maybe per chance also rate a turning point for Chainlink’s sign, as long-term holders might maybe per chance also impartial step in to develop beef up and power sign restoration.

LINK Imprint Prediction: Bouncing Motivate

Chainlink’s sign has fallen by 25% since the open of the month, currently trading at $18.84. The altcoin has been struggling to interrupt above the resistance at $19.23 for the past week, which indicates an well-known stage that must be breached for a seemingly restoration.

If investors confide in get LINK at these lower costs, there is an spectacular possibility that the $19.23 resistance shall be flipped into beef up. This might occasionally maybe well also push Chainlink toward the next barrier at $22.03, providing the momentum wished for additonal sign positive aspects.

Nonetheless, if the breach of $19.23 fails, Chainlink might maybe per chance also plunge thru its downtrend beef up line, hitting $17.31. A plunge below this stage would invalidate basically the most modern bullish outlook, signaling a endured bearish model for LINK and maybe triggering extra declines.