Oracle network Chainlink’s (LINK) native token sharply rebounded with the broader crypto market following Federal Reserve Chair Jerome Powell’s dovish remarks in Jackson Gap, Wyoming.

LINK rallied 12% all thru the last 24 hours, hitting $27.8, its strongest price since December. Bitcoin BTC$116,870.71 appreciated 3.5% all thru the same length, whereas the worthy-market CoinDesk 20 index jumped 6.5%.

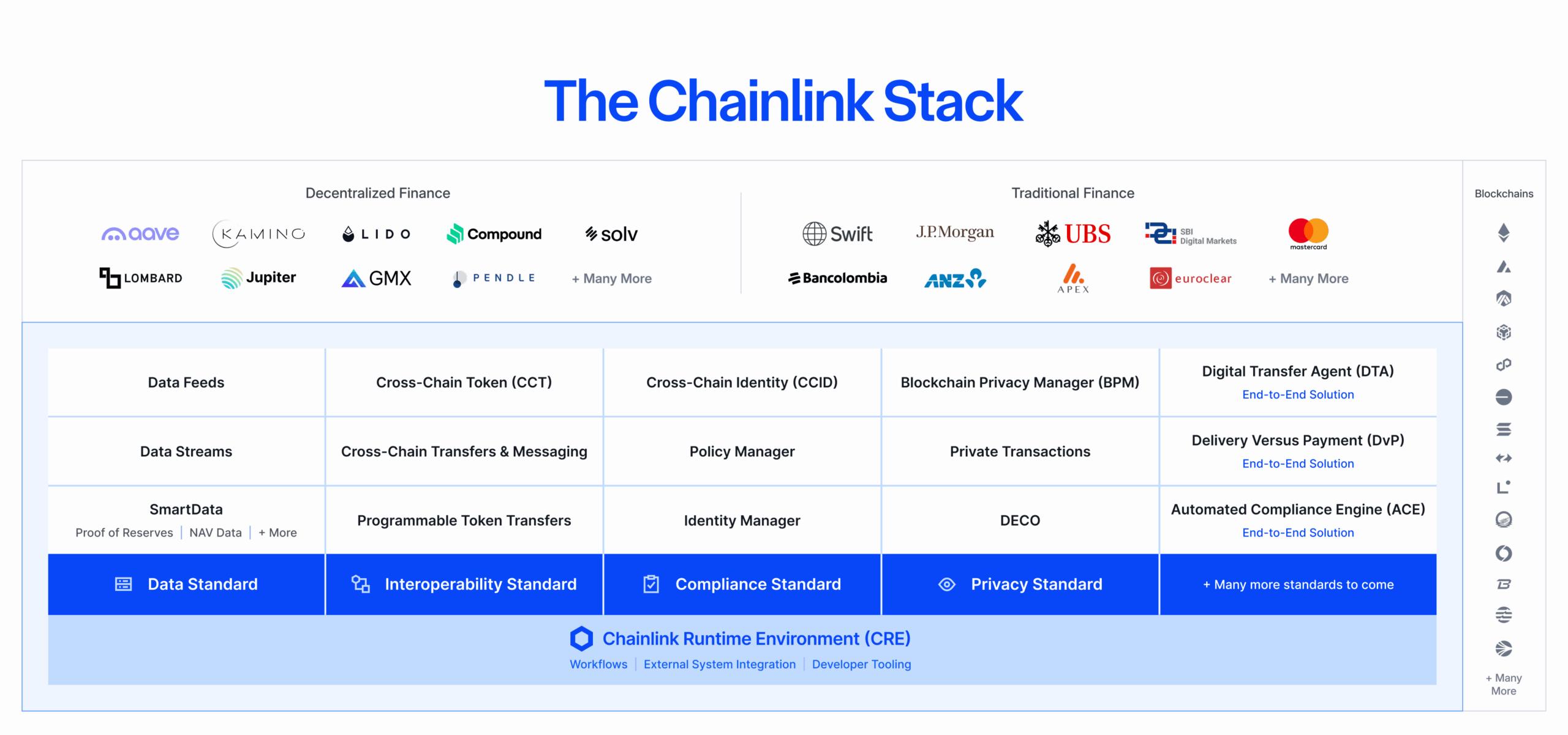

In protocol-particular news, Chainlink bought two predominant security certifications this week: ISO 27001 and a SOC 2 Kind 1 attestation, marking a predominant for a blockchain oracle platform. The audits, utilized by Deloitte, lined Chainlink’s price feeds, proof-of-reserve companies and the Deplorable-Chain Interoperability Protocol (CCIP).

The oracle provider says the pass strengthens belief in its recordsdata companies and could presumably well bolster adoption amongst banks, asset issuers and decentralized finance protocols.

Extra supporting the rally, the Chainlink Reserve, which periodically purchases LINK tokens on the launch market the usage of protocol revenues, supplied 41,000 tokens on Thursday, value roughly $1 million at that time. That brought total holdings to 150,778 tokens, around $4.1 million at fresh costs.

Technical prognosis

- Toughen Ranges: Sizable defense established at $24.15 with high-volume confirmation, according to CoinDesk Review’s technical prognosis recordsdata.

- Resistance Penetration: Systematic construction thru $25.00, $25.50, and $26.00 ranges with volume validation from institutional people.

- Shopping and selling Volume Diagnosis: Distinctive 12.84 million volume surge all thru breakout fragment, representing five times the 24-hour moderate of two.44 million units.

- Consolidation Patterns: Prolonged tight range consolidation around $24.70-$25.10 previous explosive institutional-driven breakout.

- Momentum Indicators: Sustained upward trajectory with measured advance traits and institutional accumulation alerts from corporate treasury operations.

Disclaimer: Parts of this text had been generated with the the motivate of AI instruments and reviewed by our editorial team to scheme definite accuracy and adherence to our requirements. For additional recordsdata, see CoinDesk’s paunchy AI Policy.