Chainlink payment retracted 5% on Thursday, June 20, 2024, as bulls did no longer provide on the 10% rebound recorded forty eight hours prior; on-chain facts presentations that whale traders offloading in the wait on of the scenes would possibly perhaps also be in the wait on of the most original pull-wait on.

Chainlink Dips 5% as Bears Cessation Rebound Half

Chainlink payment entered double-digit positive aspects between June 18 and June 19, as SEC shedding investigations into Ethereum precipitated a temporary rebound segment across the crypto markets.

But as the US S&P 500, led by chip-manufacturing big NVIDIA, surged to original peaks on Wednesday, it attracted the appreciate of savvy crypto traders, some of whom appear to maintain now redirected the temporary positive aspects in direction of the roaring stock markets.

As issues stand at the time of writing on June 20, the LINK payment has succumbed to at least one other wave of bearish stress.

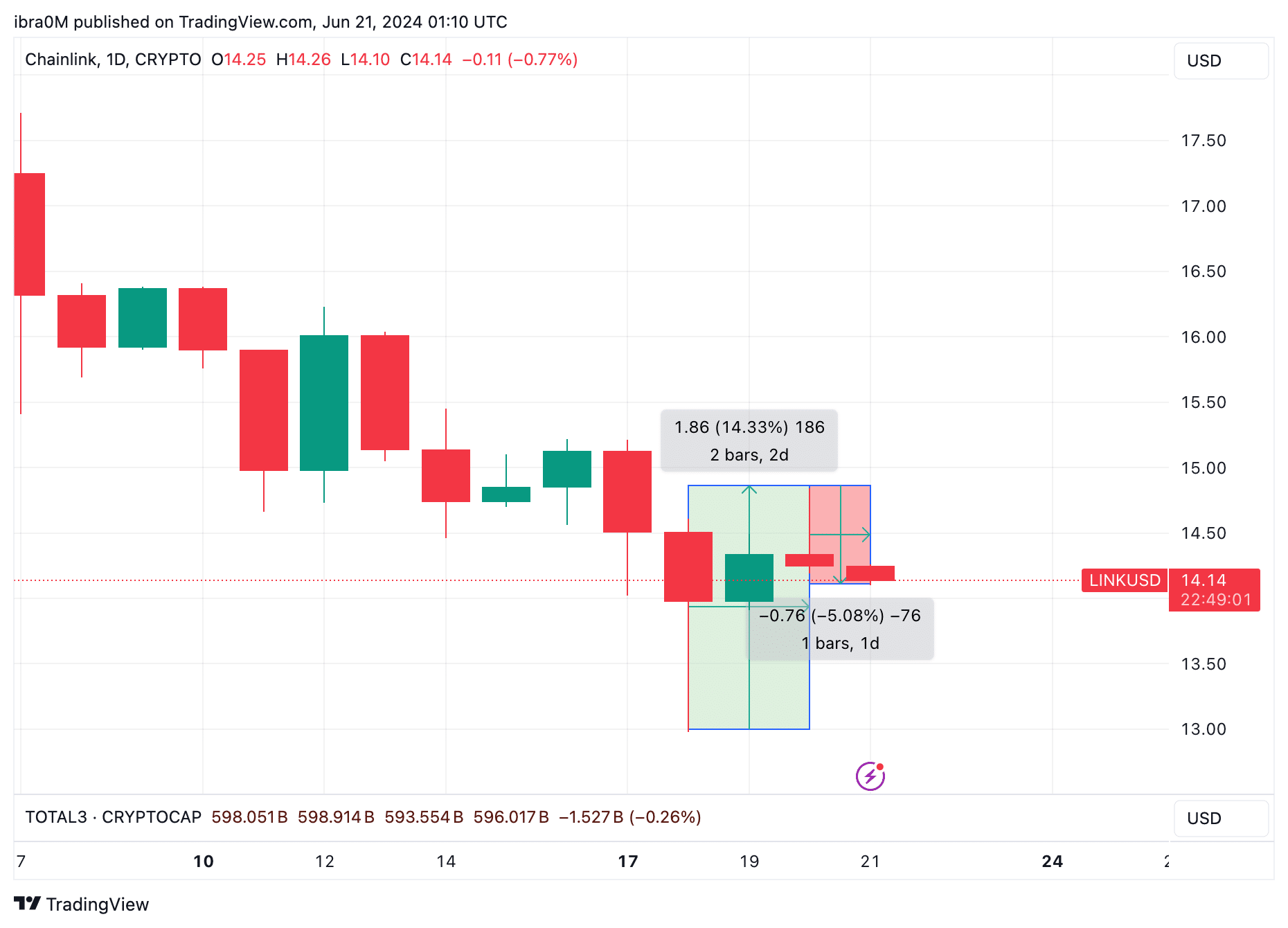

The chart above presentations how LINK payment had won 14.33% after having tumbled in direction of $12.98 on June 18. Particularly, that modified into as soon as the first time in 32-days, dating wait on to Could perhaps also impartial 15, that Chainlink payment had fallen underneath fundamental $13 mark.

This temporary Chainlink payment rebound modified into as soon as evidently fuelled by the bullish sentiment surrounding the SEC’s softened stance in direction of Ethereum. However, after hitting a fundamental resistance cluster around the $15 mark, bears are now wait on in the using seat.

Chainlink Whales Offload $40M as SEC Ends Ethereum Investigations

Basically the most original payment facts presentations LINK wobbled 5% interior the every day timeframe because it by surprise retraced in direction of the $14 territory at the time of writing on June 20. Having a gape at the underlying on-chain facts, it looks that Chainlink whale traders took advantage of the temporary market recovery to the stage and offload some of their holdings.

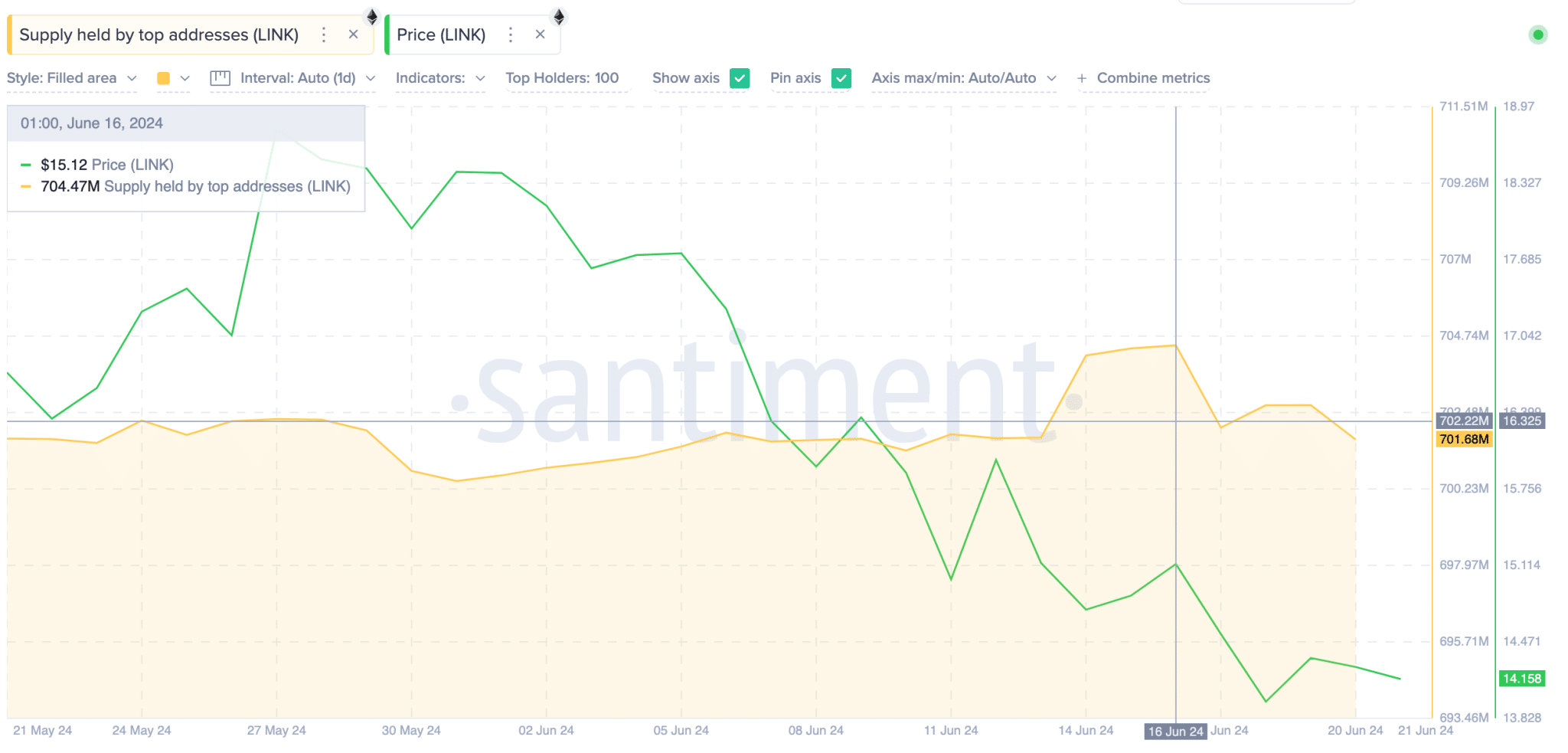

The Santiment chart underneath tracks exact-time changes in the steadiness of LINK tokens held by Chainlink’s top 1,000 largest whale wallets.

The yellow-unlit trendline in the chart above presentations how the tip 100 whale wallets held a total of 704.47 million LINK tokens as of June 16, having sat firmly on to their holdings as the month-long crypto market correction segment ensued.

But on June 17, when the data of Ethereum’s landmark pleasing clearance from the SEC broke, the Chainlink whales straight entered a promoting frenzy. On the time of e-newsletter on June 20, the tip 100 largest LINK whales now preserve a cumulative steadiness of 702.22 million LINK.

This effectively manner that Chainlink whales bought off about 2.25 million LINK tokens between June 17 and June 20. Valued at the most original payment of about $14.20 per coin, the impartial no longer too long ago offloaded coins are price approximately $40 million.

This form of rapid promoting trend amongst whale traders is typically considered a fundamental bearish signal. Unsurprisingly, the whales’ promoting frenzy coincided with the 5% payment correction recorded on Thursday.

Chainlink payment forecast: $13 Increase at Risk Over again

No matter the 5% correction in direction of $14.2, Chainlink’s payment is silent a healthy distance from the weekly timeframe backside of $12.98 recorded on June 18. But when whale traders sell off this form of wide amount of coins within a temporary length, it sends bearish signals to other strategic retail traders interior the ecosystem.

Having breached the $13 enhance earlier in the week, bears would possibly perhaps also now purpose a a lot better downswing in direction of $12.

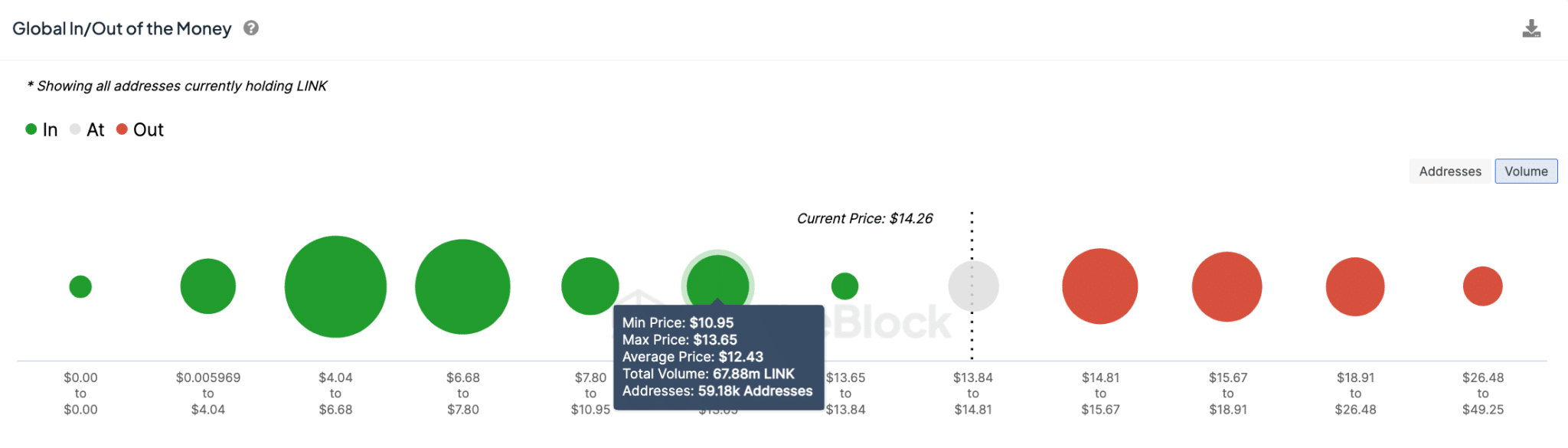

However, IntoTheBlock’s GIOM chart presentations that LINK bulls will devour transfer the enhance buy-wall in direction of the $12.40 dwelling. As viewed above, 59,180 active addresses had bought 67,88 million LINK at the practical payment of $12.43. To steer definite of big loss liquidations bull traders would possibly perhaps also initiate staging covering purchases as soon as LINK payment initiate tumbling in direction of the $12.40 dwelling.

But when that enhance buy-wall caves in, Chainlink’s payment would possibly perhaps also expertise extra downside in direction of the $11 mark.

On the flip aspect, bulls would possibly perhaps also bear a foothold in the markets another time if Chainlink can reclaim the $15 psychological resistance in the days forward.