LINK, the native token of the decentralized oracle community Chainlink, has witnessed a valuable rate dip amid essentially the most stylish general market downturn. Exchanging hands at $11.38 at press time, the tag of the 15th largest cryptocurrency asset by market capitalization has plummeted by over 20% in the last week alone.

Curiously, amid this decline, the amount of day-to-day transactions fascinating the altcoin has spiked. On the opposite hand, this is able to well not be for lawful reasons.

Chainlink Holders “Dump” Tokens On Exchanges

On-chain files unearths an 18% uptick in LINK’s day-to-day transaction count in the previous seven days. This metric tracks the entire amount of transactions for a crypto-asset on a given day.

When it rises, it suggests an uptick in the seek data from for an asset and increased person exercise on the asset’s community. This is frequently a bullish impress that confirms an asset’s uptrend or hints at a doable tag rally.

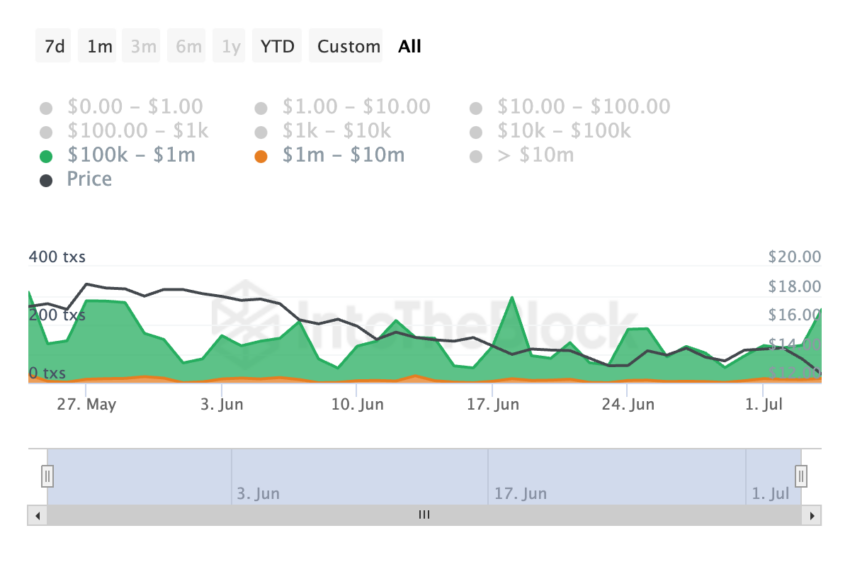

A closer examination of LINK’s on-chain efficiency unearths a valuable enlarge in its day-to-day sizable transaction count over the previous month.

As an illustration, over the previous 30 days, the day-to-day amount of LINK transactions valued between $100,000 and $1 million has surged by 82%. Moreover, bigger transactions starting from $1 million to $10 million collect seen a 15% enlarge in their day-to-day count for the length of the identical length.

Severely, amid the surge in LINK’s whale exercise, its rate has plunged by 37% for the length of the length under review.

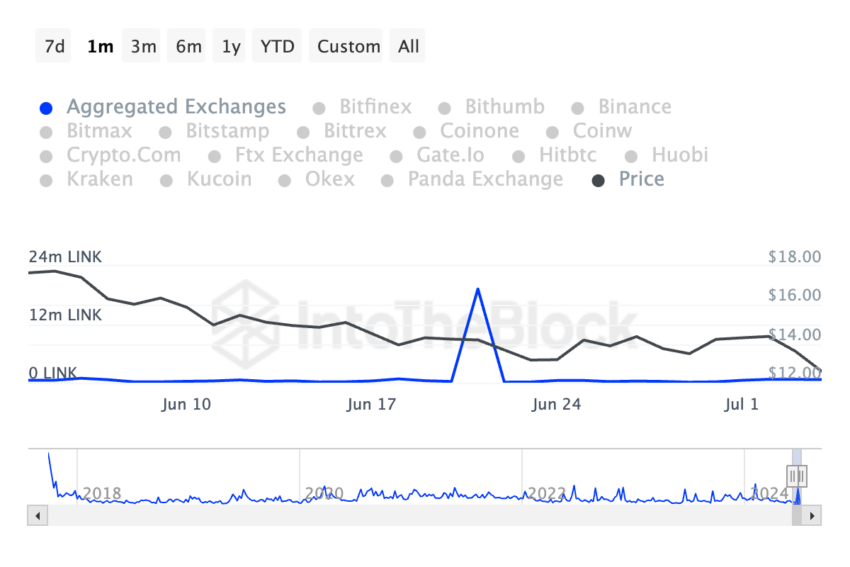

The uptick in LINK’s alternate inflows for the length of the identical length suggests that these whales collect frequently sold their holdings, hence the continuing tag decline. Within the previous 30 days, LINK’s inflow volume has risen by 29%.

Read More: How To Buy Chainlink (LINK) and The whole lot You Want To Know

When an asset’s inflow volume spikes, it indicates that a valuable amount of the asset is being transferred into exchanges for onward sales. It is miles a known bearish impress.

LINK Ticket Prediction: Liquidity Exit Locations Token At Possibility

As noticed on a one-day chart, LINK’s Chaikin Money Waft (CMF) in the intervening time developments downward and is positioned under the zero line at -0.23.

This indicator measures how money flows into and out of an asset. When its rate is negative, it is a ways a impress of market weak spot. It suggests that persons are taking out their capital from the market, thereby contributing to the price decline.

If this model continues, LINK’s tag may per chance well also just plummet to $11.11, a low last noticed in November 2023.

On the opposite hand, if market sentiment shifts from bearish to bullish, the token’s tag may per chance well climb to $13.02.