Chainlink (LINK) tag lately reached its top possible ranges in three years, reflecting a formidable 87% contain over the past 30 days. Alternatively, LINK has pulled reduction nearly 5% in the final 24 hours, signaling possible non eternal weakness.

Whale speak has also declined, with the sequence of ample holders shedding step by step since slack November, suggesting warning or profit-taking amongst major merchants.

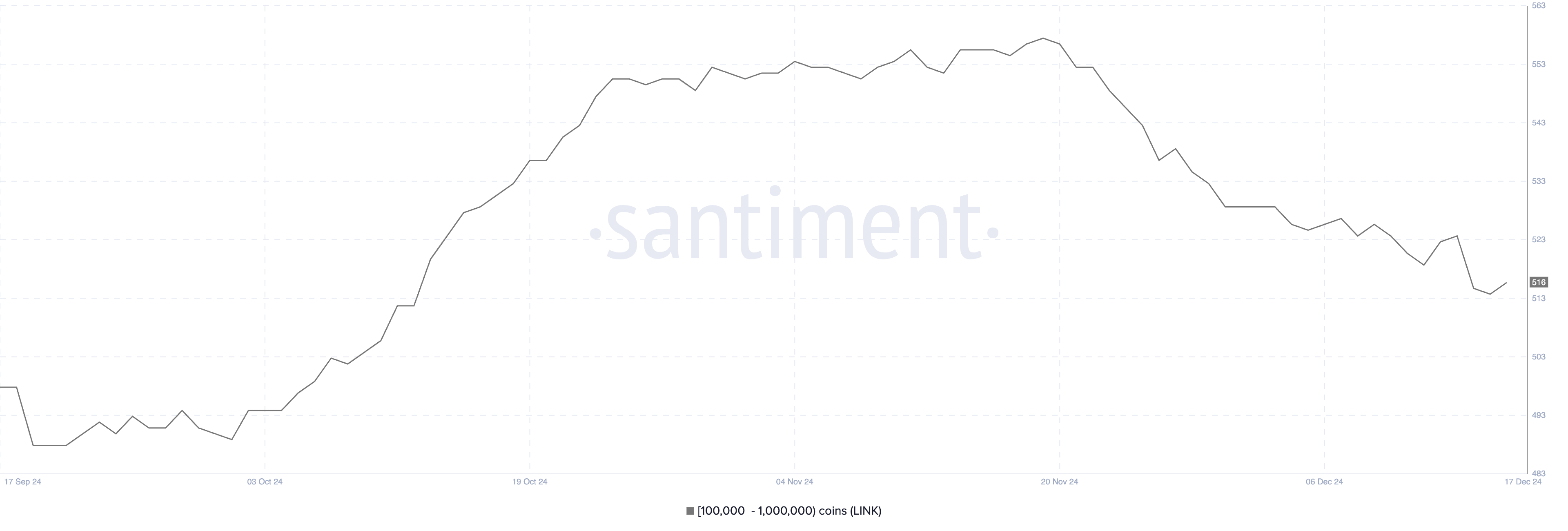

LINK Whales Are Now not Amassing Since The Slay of November

The sequence of wallets holding between 100,000 and 1,000,000 LINK has declined to 516, down from a 3-month high of 558 recorded on November 19. Extra lately, the number dropped from 524 on December 14 to 515 on December 15, indicating a considerable decrease in ample holders over a short duration.

This decline could maybe additionally advocate that some whales are lowering their positions, doubtlessly reflecting warning or profit-taking at some level of the present market stipulations.

Tracking whale speak is severe as these ample holders regularly contain significant influence over tag actions. A tumble in the sequence of whales can note a loss of self belief or a shift in sentiment amongst major merchants, which could maybe additionally add non eternal selling strain to LINK.

Alternatively, if this decline stabilizes or reverses, it can maybe additionally level to renewed accumulation, doubtlessly supporting a tag rebound in the near time frame.

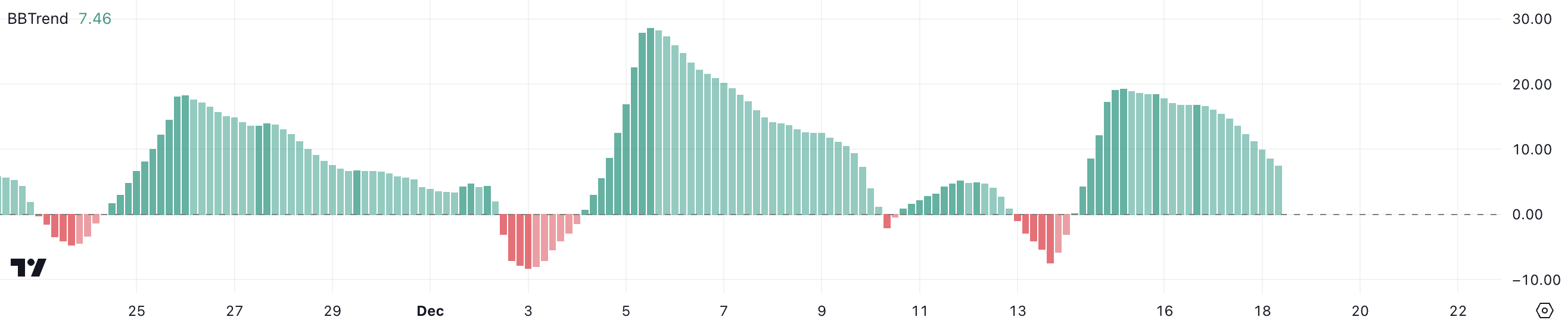

Chainlink BBTrend Is Declining

Chainlink BBTrend is currently at 7.46, reflecting a favorable pattern since December 14 however showing indicators of weakening after peaking at 19.31 on December 15.

This decline means that whereas Chainlink tag stays in an uptrend, the momentum has slowed in recent days, indicating possible non eternal consolidation or retracement.

BBTrend is a momentum indicator derived from Bollinger Bands. It measures the strength and course of tag trends. A favorable BBTrend customarily signals bullish momentum, whereas a declining fee signifies weakening strength.

With LINK BBTrend falling to 7.46, it can maybe additionally merely advocate that the serene uptrend is shedding steam. This would possibly additionally doubtlessly lead to a duration of sideways circulate or a pullback in the short time frame unless buying for strain re-emerges.

LINK Tag Prediction: Can LINK Drop Below $20 Soon?

LINK’s non eternal EMA traces are currently above the long-time frame ones, sustaining a bullish structure for now. Alternatively, the non eternal EMAs are trending downward, and in the occasion that they inaccurate below the long-time frame EMAs, it can maybe additionally note a bearish shift.

If the reinforce at $26.89 fails to abet, LINK tag could maybe additionally face further downside, doubtlessly declining to $22.41 and even $19.56.

On the assorted hand, if the uptrend regains momentum, LINK tag could maybe additionally rebound and test the resistance at $30.94. This stage would inform a key target for bulls to reassert alter and abet the broader upward trajectory.