The Chainlink designate on the present time is consolidating around $24.5, down 4.2% from its most up-to-date peak at $26.2. The rejection from the $26–$27 resistance zone has launched temporary promoting tension, even though LINK continues to interchange above key dynamic enhance ranges. With both momentum indicators and liquidity indicators exhibiting blended cues, traders are now staring at to peep whether LINK can defend its most up-to-date gains or hump into deeper retracement.

Chainlink Label Forecast Desk: August 19, 2025

| Indicator/Zone | Level / Signal |

| Chainlink designate on the present time | $24.5 |

| Resistance 1 | $25.1 |

| Resistance 2 | $26.5–$28.0 |

| Toughen 1 | $23.9 (EMA20) |

| Toughen 2 | $22.9 (Fib 0.618) |

| Toughen 3 | $21.5 (Liquidity noxious) |

| RSI (1H) | 46.8 (Impartial) |

| VWAP (Session) | $25.1 (Overhead resistance) |

| Bollinger Bands (4H) | Midline at $23.3, higher at $26.4 |

| DMI (14) | ADX 30.2, development cooling |

| Supertrend (4H) | Bullish above $23.0 |

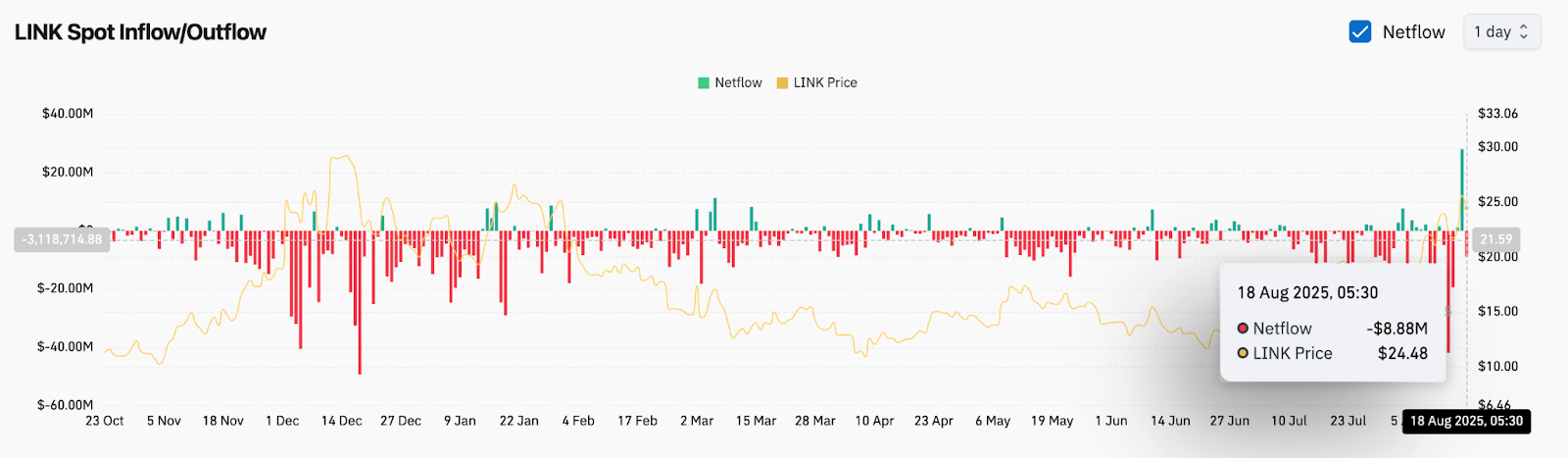

| Discipline Netflow (Aug 18) | -$8.9M (Distribution tension) |

| Fibonacci Phases (Weekly) | 0.618 = $22.9 / 0.786 = $26.4 |

What’s Going down With Chainlink’s Label?

On the 4-hour chart, LINK remains above its EMA20 at $23.9 and EMA50 at $22.7, exhibiting that traders peaceful preserve structural help watch over despite the correction. Label additionally hovers between the midline and higher band of Bollinger Bands, indicating a cooling off piece after the sturdy rally earlier this week.

The Neat Money Concepts day to day chart highlights that LINK tapped a “pale high” liquidity pocket conclude to $26.5 forward of withdrawing. This aligns with a historic supply zone from March, explaining the animated rejection. Below, the necessary liquidity cluster sits around $21–$22, a zone that will presumably act as a sturdy defensive noxious if promoting continues.

Why Is the Chainlink Label Going Down On the present time?

Why Chainlink designate occurring on the present time ties help to both technical exhaustion and market flows. On the hourly chart, RSI has cooled to 46 after overbought instances earlier within the week, reflecting fading bullish momentum. VWAP readings additionally expose LINK consolidating below $25.1, suggesting diminished intraday shopping tension.

On-chain, LINK seen detrimental situation netflows of about -$8.9 million on August 18, confirming easy distribution by traders at higher ranges. This outflow aligns with the pullback from $26, exhibiting that profit-taking is within the intervening time outweighing recent accumulation.

Key Indicators Signal Mixed Momentum

From a weekly standpoint, Fibonacci retracement prognosis reveals LINK rejecting conclude to the 0.786 retracement at $26.4, while holding firmly above the 0.618 zone at $22.9. This implies that broader construction remains bullish as long as designate sustains above $23.

Supertrend indicator on the 4-hour chart stays bullish above $23.0, providing conclude to-duration of time enhance. Meanwhile, DMI indicators expose a exiguous lack of directional strength, with +DI cooling in opposition to -DI, even though ADX remains elevated conclude to 30, reflecting that LINK is peaceful in a trending atmosphere.

LINK Label Prediction: Quick-Time duration Outlook (24H)

If bulls handle to reclaim $25.1 on quantity affirmation, LINK may presumably retest the $26–$26.5 resistance zone. A breakout above this band would converse the following upside target conclude to $28. Nonetheless, failure to preserve above $23.9 (EMA20) dangers a rush in direction of the $22.5–$21.5 liquidity zone, where original bids are doubtless to emerge.

Given the combine of supportive EMAs, fading RSI, and most up-to-date detrimental flows, the following 24 hours are doubtless to peep a consolidation piece, with volatility spikes doubtless around the $23.5–$25.5 fluctuate.

Disclaimer: The certainty presented on this article is for informational and instructional capabilities simplest. The article doesn’t describe financial advice or advice of any sort. Coin Version is no longer to blame for any losses incurred as a results of the utilization of express, products, or services mentioned. Readers are actually helpful to exercise caution forward of taking any action linked to the corporate.